Atmos Rewards (formerly Alaska Airlines Mileage Plan) is a popular loyalty program known for its great deals on redemptions with a number of airlines and frequent mileage sales.

With the current flash sale on Atmos Rewards points, you can earn a mystery bonus on your purchase of up to 100%, which can be a worthy endeavour in certain circumstances.

This time, the sale runs until 11:59pm Pacific Time on November 4, 2025, so be sure to capitalize on the offer before then if you’re interested.

Buy Atmos Rewards Points with a Mystery Bonus

Normally, Atmos Rewards sells points for 3.5 cents per point (USD), plus a 7.5% tax recovery fee, for a total of 3.76 cents per points (USD).

Note that this is an increase to the previous base cost of buying Alaska miles (2.75 cents per mile, plus a 7.5% tax recovery fee, for a total cost of 2.96 cents per mile (USD)).

Luckily, Atmos Rewards frequently offers discounts or bonuses on purchased points, so it doesn’t ever really make sense to buy them outside of sales.

This time around, you can get up to a 100% bonus on purchased points.

You might have a different offer, so be sure to log in to your Atmos Rewards account to see the exact breakdown of your bonus, as not all members are given the best-available offer.

My account has an 80% bonus available, which is structured as follows:

- Buy 3,000–9,000 points, get a 60% bonus

- Buy 10,000–19,000 points, get a 70% bonus

- Buy 20,000+ points, get an 80% bonus

With an 80% bonus, you could buy 180,000 Atmos Rewards points for $3,762.50 (USD) including tax, which works out to a cost of 2.09 cents per point (USD).

If you have the 100% offer available on your account, you could buy 200,000 Atmos Rewards points for $3,762.50 (USD), which works out to a cost of 1.88 cents per point (USD).

At our current valuation of 1.8 cents per mile (USD), the sale prices are above our target value, but it could represent a solid deal if you have a specific use in mind.

How many Atmos Rewards points can you buy?

Unless you have elite status with Atmos Rewards, each member is limited to receiving 150,000 points per calendar year from points purchases (excluding bonuses), whether buying for yourself or being gifted from someone else.

There’s also a limit of 100,000 points purchased per transaction (excluding bonuses). If you split your purchase up into multiple transactions, you could buy up to 300,000 points including the 100% bonus, assuming you haven’t already bought or been gifted Atmos Rewards points this year.

Which credit card should you use to buy Atmos Rewards points?

Atmos Rewards sells points through Points.com. This means that since you aren’t buying points directly from Alaska Airlines, you won’t earn any category bonus for using an Atmos Rewards credit card.

Furthermore, the purchase won’t code as travel for a category accelerator on other travel credit cards. Therefore, you should consider using any card with a high baseline earning rate, or one where you’re working towards meeting the minimum spend requirement to unlock a welcome bonus.

The purchase will be charged in US dollars, so to avoid extra costs, you should use a US credit card.

If you use a card with a Canadian billing address, you’ll be charged GST/HST on top of the Tax Recovery Fee, since Points.com is registered in Canada.

Even if you have a Canadian card with no foreign transaction fees, use it only as a last resort, since the extra cost eats into the value you can get from your points.

Scotiabank Passport® Visa Infinite* Card

- Earn 35,000 Scene+ points upon spending $2,000 in the first three months

- Earn an additional 10,000 Scene+ points upon spending $40,000 annually

- Earn 2x Scene+ points on groceries, dining, entertainment, and transit

- Plus, earn 3x Scene+ points on grocery purchases at Sobeys, IGA, Safeway, and FreshCo

- Visa Airport Companion membership with six free lounge visits per year

- Redeem points for a statement credit against any travel expense

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $150

When Does It Make Sense to Buy Atmos Rewards Points?

As is the case with any sale on points or miles, buying Atmos Rewards points can be a good way to top up your account to make a redemption, or to score a deal on travel in premium cabins (as opposed to paying for it outright with cash).

If you’ve found a good opportunity to redeem your Atmos Rewards points at a value you like, but your account is just shy of the amount you need, you may find this sale as a good way to bring your redemption across the finish line.

In fact, as long as you’re redeeming above the cost of buying with this promotion, you’ll come out ahead.

Atmos Rewards offers access to some excellent partner airlines, including Japan Airlines, Starlux Airlines, Condor, and many more.

If you can find award space availability with one of these airlines, this sale could unlock travel in premium cabins at a steep discount. As always, just be sure to locate award space first before you purchase points.

