What we loved: The St. Regis Red Sea Resort delivers polished service from the moment you arrive at Red Sea International Airport. The private island setting is serene, beautifully landscaped, and offers a luxurious alternative to established Indian Ocean destinations, with villa options that feel both refined and deeply connected to the sea.

What we didn’t love: There is no house reef off the beach, so water excursions require a boat trip. Alcohol was not yet available at the time of our stay, and travellers seeking a lively social atmosphere may find the resort more mellow than expected.

How to book: This property participates in the Marriott Bonvoy program, with with standard room redemptions costing 188,000–250,000 points per night.

If you are booking a cash rate, reach out to Prince Collection. Since the resort participates in the Marriott STARS preferred partner program, bookings through Prince Collection include complimentary breakfast for two, a 100 USD credit, upgrade priority, and other premium perks at no extra cost.

The St. Regis Red Sea Resort – About The Property

Opened in early 2024, The St. Regis Red Sea Resort is one of the first luxury properties within Red Sea Global’s groundbreaking, sustainability driven development. Set on a private island within the Ummahat archipelago, the resort offers only 90 villas, giving it an intimate feel despite its expansive natural surroundings.

The resort draws on the concept of “regenerative luxury,” blending natural forms and curves with light woods, coastal tones, and organic textures. Overwater Coral Villas spiral outward over the lagoon, while Dune Villas blend seamlessly into sculpted sand formations, creating a harmonious connection between architecture and landscape. The resort is also fully solar powered, reinforcing its commitment to sustainability.

The atmosphere is one of relaxed elegance, balancing bright, airy spaces with discreet design details that prioritise privacy over extravagance. Combined with signature St. Regis butler service, it provides a polished yet relaxed island experience.

Location

The Red Sea region sits along the western coast of Saudi Arabia between the Arabian Peninsula and northeastern Africa, about a 1.5-hour flight from Riyadh and roughly one hour from Jeddah.

The resort sits on its own private island in the Ummahat Islands. Access begins at Red Sea International Airport, the gateway for the region.

At the airport, Red Sea Global organizes transfers for all guests to their respective resorts. The journey to The St. Regis Red Sea Resort begins with a 25-minute ride through untouched desert in a Mercedes EQS to the Turtle Bay Beach Club jetty, followed by a 45-minute boat ride to the island. Once on the island, movement is mainly by bicycle, buggy, or on foot, reinforcing the sense of peaceful seclusion.

Booking

We experienced this property on an industry rate, but normal rates for a standard One Bedroom Dune Villa with one king bed start at 6,615 (SAR) and up before taxes, or 188,000–250,000 Bonvoy points per night.

The destination intrigued us, both as a new entrant into luxury travel space and as an alternative to the Maldives.

Pre-arrival communication was excellent. The resort reached out for flight details, arrival and departure times, and passport and visa information well in advance, ensuring a smooth airport experience. Transfers to and from the resort are generally included with most cash rates. We paid for our stay using Marriott gift cards purchased at a 20% discount, which provided additional savings.

At Prince of Travel, we value Marriott Bonvoy points at about 0.8 cents (CAD) or 0.6 cents (USD). With high cash rates at this resort, redeeming points would be good value.

Had we charged incidentals to a card, we would have chosen the Marriott Bonvoy American Express Card for its elevated Bonvoy earning and annual Free Night Award.

Marriott Bonvoy American Express Card

- Earn 55,000 Bonvoy points upon spending $3,000 in the first three months

- Also, receive an annual Free Night Award worth 35,000 Bonvoy points starting in your second year with the card

- Also, receive 15 elite-qualifying nights every year and automatic Marriott Bonvoy Silver Elite status

- Bonus Bonvoy points for referring family and friends

- Annual fee: $120

The St. Regis Red Sea Resort is bookable through Marriott STARS via Prince Collection, providing exclusive benefits such as a 100 USD credit, breakfast for two, priority for upgrades, early check in, late check out, and a personalised welcome.

Book Luxury Hotels with Prince Collection

The St. Regis Red Sea Resort – Check-In Experience

Arrival begins at Red Sea International Airport, where after going through immigration, resort guests are welcomed into a bright and open lounge offering Arabic coffee, tea, and dates. Staff collected our luggage details and transferred our bags directly to the resort, allowing a truly seamless and relaxed transfer.

We were driven in a Mercedes EQS to the Beach Club to then catch our boat transfer. The water shifts from deep blue to luminous turquoise as you approach, creating a memorable arrival.

Managerial staff greeted us at the island pier with cool towels and welcome drinks, creating an immediate sense of hospitality. Our butler introduced herself and guided us through a brief island orientation en route to the Arrival Pavilion.

The island was quiet, pristine, and beautifully landscaped. Curved villas, white sand, and turquoise waters set a peaceful tone. By the time we reached our overwater Coral Villa, two bicycles were already prepared for our use and our luggage had already been placed inside along with welcome treats.

As a Marriott Bonvoy Titanium Elite member, we received the following:

- Upgrade: Confirmed through a Nightly Upgrade Award into a Two Bedroom Coral Villa.

