Over the years, Scene+ has evolved from a rewards program that gets you free cinema tickets and fast food to one of Canada’s leading players in the loyalty space.

This evolution of the program has made Scotiabank’s suite of credit cards, most of which are tethered to Scene+, more attractive.

In this guide, we’ll provide an overview of the various Scene+ cards being offered by Scotiabank to help you more easily navigate your options.

Scotiabank’s Suite of Scene+ Credit Cards

Scotiabank offers a wide array of credit cards, which can be classified into three main categories: travel and lifestyle, cash back, and low interest.

Within the travel and lifestyle group, you can find the following cards that all earn Scene+ points:

Scene+ is the loyalty program co-owned by Scotiabank, Cineplex, and the Empire Company, which is behind grocery chains like Sobeys, Safeway, Freshco, and others.

Over the years, the Scene+ program has grown thanks to recent partnerships with the Empire Company, Rakuten, Expedia, and Home Hardware.

This revitalization of the program has made Scene+ points more valuable and useful than ever before, and has also made Scotiabank Scene+ cards all the more appealing for everyone – from travellers, to those who are looking to save money on their groceries and nights out.

We’ve written a complete guide to the Scene+ program, so if you’d like to learn more about how to turn your Scene+ points into free hotels, flights, or piles of groceries, we recommend you take a look.

With this bit of background information in mind, let’s explore the different Scotiabank Scene+ cards below.

Scotiabank Gold American Express® Card

The flagship American Express product by Scotiabank, the Scotiabank Gold American Express® Card has two standout features: great domestic earning rates and no foreign transaction fees.

The fees and eligibility requirements for this card are as follows:

- Annual fee: $120 (all figures in CAD)

- Supplementary cardholders: $29

- Minimum income requirement: $12,000 (personal)

- Estimated credit score needed: Good to Excellent

That $12,000 income requirement is surprisingly low for a card in this tier. Most competitors in the same ballpark ask for $60,000+ in personal income. So if you’re a student, newcomer to Canada, or rocking a part-time gig while building credit, this is one of the few cards that gives you premium-level earning potential without gatekeeping.

Showing off its excellent domestic earning rates, this card earns Scene+ points as follows:

- 6 Scene+ points per dollar spent at Sobeys, IGA, Safeway, FreshCo, and other partnered merchants

- 5 Scene+ points per dollar spent on groceries, dining, and entertainment

- 3 Scene+ points per dollar spent on gas, transit, and streaming services

- 1 Scene+ point per dollar spent on all other purchases

As you can see, this card can effectively earn up to 5–6% in rewards, which is quite rare in the Canadian market. Its elevated earning rate categories are also wide-ranging, where other cards usually limit theirs to two to four categories.

However, Amex acceptance is still hit-or-miss globally. You won’t have trouble using it in North America, but if you’re planning to swipe your way through Europe or Asia, it’s smart to have a backup Visa or Mastercard just in case.

Overall, the Scotiabank Gold American Express® Card is ideal if you’re looking for top-tier rewards without top-tier income—or if you want to earn Scene+ points fast on the things you already spend money on.

Scotiabank Gold American Express® Card

- Earn 30,000 Scene+ points upon spending $2,000 in the first three months

- Plus, earn an additional 20,000 Scene+ points upon spending $7,500 in the first year

- Earn 6x Scene+ points at Sobeys, IGA, Safeway, FreshCo, and more

- Plus, earn 5x Scene+ points on groceries, dining, and entertainment

- Also, earn 3x Scene+ points on gas, transit, and select streaming services

- Redeem points for a statement credit for any travel expense

- No foreign transaction fees

- Enjoy the exclusive benefits of being an American Express cardholder

- Annual fee: $120 (waived for the first year)

Scotiabank Platinum American Express® Card

This is the top-tier Amex in Scotiabank’s lineup. The Scotiabank Platinum American Express® Card packs a suite of premium travel perks—plus no foreign transaction fees, just like its Gold sibling.

