Earlier this year, Chexy launched a partnership with Aeroplan which includes a limited-time offer to earn bonus Aeroplan points. The offer was set to expire on July 15, 2025, but has now been extended through to September 15, 2025.

If you haven’t taken advantage of it yet, now’s your chance to earn up to 10,000 Aeroplan points just by paying expenses like rent, tuition, utilities, taxes, and more with your credit card.

It’s a rare opportunity to rack up points on bills that normally don’t earn anything. And the best part? Chexy accepts American Express credit cards for payments.

If you’ve been sitting on the sidelines, this is the perfect time to turn your recurring payments into serious travel rewards.

Earn Up to 10,000 Bonus Aeroplan Points with Chexy!

Through Chexy’s partnership with Aeroplan, you can earn bonus Aeroplan points that come in addition to the points you can earn on your credit card for making payments with Chexy.

New Chexy users are eligible to earn up to 10,000 bonus Aeroplan points as part of this limited-time offer, which has been extended to September 15, 2025.

Here’s how the bonus breaks down:

- Earn 2,000 Aeroplan points on your first payment with Chexy

- Earn 5,000 Aeroplan points after processing $5,000 in payments through Chexy within the first six months

- Earn 500 Aeroplan points for the second and any subsequent recurring bills within six months (up to 2,000 Aeroplan points)

- Earn 1,000 Aeroplan points on your 12th consecutive month of payments through Chexy

To qualify, all transactions must be successfully processed, meaning the card is charged and the payment is issued. Points may take up to four weeks to post to your Aeroplan account.

If you’re an existing Chexy user, sign into your Chexy account to look for your individual offer, which ranges from 2,000–4,000 Aeroplan points. The milestones to reach your individual limited-time offer will also be found on your Chexy dashboard.

Which Credit Card Should you Use with Chexy?