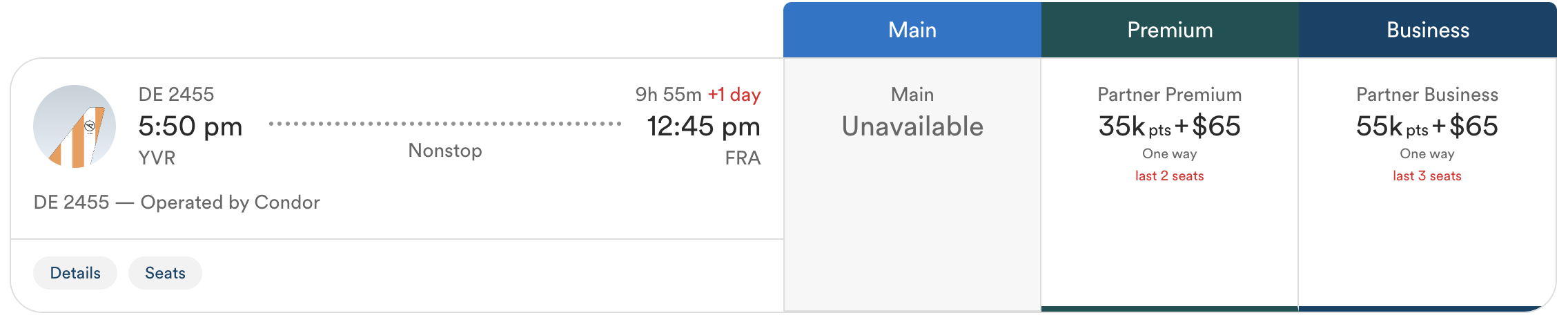

For Canadians, one of the most practical applications for Atmos Rewards is Condor flights to or from Europe.

Condor has decent coverage across Canada, linking its Frankfurt hub to Vancouver, Calgary, and Toronto.

A one-way flight in business class from Canada to Frankfurt costs 55,000 Atmos Rewards points, plus a very reasonable amount of taxes and fees.

Buying 55,000 Atmos Rewards points during this promotion would cost $1,054–1,166 (USD) depending on the bonus that you have on your account, which is an absolute steal.

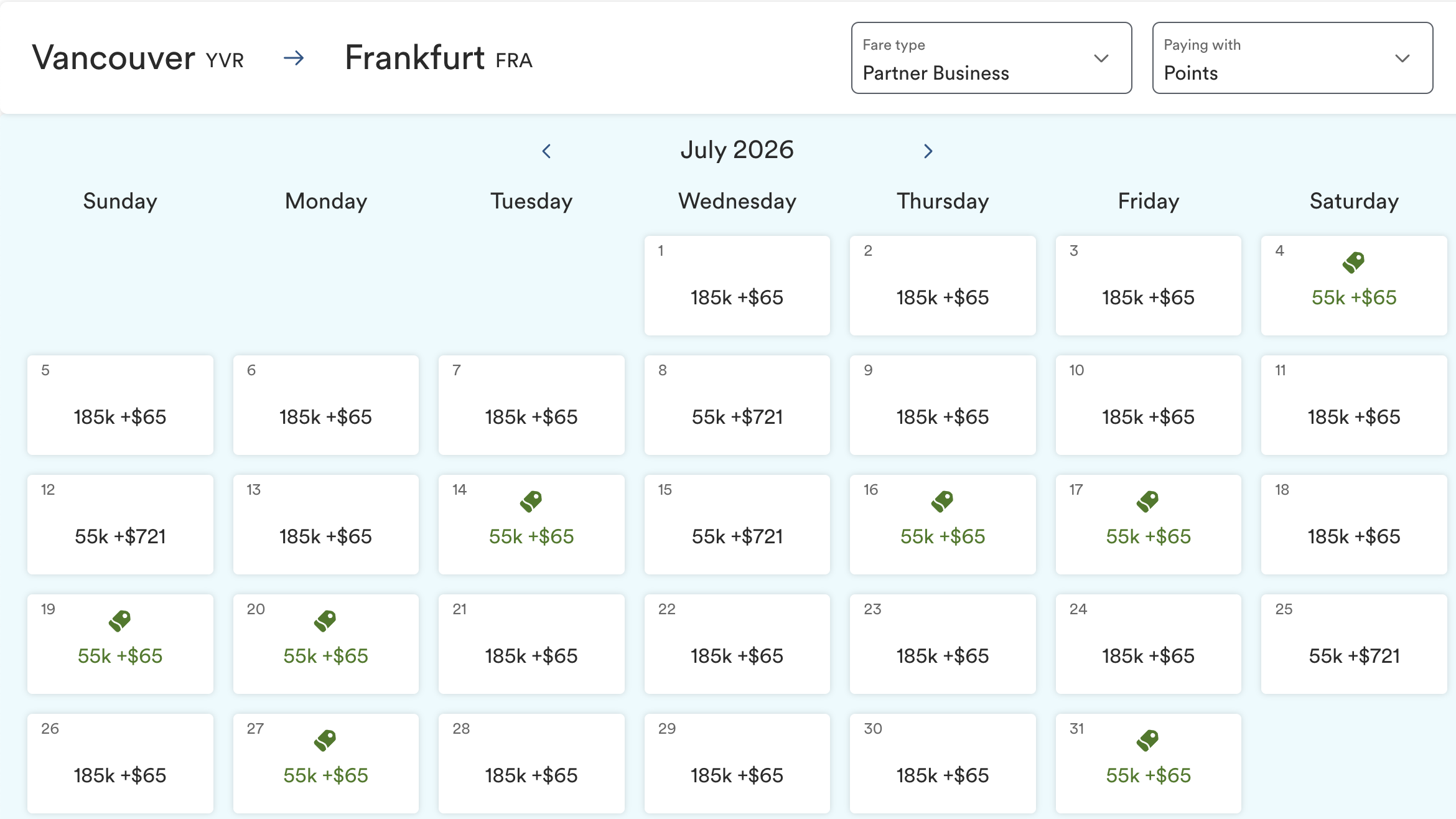

Fortunately, award availability with Condor (including multiple seats) to Canada is pretty good, especially when compared to other programs during the peak summer travel season.

