Image source: Getty Images

It’s a good idea to always have a shopping list of growth shares to hand. In the event of a stock market crash, having a ready-made collection of stocks to buy can help Stocks and Shares ISA investors act quickly.

With global conflict escalating and trade tariff tensions rumbling on in the background, a share market correction or crash could well be on the cards. But investors don’t have to wait for a full-blown crash to pick up some bargains.

Here are two great FTSE 100 shares I think investors should seriously consider right now.

Babcock International

The UK is home to several top-quality defence shares, but Babcock International (LSE:BAB) is my favourite value play. At £10.53 per share, its forward price-to-earnings (P/E) ratio is 20.3 times, far below almost all other European sector heavyweights.

Fellow Footsie operator BAE Systems, by comparison, trades on a corresponding ratio of 26.9 times.

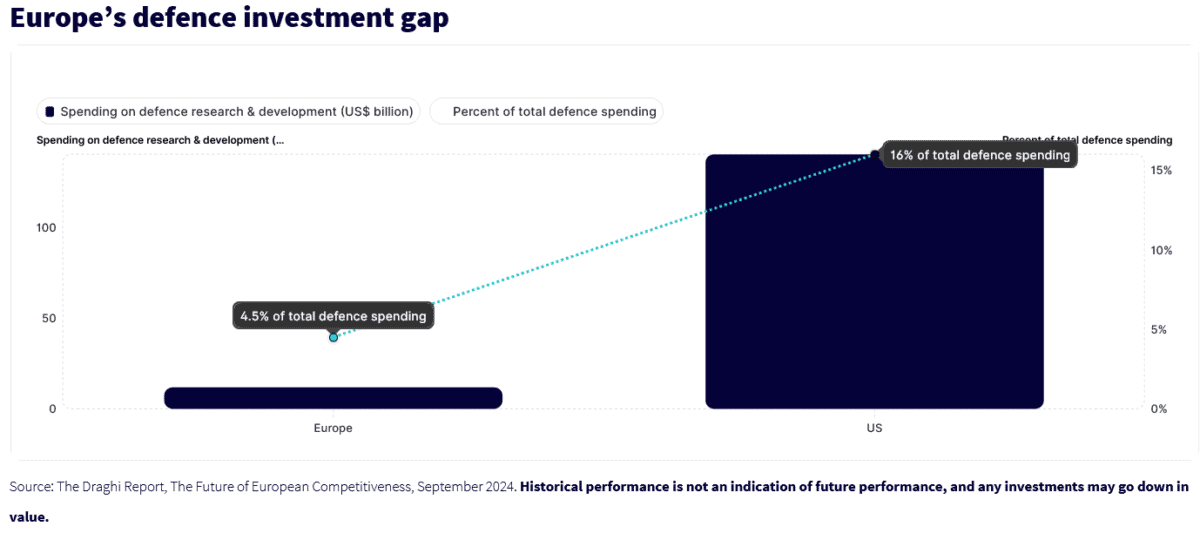

I also like Babcock because it generates a far-greater proportion of revenues from the UK and Europe. Spending here has been significantly lower in recent years than the US, providing scope for a demand boom as the region responds to changing Stateside foreign policy.

Investing in individual defence shares can be more dangerous than a sector fund. Project failures in the field can have major geopolitical ramifications, resulting in irreversible reputational damage and a loss of future business.

But encouragingly, Babcock has a great track record on this front, as reflected by its critical supplier status with the UK government. Key services include refitting and upgrading ships and submarines at Devonport, the largest naval base in Western Europe, which it jointly runs with the Ministry of Defence.

Besides, I think this risk is more than reflected in the cheapness of the company’s shares.

City analysts think Babcock will report a 57% rise in annual earnings for the financial year to March 2025 tomorrow (24 June). Further increases of 7% and 10% are forecast for fiscal 2026 and 2027, respectively.

Scottish Mortgage Investment Trust

At 986.9p per share, Scottish Mortgage Investment Trust (LSE:SMT) trades at a near-12% discount to its net asset value (NAV) per share. This demands close attention, in my view, given its exceptional track record and future growth potential as the digital economy booms.

The FTSE trust has risen an impressive 14.5% in value over the last decade.

I like Scottish Mortgage because it provides exposure to a wide range of listed and non-listed companies (96 in all). As well as popular tech names like Amazon, Meta and Nvidia, investors can grab a slice of businesses whose shares aren’t exchange traded like Elon Musk’s SpaceX and Epic Games.

Investors must accept that returns here could be volatile if economic conditions remain tough. This reflects the cyclical nature of the tech industry, as well as the high valuations of many of the trust’s holdings.

But like Babcock International, I’m optimistic that it could prove a top long-term buy for investors to consider.

This story originally appeared on Motley Fool