Most small business owners can’t earn credit card points on their biggest monthly expenses because suppliers and the CRA don’t accept credit cards directly, or they charge a large fee to do so.

That means missing out on rewards, struggling to hit signup bonuses, and tying up working capital.

Chexy fixes all of that. Now with its new small business offering, you can pay virtually any business expense with a credit card—while earning points and boosting cash flow. And for a limited time, you can earn up to 100,000 Aeroplan® points* in just 3 months.

What Is Chexy?

Chexy is a Canadian bill payment platform that lets you pay rent and other expenses with a credit card—useful when the payee doesn’t accept cards directly.

It works by Chexy taking your payment via credit card, then forwarding it to your payee through a method they do accept, such as Interac e-Transfer, Bill Pay, or Pre-Authorized Debit (PAD).

Originally launched as a tool for tenants to pay rent with a credit card, Chexy has now expanded into the small business space. That means business owners can now earn rewards on expenses that were previously ineligible for points—like rent, supplier invoices, utilities, and taxes.

How Chexy for Business Works

Chexy acts as a middleman between your credit card and the vendors who won’t accept card payments directly. You pay Chexy using your credit card, and Chexy takes care of the rest, sending funds to your vendor through one of three supported payment methods:

- Interac e-Transfer

- Bill Pay

- Pre-Authorized Debit (PAD)

This makes it possible to use your credit card for just about any major business expense, without needing to convince your landlord, accountant, or insurance provider to start accepting Visa or Amex.

The fee is just at 1.75%, which is lower than any competitor in Canada. Plus, it’s typically tax-deductible as a business banking fee (more on that later).

Eligible payment types include:

- Rent and lease payments

- Payroll and corporate tax payments

- Utilities and insurance

- Personal income taxes (CRA & Revenu Québec)

- Property taxes

- Supplier and contractor payments (coming soon)

This flexibility is what makes Chexy so appealing to small business owners. You can finally earn rewards on high-value, recurring expenses that used to go unrewarded.

Earn Up to 100,000 Bonus Aeroplan Points!*

For a limited time, Chexy is offering small business owners the chance to earn up to 100,000 Aeroplan points* just by making payments for three consecutive months.

The bonus is tiered based on your monthly spend. If you meet your chosen spend level each month for three months in a row, you’ll receive the matching number of Aeroplan points as a lump sum at the end of Month 3.

For example, if your business spends $25,000 or more per month, you’ll receive 25,000 Aeroplan points at the end of the promo period.

This is one of the largest Aeroplan-earning promos currently available in Canada and you don’t need to open a new credit card or hop on a plane to take advantage, all from the comfort of your home.

One thing to keep in mind is that if you already have a personal Chexy account, you’ll need to use a different Aeroplan® number for your SMB sign-up in order to qualify for the bonus.

Triple Dip: How to Maximize the Points

Chexy for Small Businesses isn’t just about earning one bonus—it’s a powerful way to boost your points with every payment. When used strategically, you can effectively triple dip on rewards:

1. Unlock welcome bonuses faster

Big monthly expenses like rent, insurance, or tax payments make it easy to meet the minimum spend for credit card welcome bonuses. Instead of struggling to hit $15,000 in 3 months, you can possibly do it in one single Chexy payment.

2. Earn credit card rewards

Use a high-earning credit card to pay through Chexy and accumulate points or cashback. For example, earn up to 1.25 Aeroplan points per dollar spent with the American Express® Aeroplan® Reserve Card, or 1.25 Membership Rewards points per dollar spent with Business Platinum Card® from American Express.

Alternatively, you can earn up to 4% cash back with the Scotiabank Momentum® Visa Infinite* card by making recurring payments via Chexy. However, the accelerated cash back of 4% is capped at $25,000 spend, which drops to 1% thereafter.

Scotia Momentum® Visa Infinite* Card

- Earn 10% cash back in the first three months, up to $200 total cash back for spending $2,000

- Plus, earn 4% cash back on groceries and recurring bill payments

- Also, earn 2% cash back on gas and transit

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $120 (waived for the first year)

3. Collect the Chexy SMB bonus

Make three months of payments at your chosen tier and get up to 100,000 Aeroplan points*, no extra effort needed.

Let’s take a look at quick example:

A business owner with a monthly expense of $50,000 signs up for Chexy and pays all their bills using the Business Platinum Card® from American Express and pays all the expenses through Chexy for a year, here’s what that could look like:

- 170,000 MR points from the welcome bonus (110,000 points after spending $15,000 in the first three months + 60,000 points after spending $90,000 in the first year).

- 600,000 MR points from the spend (1.25x on $600,000 annual spend)

- 50,000 Aeroplan points from the Chexy promotion (based on $50,000/month for 3 months)

Total: 800,000 MR points and 50,000 Aeroplan points

MR points can be transferred to Aeroplan® at a 1:1 ratio, bringing the total haul to 850,000 Aeroplan points.

