Earlier this year, BMO and Porter Airlines officially announced the pending launch of a suite of VIPorter co-branded credit cards, slated to be open for applications in Spring 2025.

As of today, the BMO VIPorter World Elite®* Mastercard®* and the BMO VIPorter Mastercard®* are open for applications as the newest credit cards to hit the Canadian market.

Let’s take a detailed look at each of the cards, including the welcome bonus, earning rates, fees, perks, and benefits.

The New BMO VIPorter World Elite®* Mastercard®*

BMO’s new flagship VIPorter co-branded credit card is officially known as the BMO VIPorter World Elite®* Mastercard®*, which commands an annual fee of $199 (rebated in the first year as part of the introductory offer).

This card brings a welcome bonus of up to 70,000 VIPorter points to the table, broken down as follows:

- Earn 20,000 VIPorter points upon spending $5,000 in the first 110 days

- Earn 20,000 VIPorter points upon spending $9,000 in the first 180 days

- Earn 30,000 VIPorter points upon spending $18,000 in the first 365 days

BMO VIPorter World Elite®* Mastercard®*

- Earn 20,000 VIPorter points upon spending $5,000 in the first 110 days

- Plus, earn an additional 20,000 VIPorter points upon spending $9,000 in the first 180 days

- Plus, earn an additional 30,000 VIPorter points upon spending $18,000 in the first 365 days

- Then, earn 3x VIPorter points per dollar spent on Porter purchases

- And, earn 2x VIPorter points per dollar spent on gas, transportation, dining, groceries, and hotels

- Get one free checked bag and one free carry-on bag for yourself and up to eight guests on the same booking

- Priority airport services & priority rebooking in the event of delays

- Earn Qualifying Spend towards Avid Traveller status

- Annual fee: $199 (rebated in the first year)

If you signed up for the waitlist, keep an eye on your email for an elevated offer that should be worth 10,000 points more than this offer.

We value VIPorter points at 1.5 cents per point, and using this figure, we’d estimate that the total welcome bonus is worth $1,050. This doesn’t take into account any points earned from qualifying spending, nor does it factor in the card’s annual fee (starting in year two) or the value of the card’s other perks and benefits.

VIPorter doesn’t use an award chart, and instead employs a form of dynamic pricing. If you’re wondering how many points you’ll need to book a flight with Porter, here are some examples of the lowest one-way prices you’ll find on a handful of routes:

- Toronto–New York: 5,000 VIPorter points

- Toronto–Edmonton: 8,000 VIPorter points

- Toronto–Halifax: 7,000 VIPorter points

- Toronto–Vancouver: 8,000 VIPorter points

- Toronto–Miami: 7,000 VIPorter points

- Toronto–Los Angeles: 7,000 VIPorter points

Assuming you can find prices at these levels, the welcome bonus is easily good for a number of flights for you, your significant other, your family, and/or your friends!

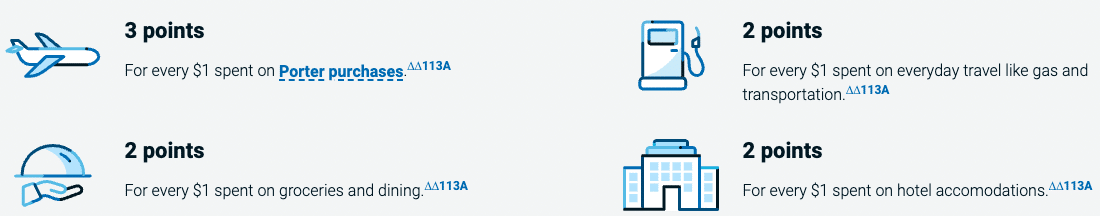

In terms of earning rates on everyday spending, the card has a 3-2-1 structure, broken down as follows:

- Earn 3 VIPorter points per dollar spent on up to $20,000 of Porter purchases (and earn 1 VIPorter point per dollar spent thereafter)

- Earn 2 VIPorter points per dollar spent on up to $5,000 of gas & transportation purchases (and earn 1 VIPorter point per dollar spent thereafter)

- Earn 2 VIPorter points per dollar spent on up to $10,000 of dining and grocery purchases (and earn 1 VIPorter point per dollar spent thereafter)

- Earn 2 VIPorter points per dollar spent on up to $5,000 of hotel purchases (and earn 1 VIPorter point per dollar spent thereafter)

- Earn 1 VIPorter point per dollar spent on all other eligible purchases

The spending caps are tallied by the calendar year, and once you’ve reached the cap, your earning rate in that category reverts to the card’s baseline earning rate of 1 VIPorter point per dollar spent through to the end of the year.

There are a number of perks and benefits specific to Porter Airlines that come included with the BMO VIPorter World Elite®* Mastercard®*.

