TD Canada Trust is one of Canada’s largest and most popular banks, offering a range of products and services through in-person and online banking.

In this guide, we provide an overview of TD’s bank account and credit card portfolio, with links to more in-depth articles on specific products and other key information.

Chequing and Savings Accounts

TD has four personal chequing accounts and three personal savings accounts, which we’ll go over in this section.

When considering which type of account to open, it’s important to think about your banking priorities and preferences, and how you tend to use and access your account.

TD also often has promotional offers when you sign up for a specific account or multiple accounts together that can garner you a cash bonus, higher interest rates on savings, and other perks (e.g., merchandise).

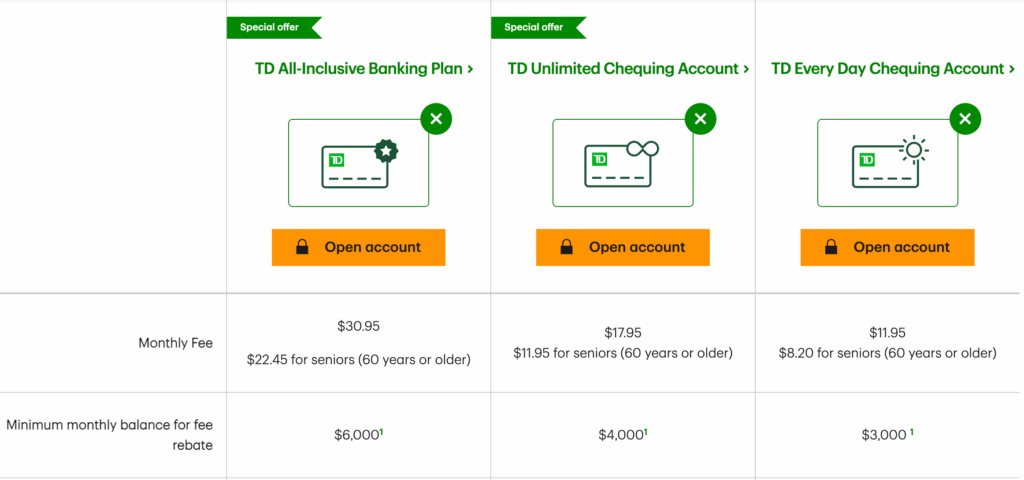

Chequing Accounts

Chequing accounts are the best day-to-day account as they tend to offer more monthly transactions and lower fees compared to savings accounts. Plus, they often come with perks such as free Interac e-transfers and rebates on credit card annual fees.

To learn more, let’s take a look the key characteristics of each of TD’s personal chequing accounts from the simplest to the most comprehensive:

TD Minimum Chequing Account

- Monthly fee: $3.95 (waived for seniors receiving the Guaranteed Income Supplement (GIS) and for Registered Disability Savings Plan beneficiaries)

- Included transactions: 12 (additional transactions = $1.25/each)

- Interac e-transfers: $0.50/each (for transactions up to $100) and $1/each (for transactions above $100)

- ATM fees: $2 for non-TD ATMs in Canada, $3 for foreign ATMs in the US and Mexico, and $5 for foreign ATMs in any other country

- Credit card annual fee rebate: None

- Best for: Individuals with minimal banking needs

TD Every Day Chequing Account

- Monthly fee: $11.95 (waived if a $3,000 account balance is maintained); $8.20 for seniors over the age of 60

- Included transactions: 25 (additional transactions = $1.25/each)

- Interac e-transfers: Free

- ATM fees: $2 for non-TD ATMs in Canada, $3 for foreign ATMs in the US and Mexico, and $5 for foreign ATMs in any other country

- Credit card annual fee rebate: None

- Best for: Individuals who make fewer than 25 transactions per month

TD Unlimited Chequing Account

- Monthly fee: $17.95 (waived if a $4,000 account balance is maintained); $11.95 for seniors over the age of 60

- Included transactions: Unlimited

- Interac e-transfers: Free

- ATM fees: $0 for all ATMs in Canada, $3 for foreign ATMs in the US and Mexico, and $5 for foreign ATMs in any other country

- Credit card annual fee rebate: First year annual fee rebate for an eligible TD credit card

- Best for: Individuals who want the freedom of unlimited transactions and who can take advantage of the credit card fee rebate

TD All-Inclusive Banking Plan

- Monthly fee: $30.95 (waived if a $6,000 account balance is maintained); $22.45 for seniors over the age of 60

- Included transactions: Unlimited

- Interac e-transfers: Free

- ATM fees: $0 for all ATMs globally

- Credit card annual fee rebate: : Yearly annual fee rebate for an eligible TD credit card

- Additional features: A small safety deposit box (subject to availability) and free personalized cheques

- Best For: Individuals who often use non-TD ATMs and those who can take advantage of the annual credit card fee rebate and the additional product perks

Savings Accounts

TD also offers three savings accounts for clients looking to build their savings while still having easy access to their funds.