- Welcome amenity: 1,000 points plus in villa treats of dates, nuts, dried fruit, and fresh fruit.

- Late check-out: We did not need this as we were moving to Nujuma, a Ritz-Carlton Reserve, though the resort offers flexible timing tailored to a guest’s departure.

- Breakfast: Included with our stay and generally provided to all guests.

The St. Regis Red Sea Resort – Two Bedroom Overwater Coral Villa

The Two Bedroom Overwater Coral Villa combines bright coastal design with expansive indoor and outdoor space. Inside, the living room features floor to ceiling windows and soft, neutral décor. A curved sofa and textured seating creates an inviting space for relaxing with snacks or watching a movie.

Conveniences like a powder room and a discreet corner kitchenette added comfort without disrupting the villa’s airy feel. The kitchenette includes a microwave, beverage fridge, sink, toaster, and tea and coffee station.

Sliding doors lead to a generous terrace with loungers, a dining area, a plunge pool, and steps descending into the water. Privacy screens create a secluded retreat without limiting views.

The first bedroom includes two queen beds. Its ensuite features a double vanity, shower, and freestanding tub, with décor that subtly mirrors seashells and coral textures.

The master bedroom offers panoramic ocean views, a plush king bed, a round chaise lounge, and a writing desk.

Its master ensuite is anchored by a large circular soaking tub, complemented by a spacious shower, double vanity, and separate water closet. Closet space is integrated within the bathroom, keeping the bedroom clean and uncluttered. Sodashi amenities and bath salts further enhanced the spa-like feel.

Overall, the villa felt expansive yet cozy, ideal for families or friends seeking a stylish, contemporary overwater experience with direct lagoon access and ample privacy.

The St. Regis Red Sea Resort – Food and Drink

The resort features several dining venues:

- Nesma for Middle Eastern-inspired all-day dining

- Gishiki 45 for Japanese fare

- Tilina for a fine-dining experience

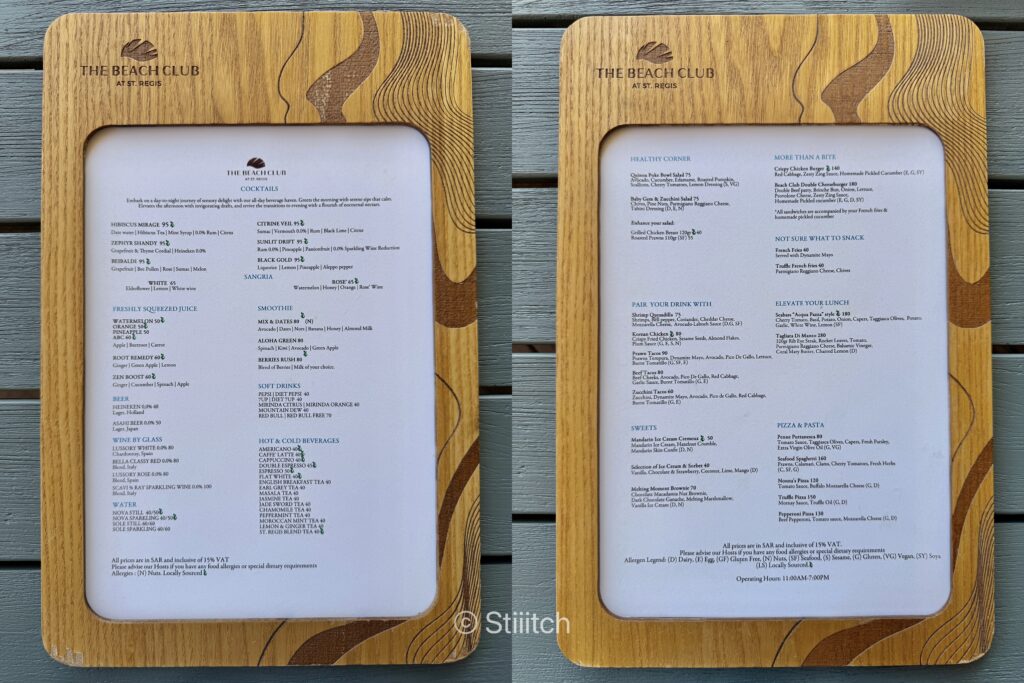

- The Beach Club for casual meals

- The St. Regis Bar for evening ambience, drinks, and live music

Breakfast at Nesma is included with all stays and was excellent, combining an well-rounded buffet with à la carte menu for main dishes.

We especially enjoyed Grill Night at the Beach Club one night, which offered a relaxed atmosphere with fresh seafood and meats grilled to order.

Tilina provided an elevated evening, with dishes that were visually artistic and flavourfully refined, while Gishiki 45 served excellent Japanese-inspired dishes, including a matcha dessert that I especially enjoyed.

Dining prices are high but in line with high-end Maldivian resorts; expect lunch to cost around $100 USD and dinner around $250+ USD for two guests. Wherever we dined, service was attentive without being rushed, with staff quickly remembering preferences.

