In this edition of Head-to-Head, we’ll compare the two Mastercard products issued by Rogers Bank: the Rogers Red Mastercard® (formerly the Rogers Connections Mastercard) and the Rogers Red World Elite® Mastercard.

Both cards offer cash back on purchases, no annual fees, and useful perks that are especially beneficial for those who use Rogers products and services.

Let’s put the cards up against each other to help decide which is best for your wallet.

Rogers Mastercard vs. Rogers World Elite® Mastercard

Card Basics

We’ll kick things off with a look at the essentials offered by both cards: the welcome bonus, the annual fee, and the earning rates.

1. Welcome Bonus

At this time, neither the Rogers Red Mastercard® nor the Rogers Red World Elite® Mastercard is offering a welcome bonus.

Verdict: A tie. No extra upfront value on either card right now.

2. Annual Fee

The Rogers Red Mastercard and the Rogers Red World Elite® Mastercard both have no annual fees,† putting them squarely on even ground in this category.

Verdict: This is a clear tie, since neither card requires an annual fee.

3. Earning Rates

Both the Rogers Red Mastercard and the Rogers Red World Elite® Mastercard offer opportunities to earn cash back on eligible purchases.

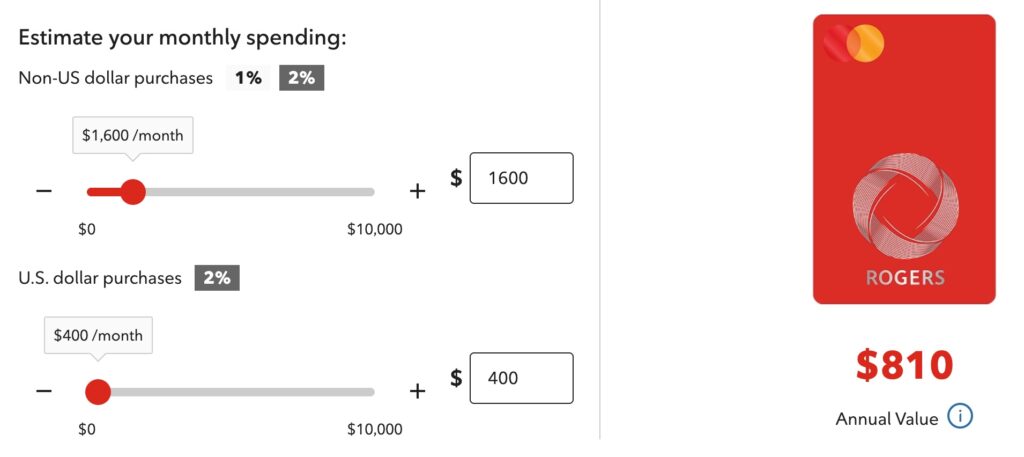

With the Rogers Mastercard, you can earn cash back at the following rates:

- 2% unlimited cash back on all eligible purchases in US dollars

- 2% unlimited cash back on non-US dollar purchases if you have a qualifying service with Rogers, Fido, or Shaw†

