In 2022, Chexy launched as a platform for Canadians to pay rent with a credit card and earn points one of their biggest monthly expenses. Ever since then, Chexy has been a key tool for savvy Canadian Miles & Points enthusiasts to meet minimum spending requirements and unlock rewards on rent.

Today, Chexy is officially launching two new features – Chexy Wallet and Chexy Taxes – which allow you to earn even more rewards by paying your bills and taxes with your credit card. Better yet, the processing fees charged by Chexy are the lowest in Canada, which makes Chexy the preferred platform for paying rent, bills, and taxes with your credit card.

Let’s take a close look at each of these two new features, and then explore how they can fit into your overall Miles & Points strategy.

If you’re signing up for Chexy, consider doing so through the Prince of Travel referral link, which helps to support the website.

Chexy Wallet: Pay Bills with a Credit Card

Chexy Wallet is official name of the bill payment service provided by Chexy, which allows you to pay one-off and recurring bills using your credit card on the Chexy platform.

You can pay a wide variety of bills using Chexy Wallet, including major expenses like tuition, daycare, condo/strata fees, and even car lease payments, all the way through to utility bills, internet, cable, phone bills, child care, and more.

After you’ve activated your Chexy account, setting up a payment using Chexy Wallet involves a simple three-step process.

Step 1 is to set up your payee details. Simply enter the name of your payee using the search field, and then follow the prompts to add your account number and other recipient information.

Step 2 is to select your payment date, which should be the date on which you’d like your payee to receive your payment. As we’ll show below, Chexy charges your card three days in advance to ensure your payment is delivered on time.

Step 3 is to add the credit card you’d like to use for the one-off or recurring bill payments. As it stands, Chexy accepts Canadian Visa and American Express cards, as well as international Mastercard, Visa, and American Express cards.

At this step, you’ll also see the processing fee that Chexy charges, which is 1.75% for Canadian cards and 2.5% for international cards. It’s worth noting that Chexy’s processing fees are the lowest in Canada, since other platforms like PaySimply and Plastiq charge 2.5% for the same service.

Once you have everything set up, your bill payment will proceed as per usual with the information you entered.

Here’s a screen-by-screen walkthrough of setting up a bill payment with Chexy.

Three days prior to your bill’s due date, Chexy will charge the credit card you selected for each bill, and the funds will arrive in your Chexy Wallet. The money stays in your Chexy Wallet until the payment is processed.

On the bill’s due date, Chexy will transfer the funds to your payee by way of Interac e-Transfer, pre-authorized debit, or bill pay (whichever format you choose when you set up the bill payment).

Setting up one-time or recurring bill payments only takes a few moments of your time, and while there’s a 1.75–2.5% processing fee, you can now earn even more rewards on some of your everyday expenses.

Plus, if you use the right credit card, the rewards should outweigh the cost.

Chexy Tax: Pay Taxes with a Credit Card

In addition to being able to pay rent and bills with your credit card, you can now pay your taxes on the Chexy platform with the launch of Chexy Tax.

The platform supports payments to the Canada Revenue Agency andRevenu Québec, and you can also pay property taxes to municipalities across the country through Chexy Wallet.

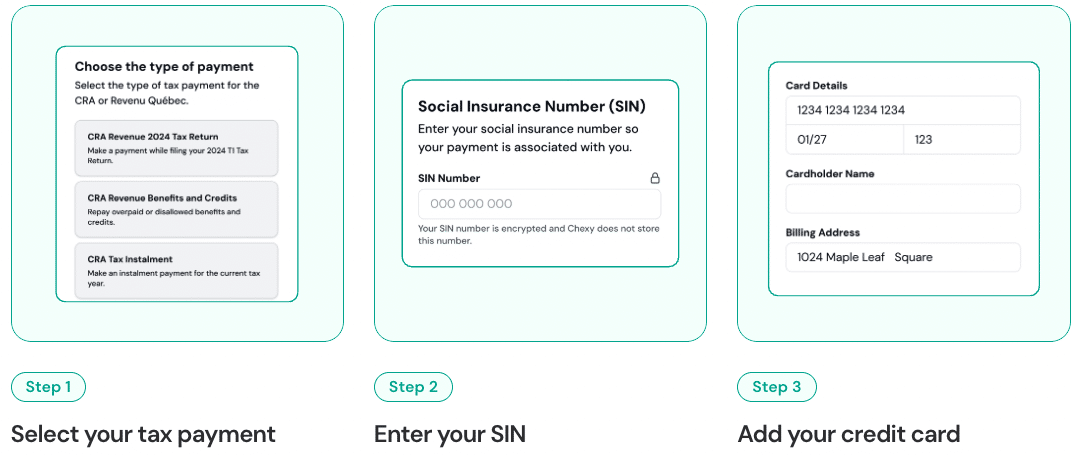

Chexy Tax works very similarly to Chexy Wallet, in that it’s a simple three-step process.

First, you’ll need to select the type of taxes you’d like to pay with your credit card. For example, if you owe income tax on your T1 tax return to the Canada Revenue Agency, you’d select CRA Revenue 2024 Tax Return.

Next, you’ll need to enter your Social Insurance Number (SIN) twice. Chexy’s website is fully encrypted, and your encrypted SIN is deleted once your payment is processed.

Lastly, enter the amount you’d like to pay, and then review all of the information to ensure it’s accurate. The fees charged are the same as those through Chexy Wallet: 1.75% for Canadian Visa and American Express cards, or 2.5% for international Mastercard, Visa, and American Express cards.

Once you click “Pay Now”, your credit card is charged, and the funds are moved to your Chexy Wallet in the next three days. Three business days later, Chexy submits your taxes to the CRA, Revenu Quebec, or your municipality via Bill Pay, and then they’re processed by the payee thereafter.

Here’s a screen-by-screen walkthrough of setting up a payment with Chexy Tax.

Again, it’s worth noting that Chexy Tax has the lowest fees for Canadian bill payment services that support tax payments, as both PaySimply and Plastiq charge 2.5%, whereas Chexy charges 1.75% for Canadian-issued American Express and Visa cards.

If you have taxes owing this year, be sure to check out Chexy Tax to further boost your points balance.

Conclusion

Chexy has officially launched two new features – Chexy Wallet and Chexy Tax – which allow Canadians to pay bills and taxes with their credit card and earn more rewards.

These new features are great tools for any Miles & Points enthusiast looking to squeeze more value out of every dollar they spend. Even with a processing fee of 1.75–2.5%, the potential value for individuals and business owners here is huge.

With the launch of Chexy Wallet and Chexy Tax, the Chexy platform now offers Canadians an excellent opportunity to earn credit card rewards on rent, bills, and taxes.

Indeed, these payments make up a good portion of many household budgets, and if leveraged strategically, you’ll be able to supercharge your rewards even further.

If you’re signing up for Chexy, consider doing so through the Prince of Travel referral link, which helps to support the website.

This story originally appeared on princeoftravel