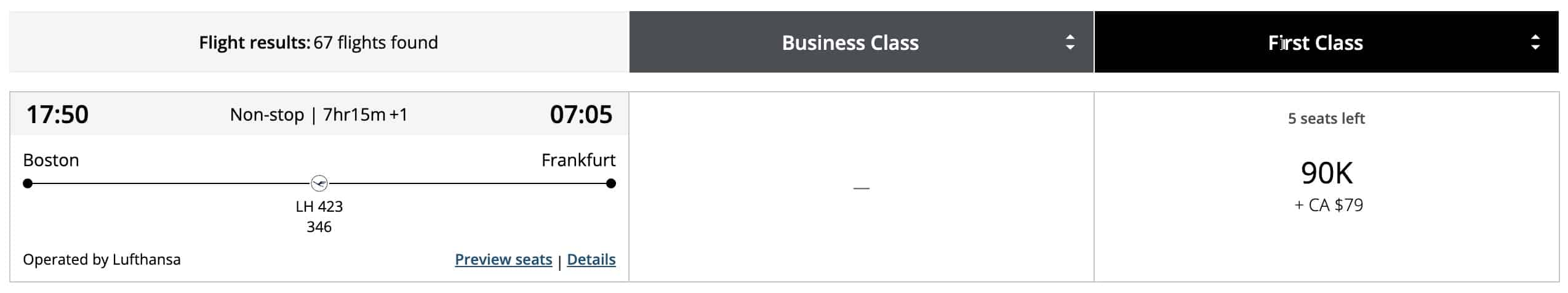

That’s more than enough for a family of four to fly round-trip in First Class to Europe—just by paying bills the smarter way.

Real Financial Benefits: Tax and Cash Flow

Chexy doesn’t just help you earn more points—it can also make your business more efficient when it comes to cash flow and taxes.

1. Fees can be tax-deductible

Chexy charges a 1.75% processing fee, which may seem steep at first glance.

But here’s the kicker: this fee is typically tax-deductible, since it’s often categorized as a “banking fee”. That means it can reduce your taxable income—and effectively lower your true out-of-pocket cost.

Here is a simple Example:

Say you use Chexy to pay $10,000 in business expenses. You’ll pay $175 in Chexy fees. If your business tax rate is 15%, you’ll likely get $26.25 back as a tax deduction at year-end.

So instead of the full $175, your real cost is closer to $148.75. That’s an effective fee of 1.49%, not 1.75%.

For incorporated professionals with even higher marginal rates, the savings could be even greater.

Moreover, the rewards you earn from credit card purchases are generally not taxed by the CRA, since they’re viewed as rebates or incentives, not income.

Note: We’re not tax professionals or financial advisors, so be sure to consult your accountant to confirm how Chexy payments and fees apply to your specific situation.

And if you take vacations from time to time, the points you earn through Chexy can help cover travel costs that you’d otherwise pay out of pocket—or require you to withdraw more funds from your corporation, potentially triggering additional personal taxes.

Being able to book a flight, even in business or First Class, using points earned from regular business expenses can easily outweigh the fee you paid to earn them.

2. Boosted cash flow without the bank

In addition to earning rewards, using Chexy can improve your cash flow by giving you access to your credit card’s interest-free grace period, which can be as long as 55 days depending on your billing cycle and card provider.

Instead of paying bills immediately out of your business account, you can preserve cash for longer while your vendors still get paid on time. This flexibility can be especially helpful for managing seasonality, delayed receivables, or other short-term cash flow gaps.

With Chexy, you’re buying yourself time and earning rewards while you’re at it, a smart move for any business owner.

Which Credit Cards Should You Use with Chexy?

One of Chexy’s biggest advantages is flexibility: you can use almost any credit card to make payments through the platform, whether you’re chasing Aeroplan redemptions or looking to squeeze some cashback out of routine expenses.

Note: At the moment, Canadian-issued Mastercard credit cards aren’t supported on Chexy.

For business owners that love to travel:

If you’re in it for flights and luxury travel, pairing Chexy with a high-earning points card is a no-brainer—especially when combined with the limited-time Aeroplan bonus.

The American Express® Aeroplan® Business Reserve Card earns 1.25 Aeroplan points per dollar spent, and comes with premium Air Canada perks like priority check-in, Maple Leaf Lounge access, and a free first checked baggage. Great for those who fly Air Canada frequently.

The RBC® Avion® Visa Infinite Business* Card also earns 1.25 Avion points per dollar spent. These points can be redeemed at a fixed value of 2 cents per point when booking premium flights—ideal for travellers who need date flexibility and want guaranteed access to business or First Class seats.

The Business Platinum Card® from American Express earns 1.25 Membership Rewards points per dollar spent. MR points are highly flexible and can be transferred to a wide range of airline and hotel partners, including Aeroplan®, British Airways Avios, Marriott Bonvoy, and more.

Best Travel Credit Cards for Chexy Business Payments

For business owners who prefer cashback:

If travel rewards aren’t your thing, Chexy can still add value—especially when paired with the right cashback card. Since Chexy payments are coded as recurring bills, some credit cards offer elevated earn rates that can help offset, or even surpass, the 1.75% fee.

The Scotia Momentum® for Business Visa Card* earns 3% cashback on recurring payments, up to $50,000 in annual spend (then drops to 1%). It’s a great fit for small business owners with moderate monthly expenses, but less ideal for those with high-volume spending.

The Wealthsimple Visa Infinite Card earns 2% unlimited cashback on all eligible purchases. With no category restrictions or caps, it’s a strong choice for high-spending businesses—just be sure to use it exclusively for business purchases to keep your bookkeeping clean.

Conclusion

Chexy’s small business feature unlocks a powerful way to earn rewards on expenses that typically go unrewarded—like rent, insurance, and taxes. With the ability to pay by credit card and earn up to 100,000 Aeroplan® points* through the current promo, there’s real potential to turn your business bills into meaningful travel rewards or cashback.

Add in the benefits of tax-deductible fees, improved cash flow, and flexible card compatibility, and it’s easy to see why Chexy is becoming a go-to tool for savvy Canadian business owners.

Whether you’re a points chaser or just looking to make the most of your overhead, Chexy is worth considering as part of your financial toolkit.

This story originally appeared on princeoftravel