- Otherwise 1% cash back on all other eligible non- US dollar purchases†

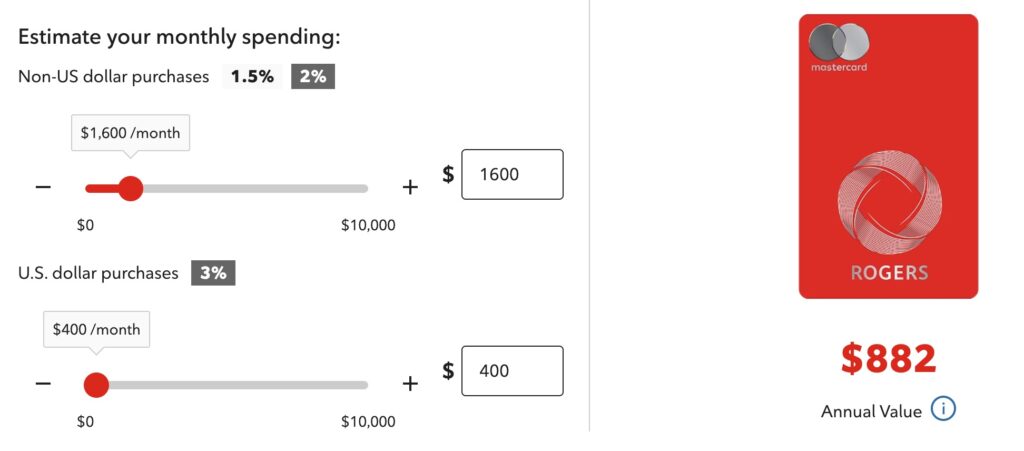

Comparatively, the Rogers Red World Elite® Mastercard offers the following slightly elevated earning rates:

- 3% unlimited cash back on eligible US dollar purchases†

- 2% unlimited cash back on eligible non-US dollar purchases if you have a qualifying service with Rogers, Fido, or Shaw†

- Otherwise, 1.5% unlimited cash back on all other eligible non-US dollar purchases†

It’s worth noting that the category earning rate for US dollar purchases on both cards is offset by a 2.5% foreign transaction fee levied by both cards. If you have a high volume of spending in US dollars, you may want to consider a card with true no foreign transaction fees instead.

Verdict: If you’re not a Rogers/Fido/Shaw customer, the Rogers Red World Elite® Mastercard wins (1.5% vs. 1%). If you are a customer, both cards earn 2% on non US dollar purchases, while World Elite still leads on USD purchases (3% vs. 2%). However, both cards charge a 2.5% foreign transaction fee, so if a large share of your spending is in US dollars, these aren’t ideal choices. Consider a no-FX card instead.

Perks and Benefits

Often, the incremental perks and benefits offered by credit cards can tip the scales in one direction over another. Let’s take a look at the extra features on the Rogers Mastercard and the Rogers Red World Elite® Mastercard.

1. Redeeming

With most cash back credit cards, there typically aren’t interesting ways to redeem your rewards beyond a statement credit, and indeed, this is the case with both the Rogers Red Mastercard® and the Rogers Red World Elite® Mastercard.

Both cards earn cash back that can be redeemed against any purchase made on the card in the last 90 days.

To redeem your cash back, you’ll need a minimum of $10 available in your account. Then, you’ll simply sign into your Rogers Bank account, and choose which purchase you’d like to redeem against.

Redeeming against eligible Rogers, Fido, or Shaw purchases gives 50% more cash back. That effectively makes a 2% earn behave like 3% when you funnel redemptions to those bills.

For example, if you redeem $10 cash back to pay for a Rogers, Fido, or Shaw bill, it’ll get turned into a $15 statement credit.†

Now, if you were to exclusively use the cash back earned against Rogers, Fido, or Shaw bills, the effective baseline earning rate bumps up to 3% cash back.†

In other words, for every $100 you spend on the card, you’ll earn the equivalent of $3 cash back when it’s redeemed for an eligible Rogers, Fido, or Shaw bill.

Verdict: Tie. The 50% redemption boost applies to both cards.

2. Extra Features

Given that both cards have no annual fees, it’s not surprising that they both also have fairly limited perks and benefits compared to credit cards with higher annual fees.

