The Wealthsimple Prepaid Mastercard quietly became one of my go-to travel cards, not because of points or perks, but because it solves a very specific travel problem.

When it first launched, this was just another prepaid fintech card with a bit of cash back and some early hype. Useful, sure, but hardly something you’d plan a trip around.

Fast forward to today, and the value proposition has shifted. Between the lack of foreign exchange fees and reliable access to foreign ATMs, the Wealthsimple Prepaid Mastercard has evolved into one of the most practical tools Canadians can carry abroad, especially in destinations where cash still rules.

It’s not glamorous, and it won’t replace your primary points card. But as a no-FX, low-friction way to access cash overseas, it now does one job very well — and that’s exactly why it’s earned a permanent spot in my wallet.

A Primer on Wealthsimple

Wealthsimple is a Toronto-based fintech company that offers a growing suite of financial products, largely geared toward millennials and first-time investors.

The company started with Wealthsimple Invest, its robo-advisor investing platform, and has since expanded into Wealthsimple Trade, Wealthsimple chequing account, Wealthsimple credit cards, and other app-based financial tools.

I personally use Wealthsimple Trade from time to time to dabble in the stock market and Wealthsimple Visa Infinite during my travels.

Wealthsimple also offers Crypto trading, which lowers the barrier to entry for buying assets like Bitcoin. Just keep in mind that you’re purchasing crypto through a regulated platform, meaning you don’t control the private keys.

For travellers, this broader ecosystem matters because the Wealthsimple Prepaid Mastercard is fully integrated into the same app, making it relatively easy to fund, manage, and access money while on the road.

The Wealthsimple App

All Wealthsimple products now live inside a single app, which combines investing, payments, and spending in one place.

Within the app, users can send and receive money instantly with other Wealthsimple users, request funds, and split expenses with friends. Transfers are fast and straightforward, without waiting for Interac e-transfers to clear.

While none of this is groundbreaking, the app’s real value shows up when paired with the Wealthsimple Prepaid Mastercard, especially when travelling and needing quick access to funds for ATM withdrawals abroad.

Wealthsimple Prepaid Mastercard

The Wealthsimple Prepaid Mastercard is tied directly to your chequing account within the Wealthsimple app. There’s no credit check and no revolving credit line — just a prepaid balance you control.

Where this card truly stands out today is in how it handles foreign spending and cash withdrawals.

No FX Fees and Foreign ATM Withdrawals

The Wealthsimple Prepaid Mastercard charges no foreign exchange fees on either purchases or ATM withdrawals. Transactions are processed at the Mastercard exchange rate, without the usual 2.5% markup that most Canadian cards quietly tack on.

