Travel insurance is one of those things you hope you’ll never need—but when you do, it can save you from a financial nightmare. Whether it’s flight delays, baggage delays, trip cancellation or interruption, or even medical emergencies abroad, having the right credit card coverage can make all the difference.

However, a common belief is that credit card travel insurance only applies if you pay for the trip in full using that card. But what if you’re using points and miles? Do you still get coverage on an award ticket?

The short answer: it depends on the card and the type of insurance. Some benefits like emergency medical coverage apply automatically, while others require you to charge at least part of the trip to your card.

Let’s take a closer look at credit cards that offer insurance for award travel.

Emergency Medical Insurance: Just By Being a Cardholder

One of the biggest perks of premium travel credit cards is emergency medical insurance. The good news? You don’t have to pay for your trip with the card for this coverage to apply.

Most credit cards that offer emergency medical insurance cover you simply by being an active cardholder and travelling outside your province or territory of residence. The coverage typically applies for trips up to a set number of days—usually 15–25 days for those under 65, and significantly fewer for older travellers.

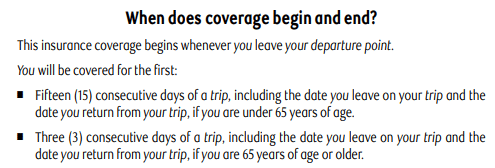

For example, the Amex Platinum Card’s insurance pamphlet states that it provides emergency medical coverage for trips up to 15 days if under 65.

The RBC Avion Visa Infinite’s pamphlet says that it covers cardholders for 15 days for if under 65, and three days if 65 or older.

And the Scotiabank Passport Visa Infinite Card’s benefits booklet states that it offers 25 days of coverage if under 65, and three days if 65 or older.

As you can see, travelling outside of your province or territory of residence is all that’s required for the emergency medical insurance to kick in, and there’s no requirement for the trip’s costs to be charged to the card itself.

This is the case for almost every card out there that includes medical insurance, including the American Express Gold Rewards Card, the American Express Cobalt Card, the CIBC Aventura Visa Infinite Card, and the WestJet RBC World Elite Mastercard, amongst others.

This means that no matter how you booked your travel—whether you paid cash, used Aeroplan points, or stitched together a multi-airline trip using various rewards—you’re still covered for medical emergencies, as long as you keep one of these premium travel credit card open.

That said, make sure you carefully read the insurance pamphlet on your credit card, since there are always certain exclusions to which the medical coverage wouldn’t apply. Most often, preexisting medical conditions or undertaking risky activities will void the coverage.

Moreover, note that the coverage typically only lasts for a certain number of days on your trip, so you may still need to purchase additional insurance if you’re travelling for a longer duration. You can do this by topping-up your credit card coverage or purchasing a policy from a separate provider.

Other Types of Travel Insurance: Use the Right Credit Card

Now, while most premium credit cards provide travel medical insurance to their cardholders regardless of whether the trip was billed to the card, the same generosity is usually not extended to other types of insurance.

To be eligible for coverage for flight delays, baggage delays, trip cancellation & interruption, or travel accident insurance, you’ll most likely need to have booked the trip and paid at least 75% of the portion with the credit card. This can be an issue for anyone who primarily travels on award tickets, as a flight that’s paid for with miles can’t really be charged “in full” to any card at all.

Thankfully, that’s where a few select credit cards on the market can fill the gap.

Aeroplan Co-Branded Credit Cards

Aeroplan co-branded credit cards extend travel insurance benefits to any trips booked using Aeroplan points, as long as the associated taxes and fees are billed to the card.

There are currently 11 Aeroplan co-branded credit cards available in Canada, issued by TD, CIBC, and American Express.

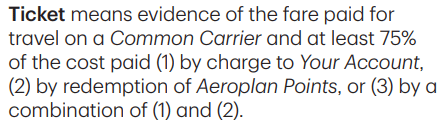

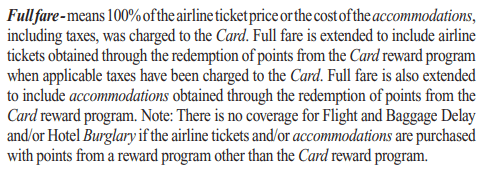

For example, here’s what the TD Aeroplan Visa Infinite Card’s insurance package has to say about ticket eligibility for flight delay, delayed and lost baggage, trip cancellation and trip interruption, and common carrier accidents:

And here’s the equivalent language on the American Express Aeroplan Reserve Card‘s insurance pamphlet:

As you can see, the insurance benefits on these cards will apply no matter whether you charged the full fare to the card, redeemed Aeroplan points for the ticket and charged the taxes and fees to your credit card, or redeemed a hybrid amount of Aeroplan points and cash using the Points + Cash feature.

Therefore, whether you’re redeeming Aeroplan points for a quick one-way flight or a complex trip and you want to enjoy the full insurance protection of a premium travel credit card on your trip, then it’s best to put the taxes and fees onto one of Amex, TD, or CIBC’s Aeroplan-affiliated cards.

And if you regularly travel on Aeroplan points, you might find it worthwhile to continuously keep one of these cards open for the purpose of giving yourself some peace of mind along your points-funded trips.

Credit Cards with Other Loyalty Programs

Most Canadian credit cards that have a loyalty program associated with them will typically extend their insurance benefits to travel booked through that specific points program as well. A few examples are as follows:

Therefore, whenever you’re looking to redeem one of the major Canadian points currencies for a flight, you’ll usually be able to take advantage of the insurance perks on whatever credit card is associated with that points program (which is probably the card that you had used to earn the points to begin with).

And if that plan doesn’t work out for some reason, you can always charge the remaining balance to another card as a fallback option…

A Credit Card That Covers All Reward Bookings

In Canada, the National Bank® World Elite®Mastercard® is the lone credit card that covers all reward bookings.

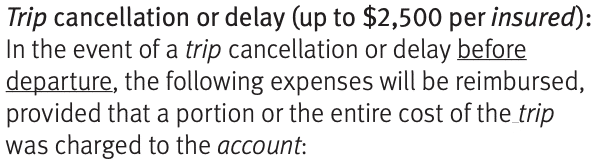

The insurance coverage for the National Bank® World Elite® Mastercard® doesn’t mandate that the full cost of the trip be charged to the card, but rather only requires that a “portion or the entire cost of the trip” is charged to be sufficient for coverage.

This means that whenever you’re redeeming any type of rewards currencies for a flight, be it with Aeroplan points, Cathay Pacific Asia Miles, Alaska miles, Air France/KLM Flying Blue miles, or Ethiopian Airlines ShebaMiles, you’ll be eligible for insurance coverage with the National Bank® World Elite® Mastercard®, since you’re fulfilling the criterion of “partial cost” in doing so.

This card’s far-reaching insurance proposition is one of the reasons why you might wish to pick it up and/or hold onto it in the long term.

Conclusion

If you primarily travel on points, you don’t have to sacrifice insurance protection—you just need the right credit card.

Emergency medical insurance is generally active as long as you’re traveling out-of-province and your card account is in good standing. Meanwhile, using a co-branded credit card through TD, CIBC, American Express, or RBC can usually take care of the remaining types of coverage.

For those who want the ultimate peace of mind, the National Bank® World Elite® Mastercard® stands out as the best choice, offering insurance protection on any award booking, regardless of the loyalty program used.

Whether you’re a seasoned points collector or just getting started, making sure you have the right credit card in your wallet can help ensure your travels go smoothly, even when the unexpected happens.

This story originally appeared on princeoftravel