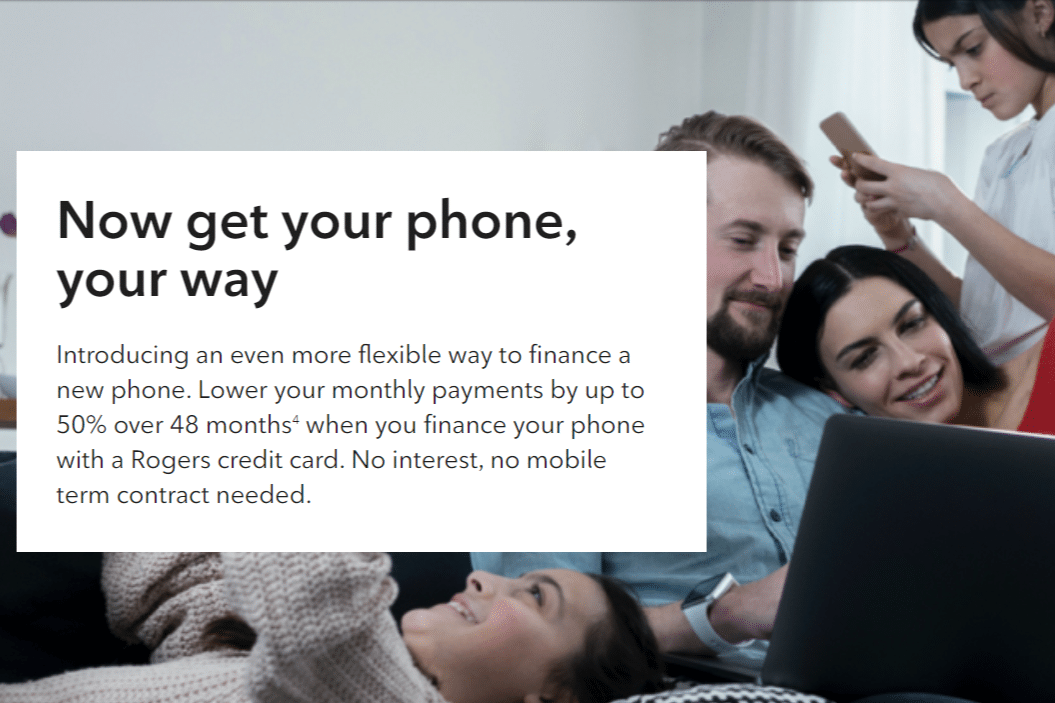

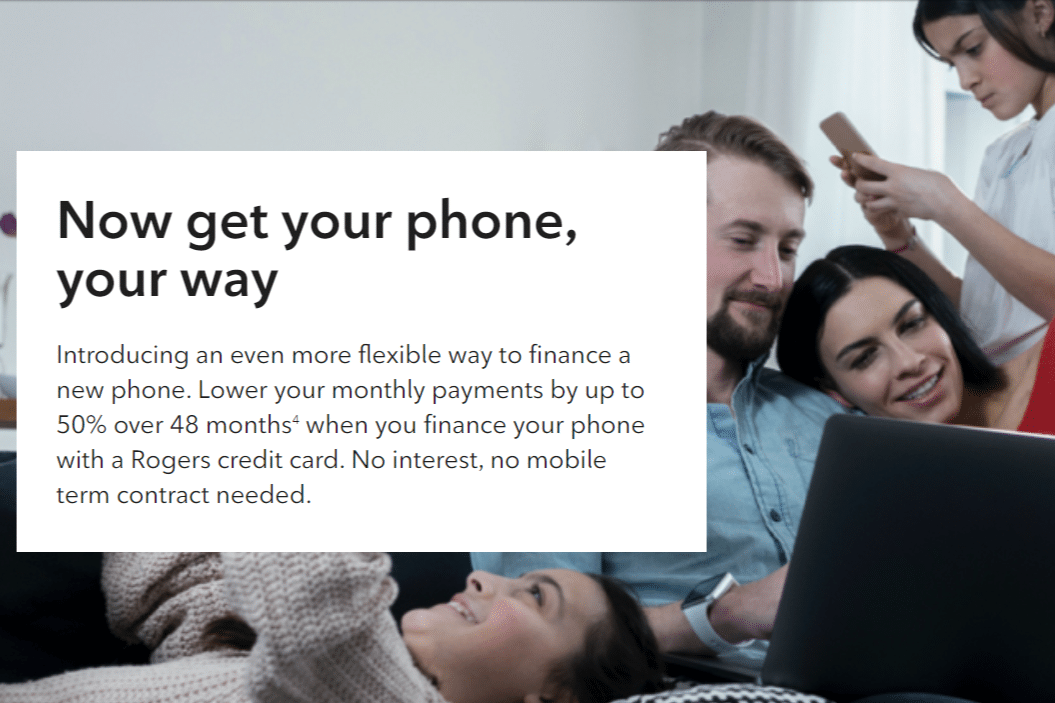

Of the benefits, one that the two cards have in common is the opportunity to purchase a new phone with a 0% interest rate through the Equal Payment Plan.†