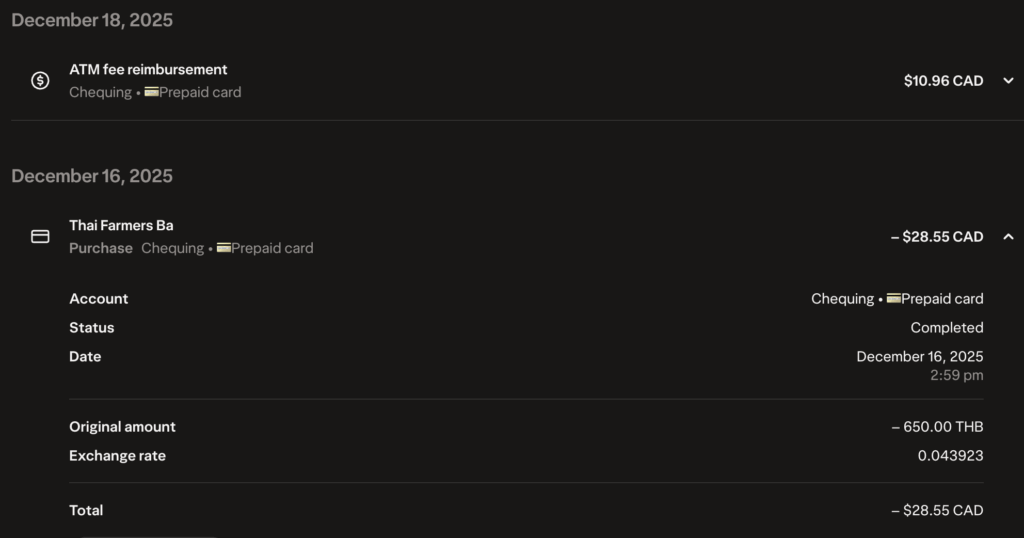

But here’s the part that really matters for travellers: ATM fees charged by the machine itself are reimbursed by Wealthsimple.

In many countries, local ATMs will charge a flat withdrawal fee, often in the $2–$5 range. With most Canadian cards, you’d pay that fee plus a foreign exchange markup on top.

With the Wealthsimple Prepaid Mastercard, those ATM fees are refunded, which significantly lowers the real cost of accessing cash abroad.

I’ve been using the card in Thailand, where ATM withdrawals typically come with a 250 THB fee (roughly $11 CAD) per transaction. Each time I withdrew cash, the ATM fee posted to my account and was later reimbursed by Wealthsimple.

Combined with no FX markup, that made these withdrawals far cheaper than alternatives like the EQ Bank Mastercard or Wise card for ATM withdrawals.

For destinations where cash is still widely used — think Southeast Asia, Africa, or smaller towns in Europe — this makes the Wealthsimple Prepaid Mastercard one of the most cost-effective ways for Canadians to access cash while travelling.

Between no FX fees and reimbursed ATM charges, the Wealthsimple Prepaid Mastercard covers two of the biggest pain points Canadian travellers face when dealing with cash abroad.

Not a Spending Card (And That’s Fine)

The Wealthsimple Prepaid Mastercard recently phased out their 1% cash back rewards and does not earn any rewards currently.

In practical terms, there’s no reason to use this card for everyday purchases.

Therefore, this card is best treated as a cash-access tool, not a spending card. Use it to withdraw money from ATMs abroad, then switch back to a proper no-FX credit card for purchases.

Ideally, you’d want to pair it with cards like the Scotiabank Passport™ Visa Infinite* Card, which earns points on purchases while avoiding foreign transaction fees.

Wealthsimple also offers its own premium product, the Wealthsimple Visa Infinite* Card, which would be a natural companion for spending abroad. Unfortunately, that card remains under a waiting list and is not yet open to the general public.

Until then, pairing the Wealthsimple Prepaid Mastercard for cash withdrawals with a strong no-FX credit card for purchases remains the most effective strategy.