The fees and eligibility requirements of this card are as follows:

- Annual fee: $399

- Supplementary cardholders: $99

- Minimum income requirement: $12,000 (personal)

- Estimated credit score needed: Excellent

Again, that low $12,000 income requirement is eye-catching. For a card with lounge access, concierge service, and strong travel insurance, it’s rare to see that level of accessibility. This could be a solid pick for someone with modest income but big travel plans.

This card earns 2 Scene+ points per dollar spent on all purchases, regardless of currency, so this means you’ll be earning 2% in rewards even when you’re abroad.

The travel perks are quite strong, such as 10 Visa Airport Companion Program lounge visits per year, Hertz #1 Club Gold membership, and insurance coverage that includes a $2 million travel emergency medical benefit (for up to 31 days for those under 65).

However, it doesn’t have any boosted earning categories. So if you spend heavily in groceries, dining, or transit, the Gold Amex might give you better returns overall—at a third of the annual fee.

Still, if you want a straightforward earn rate, solid perks, and wide-ranging travel insurance—without worrying about income thresholds—this card is an underrated pick.

Scotiabank Platinum American Express® Card

- Earn 60,000 Scene+ points upon spending $3,000 in the first three months

- Earn an additional 20,000 Scene+ points upon spending $10,000 in the first 14 months

- Plus, earn 2x Scene+ points on all purchases

- Priority Pass membership with 10 complimentary lounge visits per year

- Enjoy the exclusive benefits of being an American Express cardholder, including Amex Offers

- Annual fee: $399

Scotiabank American Express® Card

The Scotiabank American Express® Card markets itself as an entry-level option—but if we’re being honest, it’s a bit of an odd one.

The fees and eligibility requirements of this card are as follows:

- Annual fee: $0

- Supplementary cardholders: $0

- Minimum income requirement: $12,000 (personal) or less (students/newcomers)

- Estimated credit score needed: Good

Despite having no annual fee, this card still requires the exact same income level as the Gold and Platinum versions. So unless you’re absolutely set on keeping your annual fees at zero, it’s hard to justify picking this one over the others—especially when the Scotiabank Gold Amex earns significantly more and includes better perks.

That said, there is a student version of this card, which may be easier to get approved for if you don’t yet meet the income requirement yet. In that case, it can serve as a solid first step into the world of rewards points.

The earning rates are as follows:

- 3 Scene+ points per dollar spent at Empire grocery stores such as Sobeys, IGA, Safeway, Foodland, and FreshCo

- 2 Scene+ points per dollar spent on dining, groceries, movie theatres, gas, transit, and streaming services

- 1 Scene+ point per dollar spent on all purchases

Sure, up to 3% back is solid for a no-fee card, and the fact it still includes some insurance (like mobile device protection and purchase security) is a nice bonus.

Unless you’re someone who wants absolute zero fee while being able to dabble in Amex Offers, you’re much better off with the Gold or Platinum version.

Scotiabank American Express® Card

- Earn 2,500 Scene+ points upon spending $250 in the first three months†

- Earn an additional 5,000 Scene+ points upon spending $1,000 in the first three months†

- Also, earn 3x Scene+ points on Empire grocery stores such as Sobeys, IGA, Safeway, Foodland, and FreshCo

- Plus, earn 2x Scene+ points on dining, groceries, gas, transit, and streaming purchases

- Enjoy the exclusive benefits of being an American Express cardholder

- Annual fee: $0

Scotiabank Passport® Visa Infinite* Card

Another flagship card is the Scotiabank Passport® Visa Infinite* Card, which also charges no foreign transaction fees. Great for travelling abroad, this card offers six free lounge visits annually through Visa Airport Companion Program.