To take advantage of this perk, you’ll need to pay for a new device that costs at least $250 using your Rogers credit card at a Rogers, Shaw, or Fido store, and afterwards, you’ll be able to set up financing for a 36-or 48-month term.†

If you aren’t able to pay for a phone outright, then this perk can be particularly useful, since you won’t incur any interest or additional fees, as long as you make your monthly payments.†

Beyond this perk, the two products each offer a couple of card-specific benefits that may be of value.

Both cards also offer five Roam Like Home days for Rogers mobile phone plans, which lets you enjoy your phone plan even while you’re abroad at no cost.† Depending on where you’re travelling, this benefit could have a value of up to $90.†

Uniquely, the Rogers Red World Elite® Mastercard provides cardholders with a complimentary membership to Mastercard Travel Pass provided by DragonPass.† As a member, you’ll have access to over 1,300 airport lounges worldwide.†

It’s important to note, however, that this benefit doesn’t cover the cost of entry. To take advantage of the participating airport lounges and their amenities, you’ll need to pay $32 (USD) per visit.†

Verdict: It’s difficult to pick a winner in this category, but ultimately, we may have to side with the Rogers Red World Elite® Mastercard for the incremental lounge access membership.†

However, there are plenty of other cards that offer complimentary access to airport lounges.

Other Factors

1. Insurance

When it comes to insurance, the Rogers Red Mastercard® doesn’t offer any coverage, while its World Elite® counterpart does offer some basic coverage when you use the card to make eligible purchases and bookings.

By booking your travel with the Rogers Red World Elite® Mastercard, you can take advantage of the emergency medical coverage, as well as the trip cancellation, interruption, and delay insurance for short out-of-province and out-of-country trips.†

Additionally, when you reserve and pay for a car rental using the World Elite® card, you’re provided with some coverage for theft of and damage to the vehicle.†

Finally, the World Elite® card also provides purchase protection and extended warranty coverage, which can be helpful if you run into issues with an eligible item recently purchased on the card.†

Verdict: In this category, the World Elite card is the clear winner, as it provides some limited insurance coverage compared to the zero coverage offered by the Rogers Mastercard.

2. Ease of Approval

To be eligible for the Rogers Red World Elite® Mastercard, you need to have a minimum personal annual income of at least $80,000, or a household income of at least $150,000.†

On the other hand, the Rogers Red Mastercard® has no minimum income requirement, and you’re just subject to credit approval.†

Verdict: With no minimum income required, the Rogers Red Mastercard® is more accessible, and comes out ahead in this category.

3. Supplementary Cardholders

Both the Rogers Red Mastercard® and the Rogers Red World Elite® Mastercard allow you to add up to nine supplementary cardholders for no additional fee.

Verdict: It’s a tie here, since there’s no cost either way.

4. Visual Appearance

Both cards use a similar vertical design with the Rogers logo; cosmetic differences shouldn’t drive your decision.

Conclusion

With no welcome bonus on either card, the choice comes down to how you spend and what you need. If you’re a Rogers/Fido/Shaw customer who redeems to those bills, both cards effectively turn 2% earn into 3% thanks to the 50% redemption boost. If you’re not a customer, the Rogers Red World Elite® Mastercard pulls ahead with 1.5% on non-USD purchases (vs. 1% on Red) and 3% on USD (vs. 2% on Red).

If you’re a frequent traveller and you care about protection, the World Elite’s insurance suite and DragonPass membership (pay-per-visit) make it the more complete package—provided you meet the $80k/$150k income requirement.

Lastly, Both cards charge a 2.5% foreign transaction fee, so if a big chunk of your spending is in US dollars, grab a true no foreign transaction fee card instead.

Otherwise, with no annual fee on either product, you can try the one that fits your situation today—and your wallet won’t complain.

†Terms and conditions apply. Refer to the card issuer’s website for complete, up-to-date information.

This story originally appeared on princeoftravel