Cardholders are automatically granted VIPorter Venture Avid Traveller status, which is typically earned by earning $3,000 in Qualifying Spend with Porter Airlines each year.

As a cardholder, and therefore a Venture Avid Traveller, you’ll enjoy the following perks:

- Earn 6 VIPorter points per dollar spent on all Porter Airlines purchases (except for government-imposed taxes and fees)

- Complimentary PorterClassic seat selection (rows 8 and above) for up to two passengers

- Dedicated check-in, priority security, and early boarding

- Priority reaccommodation in the event of flight delays

- One complimentary carry-on bag and one complimentary checked bag for yourself and up to eight passengers travelling on the same booking

Furthermore, upon spending $9,000 in the first year, you’ll earn a round-trip Porter companion pass, which offers a second passenger 100% off the base fare. In subsequent years, you can earn another companion pass upon spending $50,000 in a cardholder year.

As part of this offer, you’ll also earn $1,000 towards your Qualifying Spend when you reach $9,000 in qualifying purchases.

Then, on an ongoing basis, you’ll earn $1 in Qualifying Spend for every $25 spent on the card, which means that you can qualify for higher tiers of status without ever setting foot on a plane.

- Spending $50,000 would qualify you for VIPorter Passport status, as you’d have earned $2,000 in Qualifying Spend (though as a cardholder, you’ll already enjoy VIPorter Venture Avid Traveller status)

- Spending $75,000 would qualify you for VIPorter Venture status, as you’d have earned $3,000 in Qualifying Spend (though as a cardholder, you’ll already enjoy this tier of status)

- Spending $150,000 would qualify you for VIPorter Ascent status, as you’d have earned $6,000 in Qualifying Spend

- Spending $250,000 would qualify you for VIPorter First status, as you’d have earned $10,000 in Qualifying Spend

You’ll also get a free membership in Mastercard Travel Pass, powered by DragonPass, though each lounge visit will cost you $32 (USD).

The card also comes with a handful of other perks, including discounts on car rentals, prepaid hotel bookings through Booking.com, and more. Check out the full details on the BMO website.

Lastly, the card offers a suite of travel insurance, though the exact details for most weren’t available at the time of writing.

- Emergency medical insurance: 21 days

- Trip cancellation/interruption insurance

- Trip delay insurance

- Car rental collision/loss damage insurance

- Common carrier insurance

- Flight delay insurance

- Baggage insurance

- Hotel burglary insurance

- Extended warranty

- Purchase protection

To learn more about the BMO VIPorter World Elite®* Mastercard®*, click on the Apply Now button to head to the BMO website.

BMO VIPorter World Elite®* Mastercard®*

- Earn 20,000 VIPorter points upon spending $5,000 in the first 110 days

- Plus, earn an additional 20,000 VIPorter points upon spending $9,000 in the first 180 days

- Plus, earn an additional 30,000 VIPorter points upon spending $18,000 in the first 365 days

- Then, earn 3x VIPorter points per dollar spent on Porter purchases

- And, earn 2x VIPorter points per dollar spent on gas, transportation, dining, groceries, and hotels

- Get one free checked bag and one free carry-on bag for yourself and up to eight guests on the same booking

- Priority airport services & priority rebooking in the event of delays

- Earn Qualifying Spend towards Avid Traveller status

- Annual fee: $199 (rebated in the first year)

The New BMO VIPorter Mastercard®*

BMO has also launched the BMO VIPorter Mastercard®*, which comes with no minimum income requirement and commands an annual fee of $89 (also rebated in the first year as part of the introductory offer).

As part of the introductory offer, this card brings a welcome bonus of up to 40,000 VIPorter points to the table, broken down as follows:

- Earn 10,000 VIPorter points upon spending $3,000 in the first 110 days

- Earn 15,000 VIPorter points upon spending $6,000 in the first 180 days

- Earn 15,000 VIPorter points upon spending $10,000 in the first 365 days

BMO VIPorter Mastercard®*

- Earn 10,000 VIPorter points upon spending $3,000 in the first 110 days

- Plus, earn an additional 15,000 VIPorter points upon spending $6,000 in the first 180 days

- Plus, earn an additional 15,000 VIPorter points upon spending $10,000 in the first 365 days

- Then, earn 2x VIPorter points per dollar spent on Porter purchases

- And, earn 1x VIPorter point per dollar spent on gas, transportation, dining, groceries, and hotels

- Priority airport services & priority rebooking in the event of delays

- Earn Qualifying Spend towards Avid Traveller status

- Annual fee: $89 (rebated in the first year)

If you signed up for the waitlist, keep an eye on your email for an elevated offer that should be worth 10,000 points more than this offer.

