The Aeroplan® Credit Card from Chase is the lone Aeroplan co-branded credit card available in the United States. It’s packed with features geared towards frequent flyers, and is a card that we strongly recommend.

The card’s current impressive welcome offer is for up to 100,000 Aeroplan points,† which is an easy way to boost your Aeroplan balance and elevate your experience with Aeroplan.

Aeroplan® Credit Card Offer: Up to 100,000 Aeroplan Points†

The current welcome offer for the Aeroplan® Credit Card is for up to 100,000 Aeroplan points,† which can be earned in two portions during your first year of card membership.

The first portion of 75,000 Aeroplan points is earned upon spending $4,000 (all figures in USD) in the first three months as a cardholder.†

Then, the second portion of 25,000 Aeroplan points is awarded after you spend over $20,000 on purchases in the first 12 months as a cardholder.†

This welcome offer is tied with the previous all-time-high offer of 100,000 points, making this an excellent welcome bonus with a reasonable minimum spending requirement on the first portion, and an achievable minimum spending requirement for the second portion spread over 12 months.

We value Aeroplan points at 1.5 cents per point, and using this metric, we’d estimate the value of the welcome offer at $1,500, which is incredible.

With an annual fee of just $95,† if you’re able to meet the spending requirement for the entire welcome offer, you’re effectively acquiring 100,000 Aeroplan points at a cost of 0.1 cents per point, which is outstanding.

Even if you’re only able to meet the minimum spending requirement for the first tranche of points, you’ll still be earning 75,000 Aeroplan points at a cost of 0.13 cents per point, which is incredibly good.

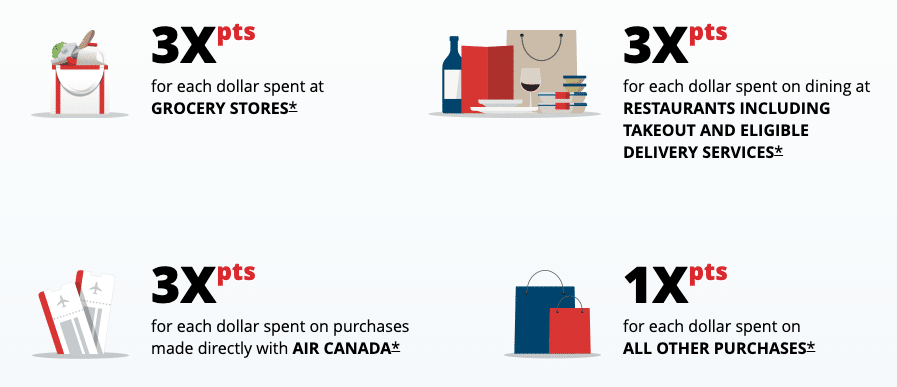

You’ll also earn points through the regular category multipliers, earning 3 points per dollar spent on grocery stores†, at restaurants (including takeout and eligible delivery services)†, and with Air Canada†.

As a Mastercard, this card will also let you enjoy much wider acceptance than with other issuers, which should aid you in easily meeting the minimum spending requirement.

Furthermore, you can earn 500 bonus Aeroplan points for every $2,000 spent each calendar month, for up to 1,500 points per month† on an ongoing basis.

To make matters even better, the Aeroplan® Credit Card doesn’t levy foreign transaction fees,† making it a great card to bring with you when traveling.

Keep in mind that you don’t need to redeem the Aeroplan points you earn through the card on Aeroplan bookings.

Last year, Chase introduced the “Pay Yourself Back” feature on the Aeroplan® Credit Card.

If you choose to redeem points this way, you can get 1.25 cents per point applied as a statement credit towards any purchase that codes as travel.†

You’re likely to get much better value by redeeming your points for premium cabin flights through Aeroplan; however, if these types of redemptions aren’t your cup of tea, at least you have another option available.

There’s no listed expiry date on this current offer.

Aeroplan® Credit Card: Spend Your Way to Elite Status

One of the best features of the Aeroplan® Credit Card is that as a new cardmember, you’ll automatically receive Aeroplan 25K Status for the remainder of the calendar year in which you’re approved, plus the entire following calendar year.†

After that introductory period, you can re-qualify for 25K status by spending $15,000 (USD) on the card in a calendar year.†

Aeroplan 25K status currently comes with 20 eUpgrade credits as a Core Benefit, and if you choose eUpgrades as your Select Benefit, you can pick up another 5 credits, for a total of up to 25 eUpgrade credits for the 2025 benefit year. That’s a very solid pool of credits you can use to score upgrades from economy to premium cabins on Air Canada flights when space is available.

Starting with the 2026 program year, Aeroplan is changing how eUpgrade credits are awarded. Instead of getting a large, fixed bundle, Aeroplan 25K members will receive a smaller core allotment of eUpgrades, and additional credits will be unlocked based on your Status Qualifying Credits (SQC) and Milestone Benefits as you earn more SQC throughout the year.

Through the end of 2025, cardholders who spend $50,000 within one calendar year will earn a one-time status bump through the following year via the Elite Status Level Up benefit.†

In practice, this means that for status earned based on 2025 activity, spending $50,000 on the Aeroplan® Credit Card can still bump you up one tier for the 2026 status year – for example, from 25K to 35K, or from 75K to Super Elite, without having to meet the normal higher flying and spend thresholds. (This benefit will no longer be available for status earned on 2026 activity and beyond.)

Historically, this has been one of the easiest and most accessible ways to climb into higher tiers like Aeroplan 50K or even Super Elite, since you could organically qualify for a lower tier (such as 35K or 75K) and then rely on the Level Up to do the final heavy lifting.

From 2026 Onward: Status Qualifying Credits (SQC)

Beginning in 2026, Aeroplan is overhauling how status is earned and how the Aeroplan® Credit Card fits into that picture.

- The Elite Status Level Up benefit is being discontinued.

- Status Qualifying Credits (SQC) become the sole metric for earning and renewing Aeroplan Elite status.

- The Aeroplan® Credit Card will instead award SQC boosts as you spend:

- 5,000 SQC awarded at the beginning of the year as a cardmember bonus

- 10,000 SQC when you spend $25,000 (USD) on your Aeroplan® Credit Card

- 10,000 SQC when you spend $50,000 (USD) on your Aeroplan® Credit Card

With these components, you can earn up to 25,000 SQC per year through the Aeroplan® Credit Card, which is the maximum amount of SQC you’re allowed to collect from Aeroplan credit cards in a calendar year.

New for 2026, there’s also a pure spend-based path to higher status: if you spend $75,000 (USD) in a calendar year on the Aeroplan® Credit Card, you’ll qualify outright for Aeroplan 35K Status, even if you barely fly.

In other words, the 2025 structure (with Level Up) still offers a powerful shortcut for one more year, while the 2026 SQC model turns the Aeroplan® Credit Card into a long-term tool for steadily building and maintaining Aeroplan Elite status through card spend, a great way to lean on credit card usage rather than flying.

Conclusion

The Aeroplan® Credit Card from Chase is currently offering an exceptional welcome offer of up to 100,000 Aeroplan points, earned in two portions, if you’re able to meet the minimum spending requirements.†

This is an excellent opportunity to grow your Aeroplan account balance while also enjoying the card’s great perks and benefits.

If you’re in the market for a new travel-focused credit card, you should certainly consider adding the Aeroplan® Credit Card to your wallet.

† Terms and conditions apply. Please refer to the card issuer’s website for up-to-date information.

This story originally appeared on princeoftravel