International Transfers

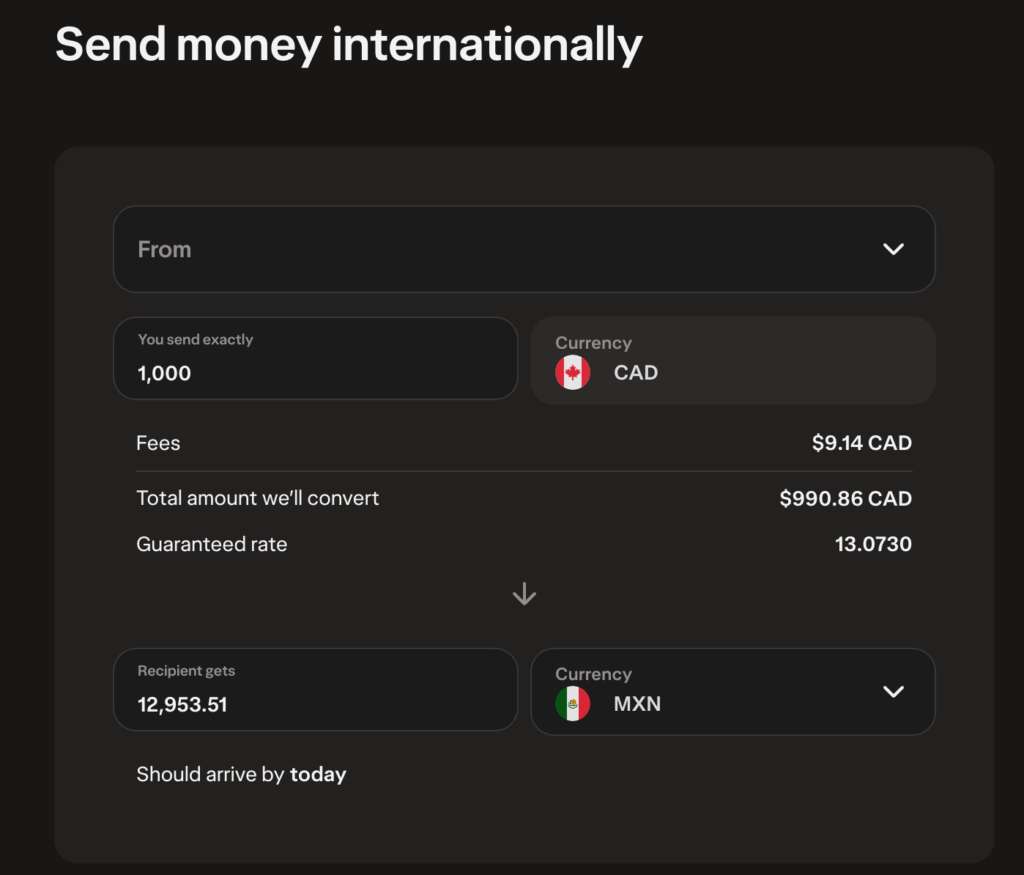

Beyond cash withdrawals, Wealthsimple has quietly built out a global money transfer feature directly within its app.

At the moment, Wealthsimple supports international transfers in 10 currencies, covering many of the most commonly used corridors. While it’s not trying to compete on sheer breadth, the supported currencies will be more than sufficient for most travellers, digital nomads, and anyone moving money between major markets.

Where this feature gets interesting is pricing. Exchange rates are quite competitive, often landing in the same ballpark as dedicated services like Wise. You won’t see the eye-watering FX spreads that traditional banks still seem proud of, and fees are generally transparent and easy to understand before you hit send.

For occasional international transfers — paying rent abroad, sending money to family, or moving funds ahead of a longer stay — this can be a very convenient option. Everything happens inside the same app that already holds your spending balance, investments, and prepaid card, which cuts down on friction and account sprawl.

That said, this still isn’t a full replacement for Wise if you regularly move money across a wide range of currencies or rely on less common transfer corridors. Coverage is more limited, and power users may still prefer a dedicated platform for more complex needs.

Still, having international transfers, a no-FX prepaid card, and reimbursed ATM withdrawals all living under one roof is genuinely useful. For many Canadians, Wealthsimple now covers most cross-border money needs without forcing you to juggle multiple apps and logins.

Conclusion

The Wealthsimple Prepaid Mastercard is one of those rare travel tools that actually feels complete.

No FX fees. Reimbursed ATM charges. Competitive global money transfers across 10 currencies. All of it wrapped into a single app that doesn’t try to upsell you every five seconds. For travellers, expats, and anyone who still needs cash abroad (which is most of us, whether we admit it or not), this setup removes a lot of the usual friction.

More importantly, it works in real-world travel scenarios. While other travellers hesitate at foreign ATMs , scanning fee disclosures and debating whether a 250 THB charge is worth it, it’s reassuring to withdraw cash, move on, and know the fee will be reimbursed. That small but tangible advantage is often enough to win people over.

I really hope Wealthsimple keeps this product exactly as it is. Because when a card offers no FX fees, ATM fee reimbursement, and global transfers at competitive rates, it stops being a niche fintech perk and starts feeling like a quiet travel privilege — one I’m more than happy to keep flexing.

This story originally appeared on princeoftravel