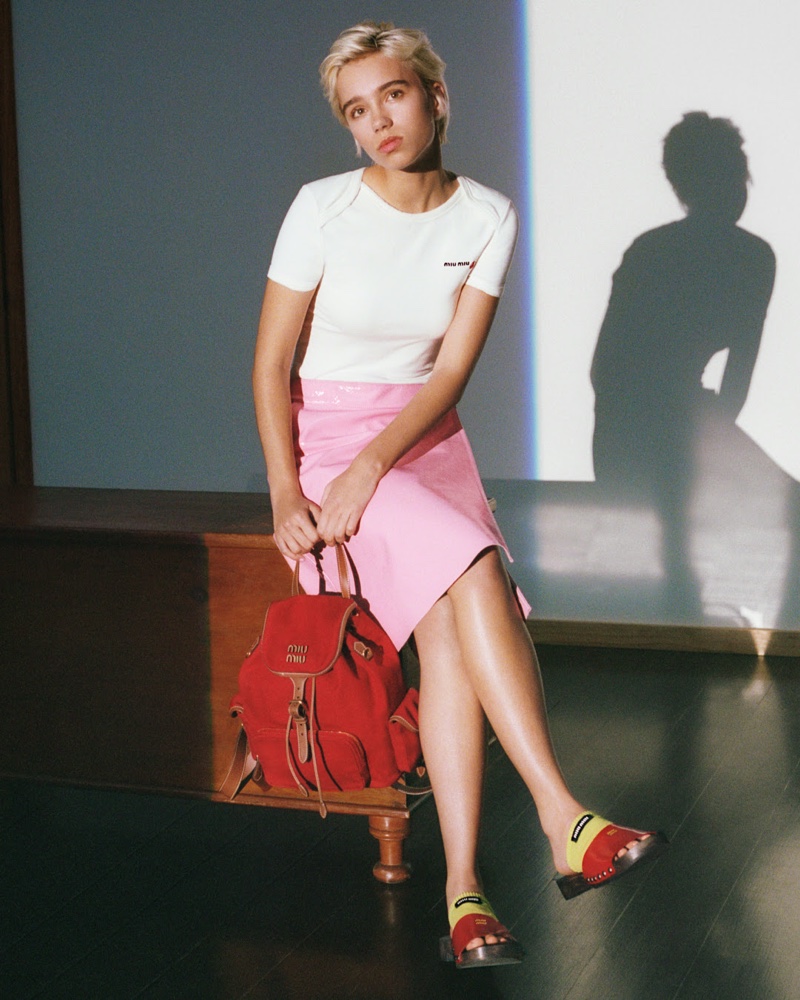

Miu Miu’s spring-summer 2025 campaign is a play on contrast. There is light and shadow, innocence and sophistication. Photographed by Lengua, the visuals feature a cast including Joey King, Liu Haocun, Kayije Kagame, Sunday Rose Kidman Urban, Lena Mantler, and Eliot Sumner.

Miu Miu Spring/Summer 2025 Campaign

The images capture the collection’s mix of youthful nostalgia and modern edge. Stylist Lotta Volkova brings a fresh take on wardrobe staples, combining pleated skirts with casual t-shirts, nylon jackets, and structured blazers.

A color palette shifts from soft pastels and crisp whites to deep neutrals like navy, grey, and black. It creates a sense of contrast in both tone and texture. Accessories play a key role, with standout pieces like the Aventure and Arcadie bags, worn alongside Mary Janes with socks, studded wooden clogs, and sleek high heels.

The campaign setting is minimal, with stark lighting that enhances the depth of each silhouette. The shadows cast by the models create an interplay of movement and stillness.

This story originally appeared on FashionGoneRogue