If you’ve got Aeroplan Elite Status and a Marriott stay on the horizon, you’ve got a window to top up some Bonvoy points if you’re short of a stay.

From now until November 30, 2025, Aeroplan Elite Status members can convert Aeroplan points to Marriott Bonvoy at the usual 1:1, and Marriott will add a 20% bonus to the Bonvoy side.

Think targeted top-ups for fifth night free stay or a Bonvoy Moments package you don’t want to miss.

What’s The Deal?

The offer runs from November 1, 2025 at 12:00 a.m. EST to November 30, 2025 at 11:59 p.m. EST. Transfers are 1:1 from Aeroplan to Bonvoy, with an extra 20% deposited to your Marriott account.

he minimum transfer is 500 Aeroplan points; the caps are 100,000 per day and 250,000 per week.

Marriott states points may take up to eight weeks to post. In practice, transfers often land quickly, but don’t count on this for a last-minute check-in. For quick math: 1,000 Aeroplan becomes 1,200 Bonvoy; 50,000 Aeroplan becomes 60,000 Bonvoy.

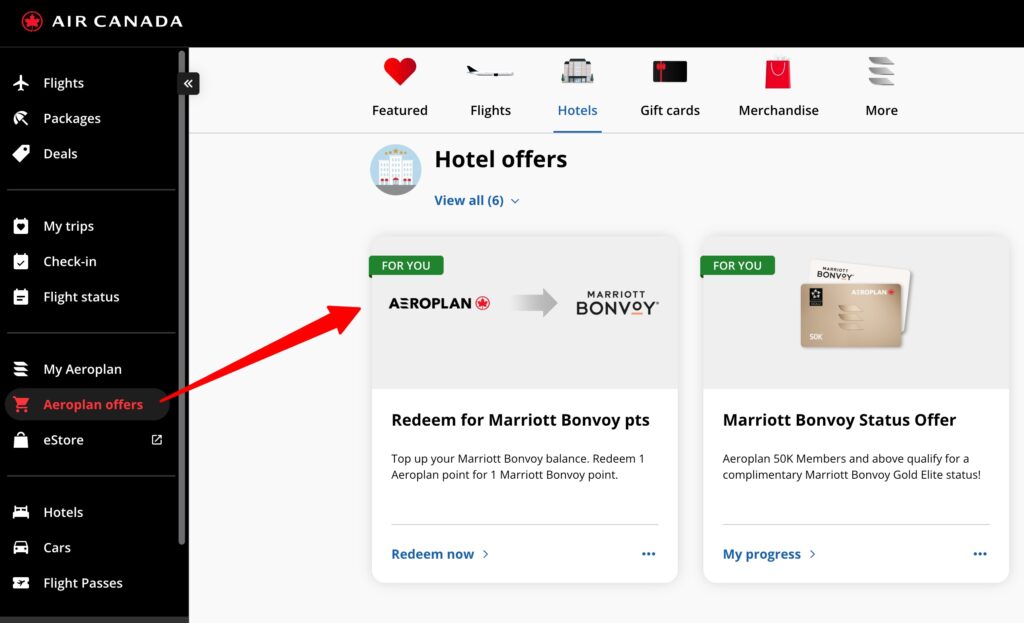

How To Initiate The Transfer

Sign in to Aeroplan, navigate to Aeroplan offers → Hotel offers → Redeem for Marriott Bonvoy points, and start the transfer process.

Enter the number of Aeroplan points you want to move and you’ll see the Marriott points you’ll receive.

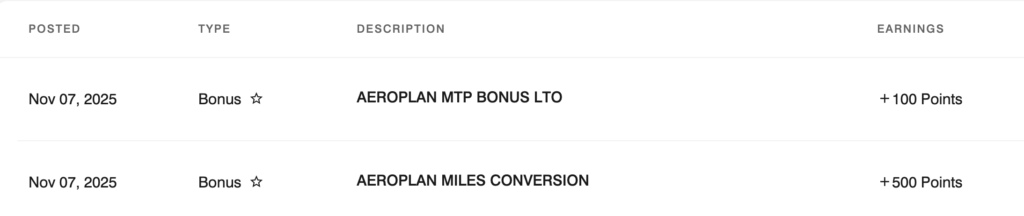

Note that the confirmation screen doesn’t show the 20% bonus portion; it posts to your Marriott account after the transfer completes.

I did a test transfer and the base amount and the 20% bonus posted immediately, but treat that as a nice surprise—not a guarantee.

Is This Promotion a Good Deal?

On pure math, Aeroplan points are generally more valuable for premium flight redemptions. We pegvalue Aeroplan points at about 2.1 cents per point and Bonvoy at about 0.8 cents per point.

After the 20% bonus, 1 Aeroplan becomes 1.2 Bonvoy points, which we value around 0.96 cents CAD. That’s still short of the typical flight value you can unlock with Aeroplan, so this is not a blanket “yes.”

It shines when you have a specific hotel stay with favourable award pricing, or you need a small, fast top-up to secure a booking. It is also useful for a Bonvoy Moments experience with a fixed points cost that you truly plan to attend.

If you just want more Bonvoy points on hand, consider alternative top-ups first, such as transferring from Amex Membership Rewards. If you’re transferring without a concrete plan, close the tab and keep earning.

Conclusion

This 20% bonus is a tactical tool for Aeroplan Elite members, not a new default strategy. Use it to finish a high-value Marriott booking, unlock the fifth-night free stretch, or secure a Bonvoy Moments package, and only move what you truly need.

Otherwise, let Aeroplan keep doing what it does best: getting you in premium cabins you wouldn’t normally pay cash for.

This story originally appeared on princeoftravel