Despite the absence of alcohol, the resort excelled in its non-alcoholic beverages. Mocktails were flavourful and thoughtfully crafted, and we frequently received complimentary welcome drinks at meals or by the pool, which added a warm touch to the experience.

The St. Regis Red Sea Resort – Other Facilities

Guests can explore the island by bicycle, on foot, or via buggy arranged through the butler.

The beach is scenic with shallow turquoise waters, though the sand is slightly more coarse than in other Indian Ocean locations. Along the shoreline, elegant wooden cabanas offer shade, with built in cooling fans, and ample privacy thanks to their thoughtfully spaced placement.

Just off the main beach, two pools including an adults-only option, provide a serene retreat overlooking the water beyond. The area is lined with loungers, and attentive staff offer iced water and prepare beach beds with thoughtful attention as soon as you arrive.

The full-service spa included a vitality pool, cold plunge, lap pool, yoga pavilion, and a well-equipped gym. Our complimentary yoga session was exceptional, with an instructor who provided one of the most effective stretches we have experienced at any resort. Tennis and padel courts are also available and complimentary for guest use.

The Little Treasures kids club is colourful and thoughtfully designed, offering indoor and outdoor play areas with daily programming for children aged 4–12 and teens.

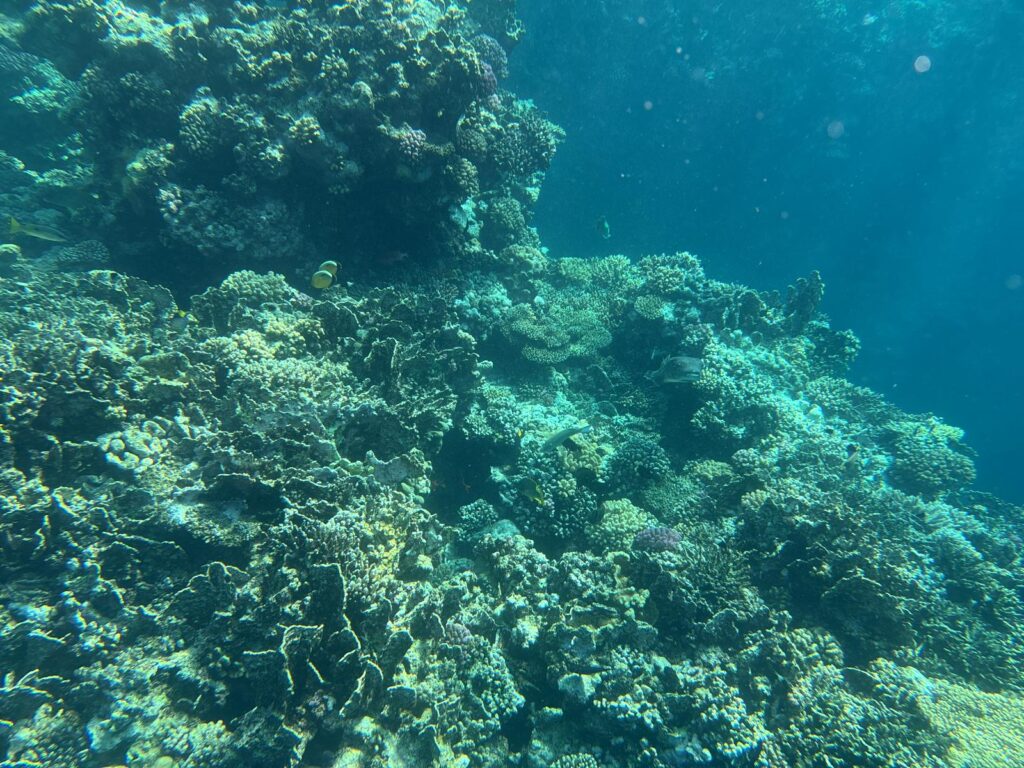

Water activities can be arranged through the WAWA Water Sports center. Complimentary water sports include kayaking and paddle boarding for 30 minutes per day. The Galaxea diving centre manages snorkelling and diving trips to nearby outer reefs, as the resort itself does not have a great house reef.

Service throughout the resort is outstanding. Staff anticipate needs effortlessly, and our butler provided several memorable gestures, including bringing us a platter of mangosteen after noticing how much we enjoyed them, and gifting us a boxed candle and room spray set after hearing my husband comment on the villa’s scent.

Lastly, each evening at sunset, the resort hosts the traditional St. Regis sabrage ceremony at the bar, adding a celebratory touch to close the day.

Conclusion

During our stay, occupancy was low as the Red Sea region awaited expanded international flight access, which created an uncommon sense of tranquil exclusivity. Even as visitor numbers grow, the resort’s thoughtful layout and abundant space ensure that guests can still find their own quiet corner of paradise.

The St. Regis Red Sea Resort is ideal for couples, families, and travellers seeking a serene, modern, and luxurious island escape with exceptional service. For those curious about emerging destinations beyond the Maldives, the Red Sea offers a compelling new alternative, and we would happily return as the region continues to evolve.

This story originally appeared on princeoftravel