The fees and eligibility requirements of this card are as follows:

- Annual fee: $150

- Supplementary cardholders: $0 for the first card, $50 for cards thereafter

- Minimum income requirement: $60,000 (personal), $100,000 (household)

- Estimated credit score needed: Excellent

Regardless of which currency you’re spending in, the Scotiabank Passport® Visa Infinite* Card earns Scene+ points as follows:

- 3 Scene+ points per dollar spent at Empire grocery stores such as Sobeys, IGA, Safeway and FreshCo

- 2 Scene+ points per dollar spent on transit, groceries, dining, and entertainment

- 1 Scene+ point per dollar spent on all other purchases

As you may have guessed from its name, the Scotiabank Passport® Visa Infinite* Card is a good travel-card option. In addition to the above-mentioned lounge passes and the fact that it doesn’t charge foreign transaction fees, the card also comes with solid insurance coverage, including emergency travel coverage for up to 25 days out-of-province, flight delay insurance, delayed and lost baggage insurance, and more.

The Scotiabank Passport® Visa Infinite* Card is a good choice for an avid traveller who can take advantage of the lounge passes and insurance, and who will appreciate the 2.5% savings on foreign currency spending.

Scotiabank Passport® Visa Infinite* Card

- Earn 35,000 Scene+ points upon spending $2,000 in the first three months

- Earn an additional 10,000 Scene+ points upon spending $40,000 annually

- Earn 2x Scene+ points on groceries, dining, entertainment, and transit

- Plus, earn 3x Scene+ points on grocery purchases at Sobeys, IGA, Safeway, and FreshCo

- Visa Airport Companion membership with six free lounge visits per year

- Redeem points for a statement credit against any travel expense

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $150

Scotiabank Passport® Visa Infinite Privilege* Card

The Scotiabank Passport® Visa Infinite Privilege Card* is a premium travel credit card designed for high-income earners who want luxury perks, strong rewards, and no foreign transaction fees—all on the Visa network.

Fees and eligibility:

- Annual fee: $599 (you can get a $150 rebate with the Scotiabank Ultimate Package)

- Supplementary cardholders: $199

- Minimum income requirement: $200,000 (personal or household)

- Estimated credit score needed: Excellent

The earning rates are as follows:

- 3 Scene+ points per dollar spent on eligible travel

- 2 Scene+ points per dollar spent on dining and entertainment

- 1 Scene+ point per dollar spent on everything else

If you book travel through Scene+ Travel (powered by Expedia), you’ll earn an extra 3 Scene+ points per dollar spent as a Scene+ member—effectively earning up to 6x on travel booked through the portal.

That said, it’s disappointing that the base earn rate is only 1x on all other purchases. For a premium-tier card with a $599 annual fee, you’d typically expect a baseline of 1.25x or more—especially when other Visa Infinite Privilege cards in Canada offer higher base earn rates.

Also, note that the elevated earning rates are capped at $100,000 in annual spending. Beyond that, all purchases earn 1 point per dollar spent.

Perks and benefits:

- No foreign transaction fees

- 10 complimentary lounge visits per year via the Visa Airport Companion Program (DragonPass)

- $250 annual travel credit (usable on Scene+ Travel bookings)

- Visa Infinite Privilege airport benefits: priority security, check-in, and baggage at select Canadian airports

- Complimentary Avis President’s Club membership

While the $250 travel credit is a solid rebate, it’s more restrictive than Scene+ points—it can only be applied to bookings made through the Scene+ Travel portal. By contrast, Scene+ points themselves can be redeemed against any travel purchase made on the card, offering far more flexibility.

Also worth noting: unlike the other Infinite Privilege products like the TD Aeroplan Visa Infinite Privilege Card, this one doesn’t include any airline-specific perks like priority boarding, free checked bags, or preferred pricing on rewards.

Still, the extra lounge passes may be a nice touch for those who travel frequently and value access over airline tie-ins.

Insurance coverage is among the strongest of any Canadian card, with highlights including:

- Up to $5 million in emergency medical coverage (31 days; 10 days if age 65+)

- Trip cancellation and interruption insurance

- Flight delay, lost/delayed baggage, and rental car collision coverage

- Mobile device insurance up to $1,000

- Purchase protection (180 days) and extended warranty (up to 2 extra years)

If you spend heavily on travel and want luxury perks without switching to Amex, this is one of the best Visa cards in Canada for premium travellers.

