The Cathay World Elite® Mastercard® – powered by Neo is the only credit card in Canada that directly earns Cathay Pacific Asia Miles through its welcome offer and on everyday spending.

Asia Miles offers members access to the best award availability for Cathay Pacific flights, as well as valuable redemptions on oneworld-member airlines.

Let’s take a look at the reasons why you might consider the Cathay World Elite® Mastercard® – powered by Neo, as well as how it stacks up compared to other cards in the Canadian market.

|

Supplementary cardholders: |

|

|

$80,000 (personal), $150,000 (household) |

|

What we love: strong welcome bonus, 15% discount on Cathay Pacific flights, World Elite Mastercard benefits. What we’d change: improve category earning rates, include airline-specific benefits.

Welcome Bonus

One of the most important things to consider when applying for a credit card is the strength of the welcome offer. It’s also worth considering how easy it is to fulfill the minimum spending requirements, as you have to work much harder with some cards than others.

Since its launch in December 2023, the Cathay World Elite® Mastercard® – powered by Neo has a welcome offers of 27,000–60,000 Asia Miles.

Fortunately, all offers have had relatively low minimum spending requirements of $3,000–5,000 in the first three months, and the points from the welcome bonus have always been awarded in full during the first year.

Cathay World Elite® Mastercard® – powered by Neo

- Earn 35,000 Asia Miles upon card activation†

- Plus, earn 25,000 Asia Miles upon spending $5,000 in the first three months†

- Then, earn 4 Asia Miles per dollar spent on Cathay Pacific flights†

- And, earn more Asia Miles at Neo’s partners†

- Enjoy a 15% discount on Cathay Pacific flights†

- Minimum income: $80,000 (personal), $150,000 (household)

- Annual fee: $180

We value Asia Miles at 1.6 cents per mile, and using this valuation, we value a welcome bonus of 27,000 Asia Miles at $432 and a welcome bonus of 60,000 Asia Miles (the card’s all-time high) at $960.

Depending on how you choose to redeem these miles, the value could end up being worth more or less than these figures. Expect a higher return for travel in premium cabins, and close to par for redemptions in economy.

Earning Rates

With the Cathay World Elite® Mastercard® – powered by Neo , you earn Asia Miles at the following rates:

- 4 Asia Miles per dollar spent on eligible Cathay Pacific purchases

- 2 Asia Miles per dollar spent on all eligible foreign currency purchases

- 1 Asia Mile per dollar spent on all other eligible purchases

Once again, using our valuation of 1.6 cents per Asia Mile, you’re looking at an effective return of 6.4% on Cathay Pacific purchases, 3.2% on eligible foreign currency purchases, and 1.6% on all other eligible purchases.

The return on Cathay Pacific purchases is excellent, and if you’re a frequent flyer with the airline, you’ll be getting a great return in miles for your purchases.

The elevated Asia Miles you receive on foreign currency purchases outside Canada is offset by the 2.5% foreign transaction fee you have to pay on those same expenses. For out-of-country expenses, you could be better off using a credit card that doesn’t levy foreign transaction fees.

The baseline earning rate of 1 Asia Mile per dollar spent and its effective 1.6% return is good, but there are also other cards to consider that offer a higher baseline return.