Let’s explore these three accounts and what makes each one unique.

TD’s savings accounts all pay variable interest that’s calculated daily and paid monthly. Rates change over time, and some accounts have balance thresholds for earning higher rates, so be sure to check TD’s site for the latest numbers before you apply.

TD Every Day Savings Account

- Monthly fee: $0

- Annual interest rate: 0.010%

- Included transactions: One (additional transactions = $3/each)

- Transfers: Free to other TD deposit accounts

- ATM fees: $2 for non-TD ATMs in Canada, $3 for foreign ATMs in the US and Mexico, and $5 for foreign ATMs in any other country

- Best For: Individuals looking for a simple place to start saving

TD High Interest Savings Account

- Monthly fee: $0

- Annual interest rate depending on your daily closing balance:

- $0–$4,999: 0.00%

- $5,000–$9,999: 0.50%

- $10,000–$99,999: 1.00%

- $100,000–$499,999: 1.30%

- $500,000 or more: 1.50%

- Included transactions: Zero (transactions = $5/each, which is waived if a $25,000 account balance is maintained)

- Transfers: Free to other TD deposit accounts

- ATM fees: $2 for non-TD ATMs in Canada, $3 for foreign ATMs in the US and Mexico, and $5 for foreign ATMs in any other country

- Best for: Individuals looking for an easy-to-access savings account

TD ePremium Savings Account

- Monthly fee: $0

- Annual interest rate depending on your daily closing balance:

- $0–$9,999: 0.000%

- $10,000 or more: 0.550%

- Included transactions: Zero (transactions = $5/each)

- Transfers: Free to other TD deposit accounts

- ATM fees: $2 for non-TD ATMs in Canada, $3 for foreign ATMs in the US and Mexico, and $5 for foreign ATMs in any other country

- Best For: Individuals who can maintain an account balance of $10,000 or higher

Additionally, for individuals who have newly immigrated to Canada, TD has created a special offer called the TD New to Canada Banking Package.

This offer provides a variety of different financial incentives when you open specific chequing and savings accounts, plus additional rewards-based incentives when you sign-up for a specific credit card.

Student Bank Accounts

TD offers one account specifically for youth (under the age of 23) and students (of any age) who are enrolled in full-time post-secondary education: the TD Student Chequing Account.

TD Student Chequing Account

- Monthly fee: $0

- Included transactions: Unlimited

- Interac e-transfers: Free

- ATM fees: $2 for non-TD ATMs in Canada, $3 for foreign ATMs in the US and Mexico, and $5 for foreign ATMs in any other country

- Credit card annual fee rebate: None

- Best for: Individuals who are under the age of 23 or who are enrolled in a full-time post-secondary program

Additionally, TD has created a special offer for young students who are new to Canada: the International Student Banking Package.

Both the New to Canada Banking Package and the International Student Banking Package regularly come with limited-time promos like cash bonuses, gift cards, and rebated TD Global Transfer fees. The exact mix changes, so check TD’s current special offers page before you apply.

US Dollar Accounts

TD has two US dollar accounts available: the US Daily Interest Chequing Account and the Borderless Account.

These accounts are ideal for people who have banking needs in both Canada and the US as they allow you to easily exchange funds between the two countries at a competitive rate.

The US Daily Interest Chequing Account has no monthly fee, making it an excellent account if you find yourself occasionally in need of banking access in the US.

Comparatively, the Borderless Account has a monthly fee of $4.95 (USD) which is waived if the account balance is $3,000 (USD).

This account enjoys a preferred exchange rate and provides account holders with free US bank drafts and basic cheques. These features make it ideal for frequent travellers to the US.

Keep in mind that these are Canadian-domiciled accounts, which means you won’t be onboarded into the U.S. banking system. In other words, you won’t get access to ACH transfers or the ability to pay U.S. billers like a true U.S.-based account would allow.

TD Credit Cards

TD offers its clients a range of personal credit cards that provide the opportunity to earn cash back, Aeroplan points, and TD Rewards Points.

Cash Back Credit Cards

TD offers two cash back credit cards: the TD Cash Back Visa Infinite* Card and the TD Cash Back Visa* Card.

These credit cards are ideal for people who like the simplicity of cash back rewards, which can be used to pay down your account at any time with a minimum of $25.

For an entry-level card, the TD Cash Back Visa* Card has no annual fee and earns 1% cash back grocery, gas & electric vehicle charging, public transit, recurring bill payments, and streaming, digital gaming & media purchases, and 0.5% on other purchases.†

- Earn $10 cash back† on first purchase with your card†.

- Earn an additional $40 cash back† when you spend $1,500 in the first 3 months of account opening†.