Scotiabank Passport® Visa Infinite Privilege* Card

- Earn 30,000 Scene+ points upon spending $3,000 in the first three months

- Plus, earn an additional 30,000 Scene+ points upon spending $20,000 in the first six months

- And, earn an additional 20,000 Scene+ points when you make at least one eligible purchase during the 14th month of account opening

- Earn 3x Scene+ points on eligible travel purchases

- Earn 2x Scene+ points on dining and entertainment purchases

- Visa Airport Companion membership with 10 free lounge visits per year

- $250 annual travel credit

- Redeem points for a statement credit against any travel expense

- Minimum income: $150,000 personal or $200,000 household

- Annual fee: $599

Scotiabank® Scene+™ Visa* Card

The Scotiabank® Scene+™ Visa* Card is one of the bank’s entry level products meant for newcomers, students, and those who are just starting to build up their credit.

The fees and eligibility requirements of this card are as follows:

- Annual fee: $0

- Supplementary cardholders: $0

- Minimum income requirement: $12,000 (personal) or less (students/newcomers)

- Estimated credit score needed: Good

This card earns 2 Scene+ points per dollar spent at Scene+ partners Empire Company grocery stores, Cineplex, and Home Hardware, and earns 1 point per dollar spent on all other purchases.

Up to 2% back in rewards on purchases is great for an entry-level card, especially if you compare it to some Visa cards at the same tier which only offer returns of 0.5–0.75%.

The Scotiabank® Scene+™ Visa* Card is a solid entry-level card and a good choice for people who often shop with Scene+ partner merchants. With no annual fee on the card or on supplementary cards, this is an easy option to add to your wallet to start earning some rewards.

Scotiabank® Scene+™ Visa* Card

- Earn 2,500 bonus Scene+ points by making at least $250 in everyday eligible purchases in your first three months

- Then, earn an additional 2,500 Scene+ point bonus when you spend at least $1,000 in everyday eligible purchases in your first three months

- Also, earn 2 Scene+ points per dollar spent at Sobeys, Safeway, Foodland & Participating Co-ops, FreshCo and more

- Plus, earn 2x Scene+ points per dollar spent on Cineplex and Home Hardware purchases

- Earn 1 Scene+ point per dollar spent on all other eligible everyday purchases

- Redeem Scene+ points against travel purchases and more

- Annual fee: $0

- Offer valid through October 31, 2025

Redeeming Scene+ Points

Scene+ points are one of the most versatile reward currencies in Canada, with a wide range of redemption options.

We’ve written extensively about all the redemption options in our Scene+ guide, but below, we’ve highlighted what we think are the best ways to redeem your points once you’ve got a nice stack of them.

Instant Rebates

The simplest way to redeem Scene+ points is for instant rebates at physical locations of the program’s partners. These include:

- Empire Company grocery stores (Sobeys, Safeway, IGA, FreshCo, etc.)

- Cineplex (including The Rec Room and Playdium)

- Home Hardware

- Recipe Unlimited restaurants (Harvey’s, Swiss Chalet, Montana’s, etc.)

At these establishments, you can usually redeem in blocks of 500 or 1,000 Scene+ points, which are worth $5 and $10, respectively.

To sweeten the deal, you can also earn extra points by logging into the Scene+ app or website for personalized bonus point offers, such as 15x bonus Scene+ points at Harvey’s, East Side Mario’s, and Montana’s.

Note that you can redeem and earn Scene+ points in the same transaction, so you won’t lose out on bonus points earned at the grocery store (for example) when you pay using your accumulated Scene+ points.