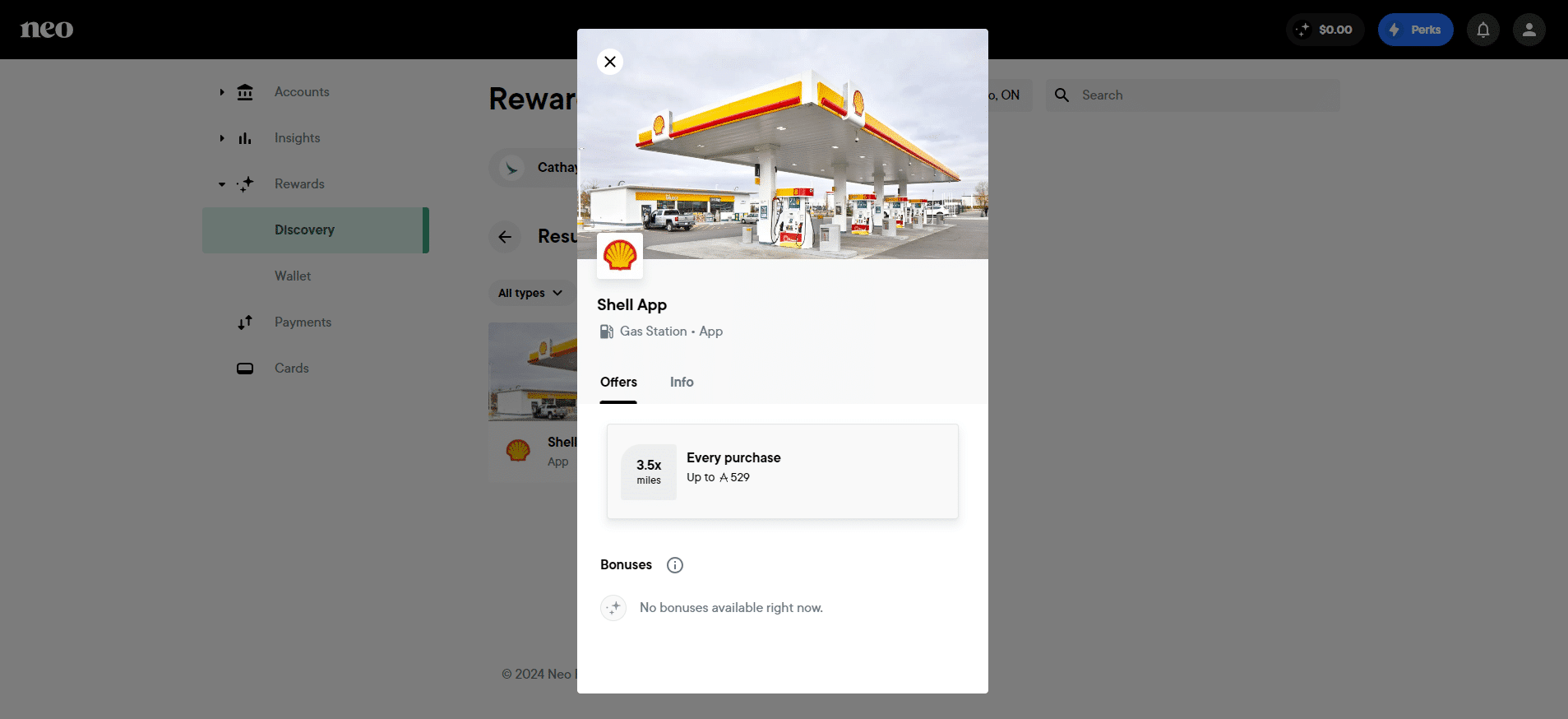

In addition to the above earning rates, the Cathay World Elite® Mastercard® – powered by Neo has exclusive partners with which you earn significantly higher Asia Miles for every dollar spent.

If you shop at one of Neo’s many partners, the Cathay World Elite® Mastercard® – powered by Neo immediately becomes more valuable.

Unfortunately, the list of partners isn’t made public until after you’ve applied for the card, and the partners list is fairly limited and comes with spending restrictions.

Redeeming Asia Miles

You can redeem your Asia Miles for award flights with Cathay Pacific and its partner airlines, including oneworld airlines like British Airways, Qatar Airways, Japan Airlines, and more.

In the last few years, Asia Miles has gone through a couple of devaluations, with some being more significant than others.

Still, there’s plenty of value to be found in the program, especially if you prioritize travel with Cathay Pacific. That’s because you’ll find the best (and in the case of premium cabins, the only) award availability on Cathay Pacific flights with Asia Miles.

In Canada, Cathay Pacific offers non-stop flights from Hong Kong to Vancouver and Toronto.