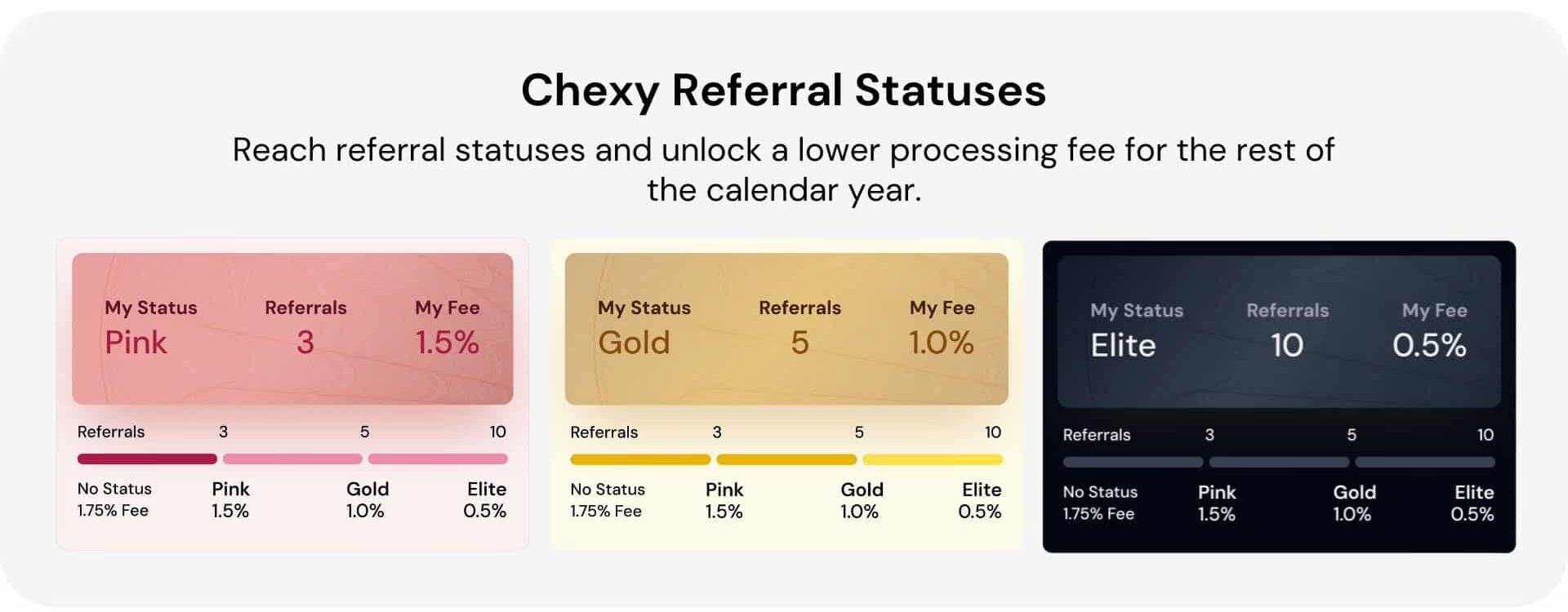

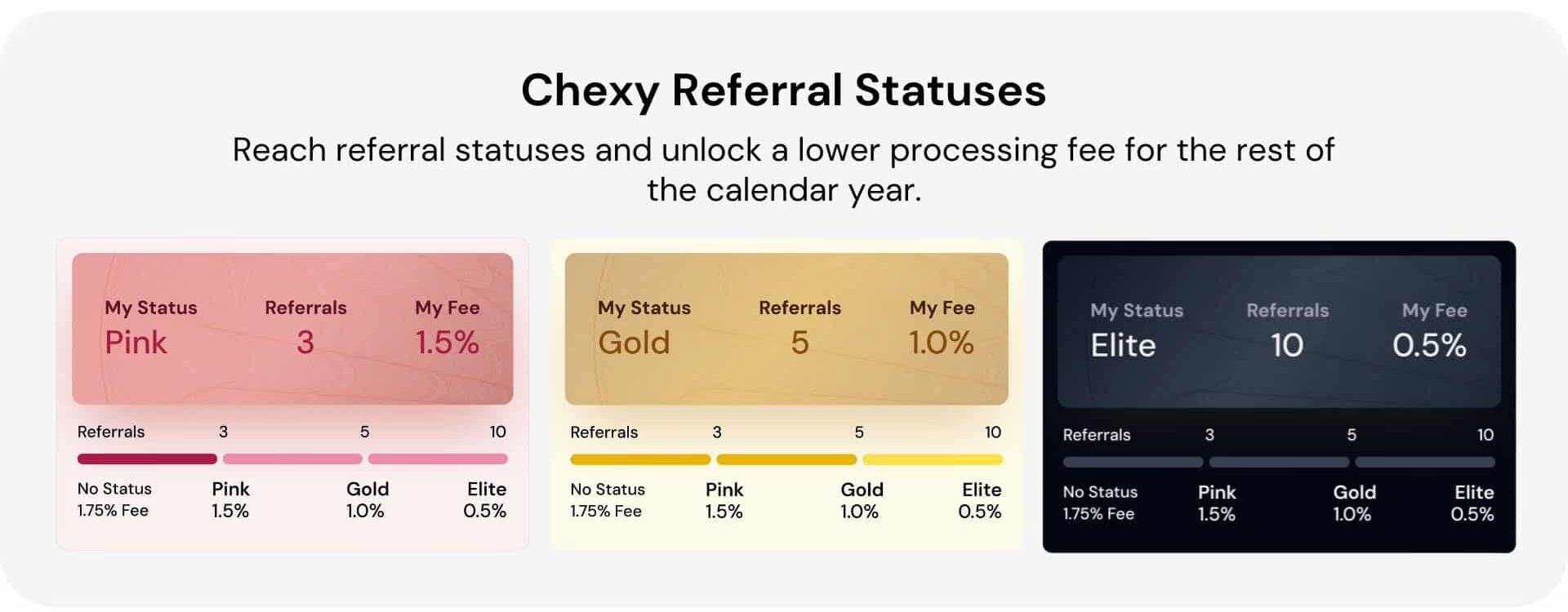

As a reminder, Chexy charges a 1.75% processing fee for payments made with Canadian-issued credit cards (which can be reduced to as low as 0.5% by referring others, which we’ll cover below). Therefore, it’s best to use a credit card that offers strong rewards or helps you unlock a welcome bonus.

American Express and Aeroplan co-branded credit cards are a great fit, thanks to our high valuation of Membership Rewards and Aeroplan points. Meanwhile, cash back cards can also make sense for those looking to maximize immediate returns.

For Miles & Points Enthusiasts

If you’re in the game for travel rewards, using a card that earns airline or transferable points can result in serious value—especially when paired with Chexy’s Aeroplan bonus offer.

For example, if you use a premium Aeroplan co-branded credit card, such as the American Express Aeroplan Reserve Card, the TD Aeroplan® Visa Infinite Privilege* Card, or the CIBC Aeroplan Visa Infinite Privilege Card, you’ll earn 1.25 Aeroplan points per dollar spent on payments via Chexy.

If you use a core Aeroplan credit card, such as the American Express Aeroplan Card, the TD Aeroplan® Visa Infinite* Card, or the CIBC Aeroplan Visa Infinite* Card, you’ll earn 1 Aeroplan point per dollar spent on payments via Chexy.