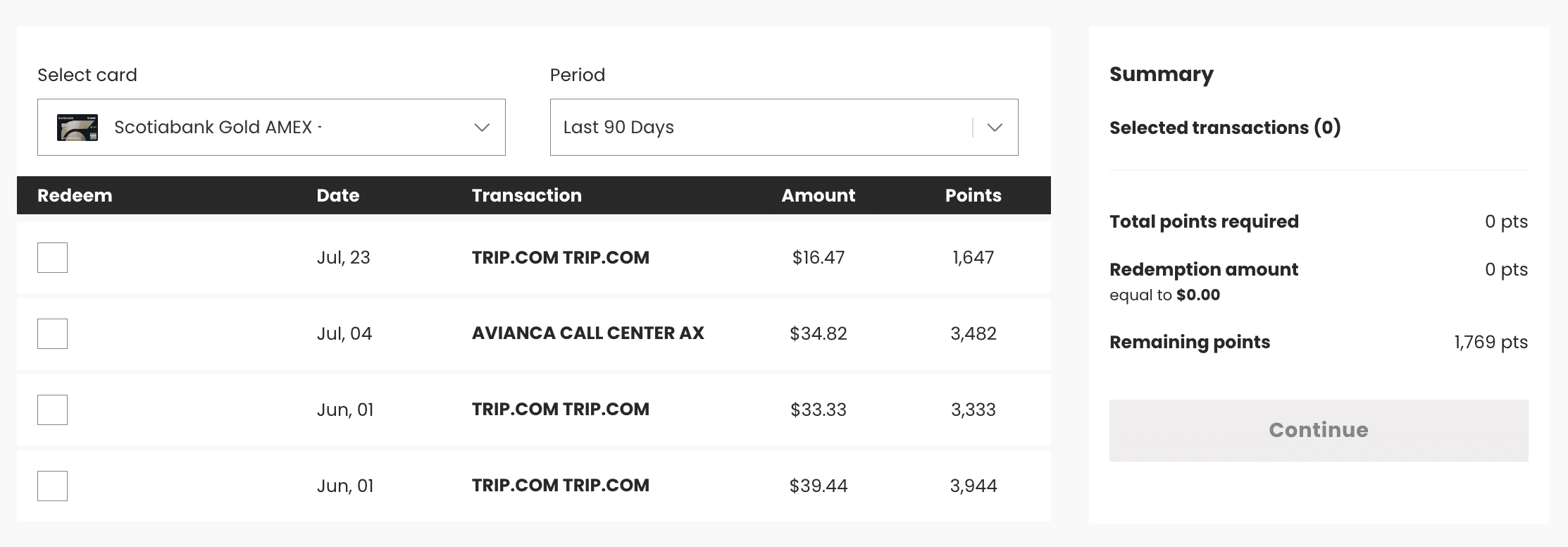

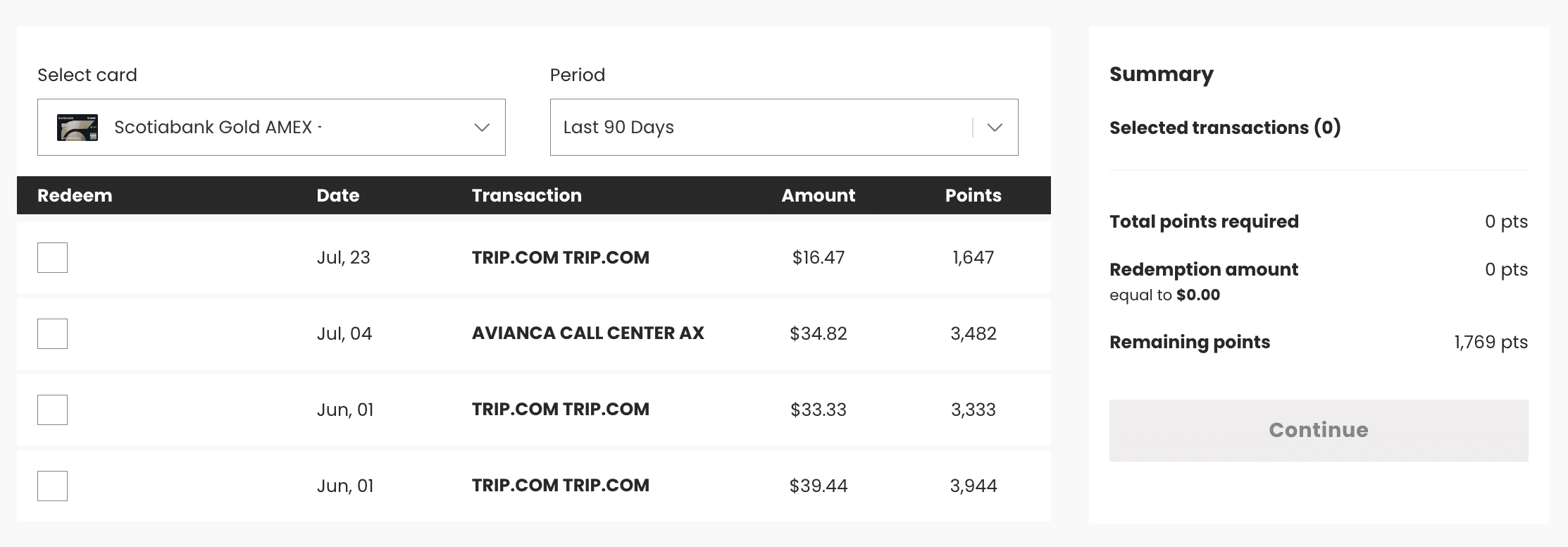

Apply Scene+ Points on Any Travel Purchase

For the Miles & Points community, the ability to redeem Scene+ points against any travel purchase made on the associated Scene+ credit card is likely the most valuable use.

When redeeming your points this way, you’re getting the optimal value of 1 cent per point, and you’re able to use your points to pay for travel purchases that can otherwise be difficult to cover using miles or points.

Purchases like boutique hotels, cruises, ultra-low-cost carrier flights, and more are all examples of the unique travel redemptions that you can make using your Scene+ points.

To redeem your points for travel purchases made on your Scene+ credit card, you’ll need to sign in to your account, and locate the purchase you’d like to offset. You can redeem your points for any travel purchase made on the card in the last 12 months.

The good thing is, if you don’t have enough Scene+ points to cover the full cost of a travel purchase, you can still make a partial redemption; however, you won’t be able to redeem against the remaining amount of that purchase in the future.

Thankfully, Scene+ points are automatically pooled into one balance from all your Scotiabank cards, so if you have more than one Scene+ credit card, you can use the accumulated points collectively for a larger purchase.

Scene+ Travel

Another interesting redemption method for travellers is through Scene+ Travel, which is backed by Expedia.

When you book through the Scene+ Travel portal, you can use your Scene+ points directly against your purchase in blocks of 100 Scene+ points = $1, and you can also use them for partial redemptions, covering the rest of the full cost with another payment method like your Scene+ credit card.

This option makes for a really streamlined experience since you’re essentially booking through Expedia but paying (at least in part) with your Scene+ points!

Conclusion

Scotiabank’s Scene+ credit card lineup covers a lot of ground, from entry-level no-fee options to premium travel cards with lounge access and perks. But when it comes to real, everyday value—not all of them hit the mark.

The Scotiabank Gold American Express® Card is the top pick for those who want high daily spend earnings, no foreign transaction fees, and the added bonus of Amex Offers. It’s rare to see that kind of return on spend with such a low income requirement.

If global acceptance is a priority and you still want strong earn rates, no FX fees, and complimentary lounge access, the Scotiabank Passport® Visa Infinite Card* is the way to go. It strikes a great balance for frequent travellers who value flexibility and perks without paying top-tier annual fees.

There’s a Scene+ card for nearly every situation—but these two offer the strongest mix of rewards, benefits, and long-term value.

This story originally appeared on princeoftravel