One-way redemptions between Hong Kong and Vancouver price out as follows, with a modest amount of taxes and fees:

- Economy: 27,000 Asia Miles

- Premium economy: 50,000 Asia Miles

- Business class: 88,000 Asia Miles

While one-way redemptions between Hong Kong and Toronto price out as follows:

- Economy: 38,000 Asia Miles

- Premium economy: 75,000 Asia Miles

- Business class: 115,000 Asia Miles

Outside of these routes, here are some examples of what you can do once you’ve amassed a healthy sum of Asia Miles:

- Fly Cathay Pacific First Class from Hong Kong to Beijing for 43,000 Asia Miles

- Fly Cathay Pacific First Class from Hong Kong to Tokyo for 50,000 Asia Miles

- Fly British Airways business class from North America to London for 63,000 Asia Miles

- Fly American Airlines business class from the US to Australia for 89,000 Asia Miles

- Fly Cathay Pacific First Class from Hong Kong to London or Los Angeles for 125,000 Asia Miles

- Fly Japan Airlines First Class from Tokyo to New York for 135,000 Asia Miles

Insurance Coverage

With the Cathay World Elite® Mastercard® – powered by Neo, you receive the following insurance benefits:

- Emergency medical insurance: up to $1 million for trips of up to 14 days for those aged 60 and younger

- Trip interruption insurance: up to $1,000 per person, up to $5,000 per trip

- Trip cancellation insurance: up to $1,000 per person, up to $5,000 per trip

- Flight delay insurance: up to $500 ($250 per day for reasonable and necessary expenses for a missed connection, denied boarding, or flight departure delay).

- Lost/delayed baggage insurance: up to $1,000 for delays of six hours or longer

- Auto rental collision/damage insurance: for up to 48 consecutive days on vehicles with an MSRP of up to $65,000

- Hotel/motel burglary insurance: up to $1,000 to cover the damage to or the loss of personal items resulting from the burglary at your hotel or motel room

- Purchase protection: for up 90 days from date of purchase

- Extended warranty: doubling the manufacturer’s warranty, up to one additional year

For a travel credit card with a $180 annual fee, the travel and retail insurance coverage on the Cathay World Elite® Mastercard® – powered by Neo isn’t quite as strong as we’d like.

For example, the emergency medical insurance of up to $1 million only covers cardholders aged 60 and younger for 14 days.

There are other credit cards with lower annual fees that offer more protection, longer coverage, and include benefits for those up to 65 years of age.

The Cathay World Elite® Mastercard® – powered by Neo also doesn’t provide mobile device insurance, which is typically seen on similar travel cards with an equivalent, or even a lower, annual fee.

Finally, a lot of co-branded airline credit cards will cover you for flight-related insurance coverage on award bookings with the airline. The Cathay World Elite® Mastercard® – powered by Neo does not.

Generally speaking, when you pay for an award booking with a co-branded credit card that earns the points/miles you earn with the card, the insurance coverage applies.

For example, if you pay for the taxes and fees on an Aeroplan booking with an Aeroplan co-branded credit card, or a Flying Blue booking with the Air France KLM World Elite Mastercard, you’re covered the same as if you’d booked the flight with cash.

Unfortunately, this isn’t the case with the Cathay World Elite® Mastercard® – powered by Neo.

For insurance coverage on an Asia Miles award booking, you’re better off paying for the taxes and fees with a different credit card, such as the National Bank® World Elite® Mastercard®, since you are then covered for insurance on your trip.

Otherwise, the travel insurance benefits provided by the card are fairly typical for a World Elite Mastercard.

Other Features

The most noteworthy unique benefit on the Cathay World Elite® Mastercard® – powered by Neo is the offer of 15% off the base fare when you make a cash booking through the Cathay Pacific website and use your Cathay World Elite® Mastercard® – powered by Neo with a promo code listed on the Cathay Pacific website to make an eligible purchase.

This benefit is only available until December 31, 2025 (though it seems to get renewed every year), and only covers one-way or round-trip flights departing from Canada. The full list of terms and conditions can be found on the Cathay Pacific website.

With the Cathay World Elite® Mastercard® – powered by Neo, you also receive standard World Elite® Mastercard® perks, including paid lounge access through Mastercard Travel Pass, powered by DragonPass.

Otherwise, the Cathay World Elite® Mastercard® – powered by Neo lacks airline-specific benefits. Notably, there are no unique benefits for Cathay Pacific flights offered to cardholders aside from the discount.

While Neo advertises this card as coming “exclusive membership perks” such as online priority check-in, extra baggage redemption, and Cathay Pacific business class lounge redemption access, the reality is that these are simply benefits enjoyed by all base-level Asia Miles members.