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

130,000 Aeroplan points $599 annual fee |

130,000 Aeroplan points | $2,682 |

Apply Now |

|

Up to 85,000 Aeroplan points† $599 annual fee |

Up to 85,000 Aeroplan points† | $871 |

Apply Now |

|

Up to 40,000 Aeroplan points† First Year Free |

Up to 40,000 Aeroplan points† | $683 |

Apply Now |

|

40,000 Aeroplan points $120 annual fee |

40,000 Aeroplan points | $573 |

Apply Now |

|

Up to 45,000 Aeroplan points† $139 annual fee |

Up to 45,000 Aeroplan points† | $525 |

Apply Now |

You can also opt for cards with strong baseline earning rates, such as the Business Platinum Card from American Express, RBC® Avion Visa Infinite Privilege†, or CIBC Aventura® Visa Infinite Privilege* Card which earn 1.25 points per dollar spent, in their respective points currencies.

Travel Credit Cards with High Baseline Earning Rates

For Cash Back Maximizers

If you prefer simple returns over points, Chexy can still deliver excellent value when paired with the right cash back credit card. Since Chexy codes transactions as recurring bill payments, certain credit cards can still yield a net positive return—even after the 1.75% processing fee.

For example, the Scotia Momentum® Visa Infinite* Card earns 4% cash back on recurring bill payments (up to $25,000 each year), resulting in a net return of 2.25% after fees. Another way to think about it is that you’re essentially getting paid to pay bills.

TD® Cash Back Visa Infinite* Card offers 3% back on the same category, leaving you with a respectable 1.25%. Meanwhile, CIBC Dividend® Visa Infinite* Card earns 2% back on recurring bills, which still results in a small profit on rent payments.

Whether you’re looking to offset your rent costs with cash back or earn rewards for your next trip, Chexy’s new partnership with Aeroplan opens the door to maximizing value on some of life’s biggest unavoidable expenses.

Credit Cards with Bonus Cash Back on Recurring Payments

Invite Friends, Earn More!

Chexy’s partnership with Aeroplan also includes a referral component, which allows you to boost your Aeroplan balance even further while lowering the cost of your processing fee.

New and existing users can earn 1,000 Aeroplan points per referral, in addition to Chexy’s existing give-and-get $15 cash referral bonus (which both the referrer and the referee get). To qualify, your referral needs to complete a successful first payment—not just sign up and disappear.

While the referral bonus of 1,000 Aeroplan points is capped at 10 referrals (up to 10,000 points each calendar year), you’ll continue to earn the $15 Chexy referral bonus for every additional friend you refer beyond that cap.

Plus, there’s an additional incentive to refer your friends, since you’ll pay a progressively lower processing fee as you bring more people into the Chexy ecosystem:

- 3 referrals = Pink Referrer Status → 1.5% processing fee

- 5 referrals = Gold Referrer Status → 1.0% processing fee

- 10 referrals = Elite Referrer Status → 0.5% processing fee

These referral counts reset each January, but they offer a compelling way to shrink your processing fee, stretch the value of every dollar you run through the platform, and boost up your Aeroplan balance.

Is Chexy’s Bonus Aeroplan Points Deal Worth It?

With up to 10,000 Aeroplan points on the table, Chexy’s limited-time offer is a compelling opportunity—especially if you’re already paying rent or bills that don’t normally earn rewards.

Based on our valuation of 2.1 cents per Aeroplan point, we’d value these bonus points at roughly $210, which can more than offset the cost of Chexy’s processing fees.

Unlike many promotions tied to specific travel purchases or elite status, this one is simple and accessible to anyone with recurring bills.

Chexy charges a processing fee of 1.75% for Canadian-issued credit cards. While that may seem like a drawback, the potential return often outweighs the cost—especially if you’re earning Aeroplan points at our estimated value of 2.1 cents per point.

Let’s run the numbers:

Say you pay $2,000 in rent using a TD® Aeroplan® Visa Infinite Privilege Card*. With the 1.75% fee, your total charge would be $2,035. You’d earn:

- 2,000 Aeroplan points from Chexy’s first-payment bonus

- 2,544 Aeroplan points from your credit card (2,035 × 1.25 points per dollar spent)

That’s a total of 4,544 Aeroplan points, which we’d value at approximately $95, in exchange for a $35 fee.

And that’s just one transaction. Combine this with Chexy’s referral program, which can lower your processing fee down to as low as 0.5%, and the value proposition becomes even more lucrative.

Conclusion

Chexy’s extended Aeroplan promotion is one of the easiest ways to earn meaningful rewards on payments that typically go unrewarded. Whether you’re working toward a dream trip, looking to hit a credit card minimum spending threshold, or just want to get something back on your rent, this deal delivers.

With up to 10,000 Aeroplan points available and a low 1.75% processing fee, the math works in your favour—especially when paired with the right credit card or referral strategy.

Make sure to sign up and complete your payments by September 15, 2025, to take full advantage of this limited-time offer.

This story originally appeared on princeoftravel