- Earn 1% cash back†on eligible grocery, gas, electric vehicle charging, public transit, recurring bill payments, streaming, digital gaming, and media purchases†

- Then, earn 0.5% cash back† on all other eligible purchases†

- No minimum income requirement

- Annual fee: $0

Comparatively, the TD Cash Back Visa Infinite* has an annual fee of $139 but offers 3% cash back on grocery, gas & electric vehicle charging, public transit, recurring bill payments, and streaming, digital gaming & media purchases, and 1% on everything else.†

TD Cash Back Visa Infinite* Card

- Earn 10% cash back† in the first three months, on up to $3,500 spent on eligible groceries, gas, electric vehicle charging, public transit, recurring bills, streaming, digital gaming, and media purchases†

- Then, earn 3% cash back† on eligible groceries, gas, electric vehicle charging, public transit, recurring bill payments, streaming, digital gaming, and media†

- Free Deluxe TD Auto Club Membership for roadside assistance†

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $0 for the first year†, then $139

- Application must be approved on or after April 30, 2025 to receive this offer

We’ve created individual in-depth guides to both of these cash back credit cards, where you can find up-to-date offers and enrollment information – just click above to learn more.

Aeroplan Co-Branded Credit Cards

For individuals looking to earn points with Canada’s most popular and powerful airline loyalty program, TD offers three personal credit cards that earn Aeroplan points on everyday spending.

The three cards are: the TD® Aeroplan® Visa Platinum* Card, TD® Aeroplan® Visa Infinite* Card, and the TD® Aeroplan® Visa Infinite Privilege* Card.

These cards are great choices for Aeroplan members looking to build up their points account balance to access award flights, as each card comes with a welcome bonus and earns Aeroplan points on everyday spend.

The entry-level member of the TD Aeroplan co-branded card family is the TD Aeroplan Visa Platinum* Card. This card often features a generous welcome bonus and comes with a few Air Canada perks.

This is a great card to consider if you have a more modest income or want to keep costs down while still earning points towards travel.

TD® Aeroplan® Visa Platinum* Card

- Earn 10,000 Aeroplan points† upon first purchase†

- Plus, earn 5,000 Aeroplan points† upon spending $1,000 in the first three months

- Earn 1x Aeroplan points† on eligible gas, electric vehicle charging, groceries, and Air Canada® purchases, including Air Canada Vacations®†

- Preferred pricing on Air Canada® flights through Aeroplan†

- Annual fee: $89, rebated in the first year†

- Offer available for applications approved on or after September 4, 2025.

The TD® Aeroplan® Visa Infinite* Card is the next level up in TD’s Aeroplan credit card family.

Much like its Platinum counterpart, this card often comes with a nice welcome bonus, and it also offers cardholders one free checked bag on Air Canada flights and a fee rebate for your NEXUS application.†

This card is a good choice for individuals who travel often and can take advantage of the related perks.

TD® Aeroplan® Visa Infinite* Card

- Earn 10,000 Aeroplan points† upon first purchase†

- Plus, earn 15,000 Aeroplan points† upon spending $7,500 in the first 180 days of account opening†

- Plus, earn an additional 20,000 Aeroplan points† on renewal when you spend $12,000 within 12 months of account opening†

- Earn 1.5x Aeroplan points† on eligible gas, groceries, and Air Canada® purchases, including Air Canada Vacations®†

- Preferred Aeroplan pricing and free checked bag on Air Canada® flights†

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $139 (rebated for the first year)

- Offer available for applications approved on or after September 4, 2025.

The third card in the TD Aeroplan family is the TD® Aeroplan® Visa Infinite Privilege* Card. Of TD’s three Aeroplan credit cards, this one will come with the highest welcome bonus and the most valuable perks.

This card is ideal for individuals who don’t mind paying the high annual fee and for Air Canada frequent flyers who can maximize the utility of the associated travel benefits, including eUpgrade rollover and unlimited Maple Leaf Lounge access.

TD® Aeroplan® Visa Infinite Privilege* Card

- Earn 20,000 Aeroplan points† upon first purchase

- Plus, earn an additional 35,000 Aeroplan points† upon spending $12,000 in the first 180 days

- Plus, earn a one-time anniversary bonus of 30,000 Aeroplan points† upon spending $24,000 within 12 months of account opening†

- Earn 2x Aeroplan points† on eligible Air Canada® purchases, including Air Canada Vacations®†

- Earn 1.5x Aeroplan points† on eligible gas, electric vehicle charging, groceries, dining, travel, and transit purchases†

- Aeroplan preferred pricing, free checked bag, priority check-in and boarding on Air Canada flights†

- Unlimited Air Canada Maple Leaf Lounge† access

- Visa Airport Companion Program membership with six free lounge visits per year

- $100 partial rebate for the NEXUS application fee every 48 months†

- Minimum income: $150,000 personal or $200,000 household

- Annual fee: $599

- Offer available for applications approved on or after September 4, 2025.