When it comes to extra baggage and Cathay Pacific business lounge redemptions, this simply means that you have the option to redeem Asia Miles for these perks, which again is something that anyone with an Asia Miles membership can choose to do.

Other Cards to Consider

The Cathay World Elite® Mastercard® – powered by Neo is worth getting if you want a nice boost to your Asia Miles balance, you can make good use of the 15% discount, and/or you shop at the Neo partners that earn elevated Asia Miles with this card.

However, if you’d like to find a credit card that earns airline miles, there are other options that give you more flexibility or that earn Asia Miles at a heightened rate.

For example, the RBC® Avion Visa Infinite† earns RBC Avion points, which you can transfer to The British Airways Club and Cathay Pacific Asia Miles at a 1:1 ratio, as well as American Airlines AAdvantage at a 1:0.7 ratio.

This gives you more flexibility for award bookings with oneworld airlines, since different loyalty programs have different sweet spots. Often, you can book the same flight with multiple programs, but the pricing might be more favourable with one over the other.

The only downside to the RBC® Avion Visa Infinite† is that it has rather low earning rates. However, if you also have an RBC® ION+ Visa – building what we like to refer to as The Optimized RBC Credit Card Portfolio – you can earn 3x Avion points on many common daily expenses:

- Earn 3 Avion points† per dollar spent on qualifying grocery, dining, food delivery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming and digital subscriptions

In other words, with The Optimized RBC Credit Card Portfolio, you can earn 3x Avion points on the above categories, which is essentially like earning 3x Asia Miles (since Avion points transfer 1:1 to Asia Miles.)

The Optimized RBC Credit Card Portfolio

Meanwhile, if your primary goal is to accumulate Asia Miles, you could consider the American Express Cobalt Card which earns American Express Membership Rewards (MR) points that can easily be converted to Asia Miles at a 1:0.75 ratio. In other words, each MR point can be exchanged for 0.75 Asia Miles.

With the American Express Cobalt Card, you earn MR points at the following rates on your purchases:

- 5 MR points per dollar spent on groceries and dining in Canada (up to $2,500 per month)

- 3 MR points per dollar spent on eligible streaming services

- 2 MR points per dollar spent on gas, transit, and rideshare in Canada

- 1 MR point per dollar spent on all other purchases

There’s a lot of flexibility with Membership Rewards points, but if you intend to convert all your MR points to Asia Miles at the rate of 1:0.75, the earning rates on the Amex Cobalt are essentially as follows:

- 3.75 Asia Miles per dollar spent on groceries and dining in Canada (up to $2,500 per month)

- 2.25 Asia Miles per dollar spent on eligible streaming services

- 1.5 Asia Miles per dollar spent on gas, transit, and rideshare in Canada

- 0.75 Asia Miles per dollar spent on all other purchases

As you can see, in most spending categories, you could end up earning almost four times as many Asia Miles by using your American Express Cobalt Card instead of your Cathay World Elite® Mastercard® – powered by Neo.

American Express Cobalt Card

- Earn up to a total of 15,000 MR points upon spending $750 in each of the first 12 months

- Earn 5x MR points on groceries, restaurants, bars, and food delivery

- Earn 3x MR points on eligible streaming services

- Earn 2x MR points on gas and transit purchases

- Transfer MR points to Aeroplan, Avios, Flying Blue, Marriott Bonvoy, and more

- Enjoy the exclusive benefits of being an American Express cardholder

- Bonus MR points for referring family and friends

- Monthly fee: $12.99

Conclusion

The Cathay World Elite® Mastercard® – powered by Neo offers a solid welcome bonus and the unique benefit of 15% off Cathay Pacific flights.

Despite being the only co-branded Cathay Pacific Asia Miles credit card in Canada, the card doesn’t offer any additional Cathay Pacific perks, and the category earning rates are relatively low.

If you can make use of the benefits that do exist, or if you’d like to boost your Asia Miles balance, then the Cathay World Elite® Mastercard® – powered by Neo deserves consideration – especially with an all-time high offer.

However, there are other cards to consider if you’d like to earn more flexible points for travel, or if you’d like to have better returns on daily spending.

This story originally appeared on princeoftravel