Use the Atmos Rewards award search calendar to easily identify dates (filter by “Partner Business” and look for dates with 55k displayed in the results).

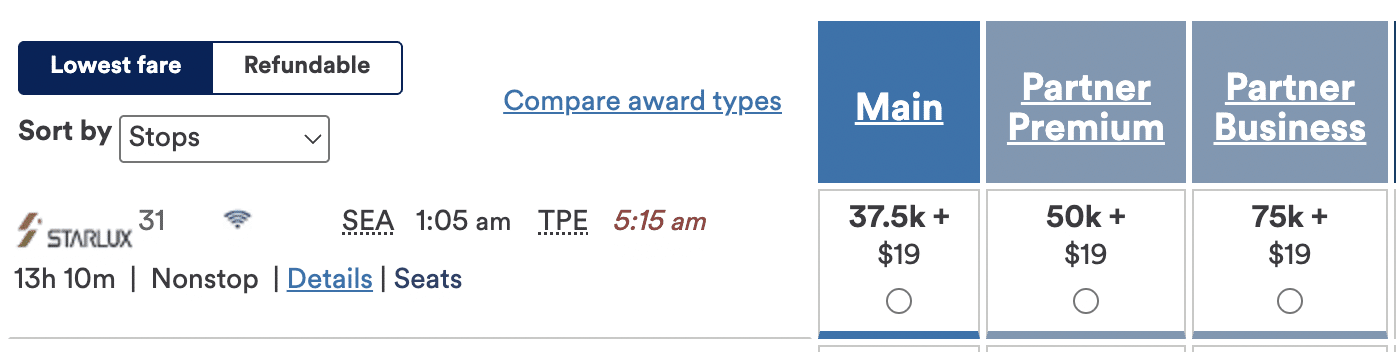

For a more aspirational example, a one-way flight between US hubs on the West Coast and Taipei with Starlux Airlines costs 75,000 Atmos Rewards points, plus a modest amount of taxes and fees.

Buying 75,000 points during this promotion works out to about $1,430 (USD), which is a great deal compared to the cash price for the same flights.

While you’ll have to contend with limited partner award availability (as you do with any loyalty program), there are many other best-use cases for Atmos Rewards points.

Other Ways to Earn Atmos Rewards Points

If you don’t have an immediate need for buying Atmos Rewards points, you can consider other ways to acquire them at a lower cost.

US Credit Cards by Bank of America

If you have a US social security number or ITIN, you’re eligible to apply for a trio of Bank of America’s Atmos Rewards co-branded cards.

All cards have frequent credits equivalent to a first-year fee rebate and occasional elevated points offers.

Marriott Bonvoy

Marriott Bonvoy points can be transferred to Atmos Rewards at a rate of 3:1, with a 5,000-mile bonus when transferred in chunks of 60,000 Bonvoy points.

At our present valuation of 0.6 cents per point, we’d value 60,000 Bonvoy points at $360 (USD). When transferred to Atmos Rewards, this is equivalent to buying 25,000 points at 1.44 cents per mile.

This is still lower than our valuation of Atmos Rewards points at 1.8 cents per point, and cheaper than the promotional cost to buy points outright. Depending on your Bonvoy balance and hotel redemption goals, you’ll have to weigh whether this is a better choice than paying cash for Atmos Rewards points.

Bilt Rewards

Last year, Bilt Rewards added Atmos Rewards as a 1:1 transfer partner, making it the only transferable points currency to have such an arrangement.

If you have access to Bilt Rewards, you can consider transferring points to Atmos Rewards to top up your account.

Atmos Rewards Shopping

You can also turn to the Atmos Rewards Shopping portal for bonuses on online purchases at many popular worldwide retailers ranging from technology to sportswear companies. High bonuses can often be found around big shopping days like Black Friday or Boxing Day.

Points usually arrive in your account within two weeks, although many stores have restrictions for purchases outside of the US.

Previous Promotions

As you weigh whether this promotion is a good opportunity for you to meet your travel goals, here’s a snapshot of Atmos Rewards’s previous offers on points sales, covering all promotions during the past year or so:

Conclusion

Atmos Rewards’s current mystery bonus promotion on buying points can be a good opportunity to push your balance over the hump for a dream trip, or to book premium flights at a discount compared to the cash rate.

This time, you can earn a up to a 100% bonus when you purchase at least 20,000 points. If you have a specific redemption in mind, this could be a good way to score an aspirational flight at a fraction of the price.

The offer runs until November 4, 2025, so be sure to have a look at what’s available and then make your purchase if you stand to benefit.

This story originally appeared on princeoftravel