Check out our in-depth guides for these three Aeroplan cards to learn about up-to-date offers and enrollment information – just click the card names above.

TD Rewards Credit Cards

TD offers three credit cards that earn TD Rewards Points on everyday spending. TD Rewards is the bank’s own rewards program, allowing clients to earn points that can be used for travel, statement credits, and gift cards.

The three TD Rewards cards are the TD Rewards Visa* Card, the TD Platinum Travel Visa* Card, and the TD First Class Travel® Visa Infinite* Card.

TD Rewards Points are particularly valuable when redeemed for travel booked through Expedia® for TD, the bank’s online travel portal operated in partnership with Expedia®.

The TD Rewards Visa* Card is this credit card family’s entry-level offering and offers the opportunity to earn TD Rewards Points on everyday purchases with zero annual fee.†

This is a great card for individuals who are looking for a straightforward, low-cost card that lets them earn towards flexible future travel.

- Earn 15,152 TD Rewards Points when you spend $500 within 90 days of Account opening+†

- Plus, earn 4x TD Rewards Points† on eligible travel purchases when you book through Expedia® for TD†

- Use your rewards for any travel bookings available on Expedia® for TD†

- Annual fee: $0

- Application must be approved on or after January 7, 2025 to receive this offer

The TD Platinum Travel Visa* Card is the mid-level card of the TD Rewards credit card family, and new cardholders usually have the opportunity to earn a welcome bonus in the first few months of card membership.

This card also offers elevated TD Rewards Points earning rates, making it a good card for individuals looking to build up their points balance faster.

TD Platinum Travel Visa* Card

- Earn 15,000 TD Rewards Points upon first purchase†

- Earn 35,000 TD Rewards Points upon spending $1,000 in the first 90 days†

- Plus, earn 6x TD Rewards Points† on eligible travel purchases when you book through Expedia® for TD†

- Earn 4.5x TD Rewards Points† on eligible grocery, dining, and public transit purchases†

- Use your rewards for any travel bookings available on Expedia® for TD†

- No minimum income requirement

- Annual fee: $89, rebated in the first year†

The TD First Class Travel Visa Infinite* Card is the premium card offering in the TD Rewards credit card family.

This card often features a generous welcome bonus and a first-year annual fee rebate.

Cardholders will also enjoy excellent earning rates for TD Rewards Points and a $100 accommodations/vacation credit that can be used when booking at least $500 worth of eligible travel through Expedia® for TD.†

This card is a good choice for individuals who are looking to quickly accumulate TD Rewards Points and who can make use of the $100 accommodations/vacation credit.

TD First Class Travel® Visa Infinite* Card

- Earn 20,000 TD Rewards Points upon making your first purchase†

- Earn 145,000 TD Rewards Points upon spending $7,500 within 180 days of account opening†

- Plus, earn a Birthday Bonus of up to 10,000 TD Rewards Points†

- Plus, earn 8x TD Rewards Points† on eligible travel purchases when you book through Expedia® for TD†

- Get an annual TD Travel Credit† of $100 when you book through Expedia® for TD†

- Use your rewards for any travel bookings available on Expedia® for TD†

- Four complimentary lounge visits through the Visa Airport Companion Program†

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $139, rebated for the first year†

- Offer effective as of September 4, 2025†

Click on the credit card names above to access our in-depth guides for the up-to-date offers and enrollment information for the three TD Rewards credit cards.

Low-Rate Credit Cards

TD offers one low-rate credit card in the TD Low Rate Visa* Card.

This card is a good choice for someone who often needs to carry a balance on their card and would benefit from the lower annual interest rate of 12.90%.

This card also often offers promotional interest rates for a set number of months, allowing new cardholders to make bigger or unexpected purchases without incurring as much interest.

TD Banking App

TD has an app available for both Apple iOS and Android.

Within the app, you can access their chequing, savings, credit, and investment accounts. You can move money between these accounts, pay bills, and deposit cheques (by taking a photo of the cheque).

You can also send and request money within Canada via Interac e-transfer or to 200+ countries using TD Global Transfer.

Within the app, you can also keep their debit and credit cards secure with the ability to lock a card if it is misplaced, lost, or stolen. They can then easily unlock the card in the app once it has been found.

If you’re new to the app, TD also provides some very helpful tutorials on their website to help you learn all about the different features.

Conclusion

TD Canada Trust is the second largest bank in Canada, with over 1,000 branches across the country.

TD offers a range of bank accounts, credit cards, and additional products designed to suit a myriad of different client types.

Whether you’re a student, a newcomer to Canada, or someone perusing new banking options, TD’s diversity of offerings are certainly worth exploring.

Frequently Asked Questions

This story originally appeared on princeoftravel