We value VIPorter points at 1.5 cents per point, and using this figure, we’d estimate that the total welcome bonus is worth $600. This doesn’t take into account any points earned from qualifying spending, nor does it factor in the card’s annual fee (starting in year two) or the value of the card’s other perks and benefits.

In terms of earning rates on everyday spending, the card has a three-tiered structure, broken down as follows:

- Earn 2 VIPorter points per dollar spent on up to $10,000 of Porter purchases (and earn 0.5 VIPorter points per dollar spent thereafter)

- Earn 1 VIPorter point per dollar spent on up to $3,000 of gas & transportation purchases (and earn 0.5 VIPorter points per dollar spent thereafter)

- Earn 1 VIPorter point per dollar spent on up to $5,000 of dining and grocery purchases (and earn 0.5 VIPorter points per dollar spent thereafter)

- Earn 1 VIPorter point per dollar spent on up to $3,000 of hotel purchases (and earn 0.5 VIPorter points per dollar spent thereafter)

- Earn 0.5 VIPorter points per dollar spent on all other eligible purchases

As with the BMO VIPorter World Elite®* Mastercard®*, the spending caps are tallied by the calendar year, and once you’ve reached the cap, your earning rate in that category reverts to the card’s baseline earning rate of 0.5 VIPorter points per dollar spent through to the end of the year.

Cardholders of the BMO VIPorter Mastercard®* are automatically granted VIPorter Passport Avid Traveller status, which is typically earned by earning $2,000 in Qualifying Spend with Porter Airlines each year.

As a cardholder, and therefore a Passport Avid Traveller, you’ll enjoy the following perks:

- Earn 6 VIPorter points per dollar spent on all Porter Airlines purchases (except for government-imposed taxes and fees)

- Dedicated check-in, priority security, and early boarding

- Priority reaccommodation in the event of flight delays

Upon spending $6,000 in the first year, you’ll earn a voucher for 35% off the base fare for yourself and up to three guests on the same Porter booking. In subsequent years, you can earn another companion pass upon spending $25,000 in a cardholder year.

On an ongoing basis, you’ll earn $1 in Qualifying Spend for every $25 spent on the card, which means that you can qualify for higher tiers of status without ever setting foot on a plane.

- Spending $50,000 would qualify you for VIPorter Passport status, as you’d have earned $2,000 in Qualifying Spend (though as a cardholder, you’ll already enjoy VIPorter Passport Avid Traveller status)

- Spending $75,000 would qualify you for VIPorter Venture status, as you’d have earned $3,000 in Qualifying Spend

- Spending $150,000 would qualify you for VIPorter Ascent status, as you’d have earned $6,000 in Qualifying Spend

- Spending $250,000 would qualify you for VIPorter First status, as you’d have earned $10,000 in Qualifying Spend

The card also comes with a handful of other perks, including discounts on car rentals, prepaid hotel bookings through Booking.com, and more. Check out the full details on the BMO website.

Lastly, the card offers a suite of travel insurance, though the exact details for most weren’t available at the time of writing.

- Emergency medical insurance: 8 days

- Common carrier insurance

- Flight delay insurance

- Baggage insurance

- Hotel burglary insurance

- Extended warranty

- Purchase protection

To learn more about the BMO VIPorter Mastercard®*, click on the Apply Now button to head to the BMO website.

BMO VIPorter Mastercard®*

- Earn 10,000 VIPorter points upon spending $3,000 in the first 110 days

- Plus, earn an additional 15,000 VIPorter points upon spending $6,000 in the first 180 days

- Plus, earn an additional 15,000 VIPorter points upon spending $10,000 in the first 365 days

- Then, earn 2x VIPorter points per dollar spent on Porter purchases

- And, earn 1x VIPorter point per dollar spent on gas, transportation, dining, groceries, and hotels

- Priority airport services & priority rebooking in the event of delays

- Earn Qualifying Spend towards Avid Traveller status

- Annual fee: $89 (rebated in the first year)

Conclusion

BMO and Porter Airlines have teamed up to officially launch the BMO VIPorter World Elite®* Mastercard®* and the BMO VIPorter Mastercard®*. Cards are open to applications as of March 24, 2025, with strong introductory offers.

It’s exciting to see Porter Airlines finally have a co-branded credit card to complement its loyalty program and rapidly expanding network.

In the near future, we’ll do a full review of each of the cards to see how they compare to other airline co-branded cards available to Canadians. In the meantime, if either of the cards have piqued your interest, be sure to head to the BMO website to learn more.

* Terms and conditions apply. BMO is not responsible for maintaining the content on this site. Please click on the Apply Now link for the most up to date information.

This story originally appeared on princeoftravel