TD Canada Trust has just rolled out a new feature called “Personalized offers” in its mobile app—and if you’ve used Amex Offers or RBC Avion Offers before, the concept will feel very familiar.

You’ll now find targeted deals that can be activated on a TD card of your choice, and once you make a qualifying purchase, you’ll receive a statement credit or cash back.

Some offers work through click-through shopping (similar to Rakuten or the Aeroplan eStore), while others simply reward you for spending in a particular category or at a specific brand.

What is TD “Personalized offers”?

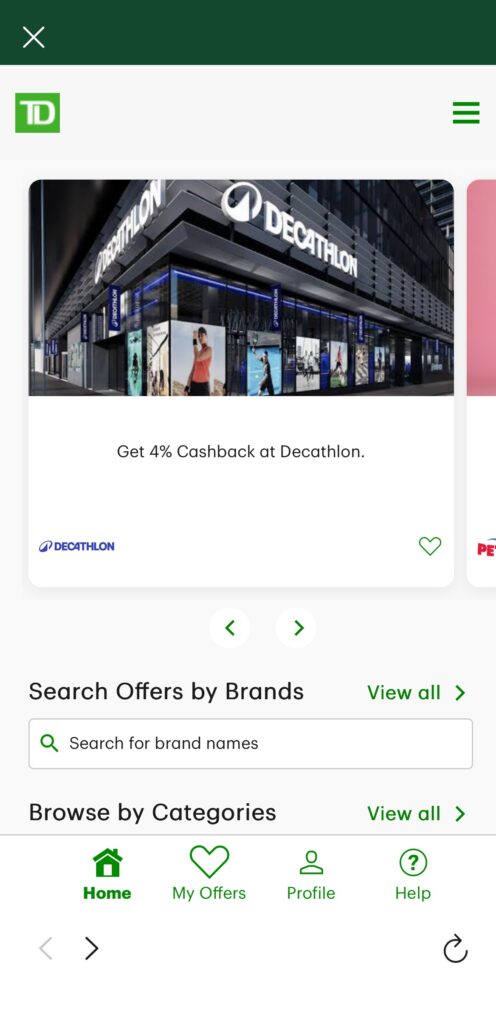

It’s a rotating set of global or targeted, opt-in deals available in the TD mobile banking app under Rewards → Personalized offers.

On first launch, you’ll be prompted to pick interest categories to help curate what you see.

Offers come in two flavours:

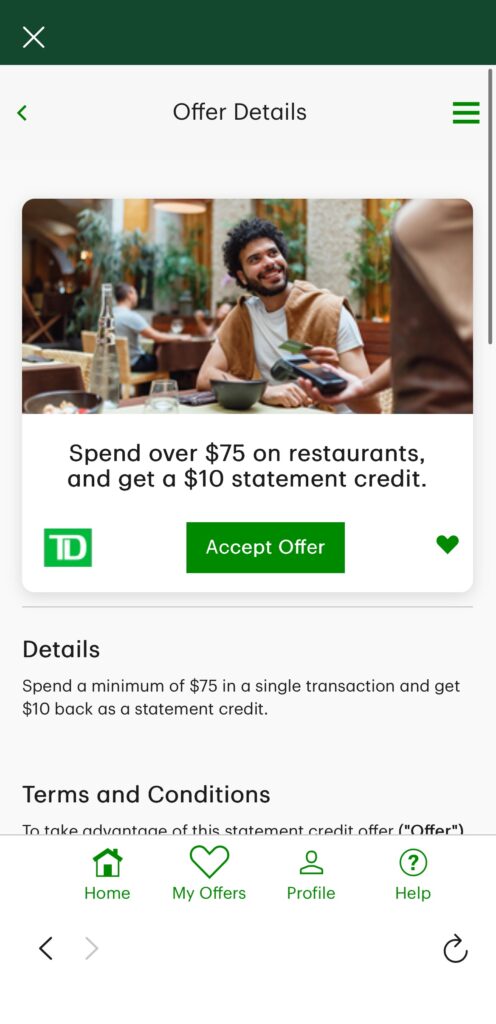

- Activate-then-spend: Make a qualifying purchase and receive a statement credit.

- Shop-through button: Click through in-app and earn cash back on the purchase amount (think Rakuten or the Aeroplan eStore model).

Early offers include:

- Spend over $75 on restaurants, and get a $10 statement credit

- Get 4% Cashback at Decathlon

- Get 4% Cashback at Simons

Where To Find In The TD App

- Open the TD mobile banking app and go to Rewards.

- Tap See offers under Personalized offers.

- Pick your interests to help curate deals (e.g., Travel, Sports & Outdoors, Home & Garden).

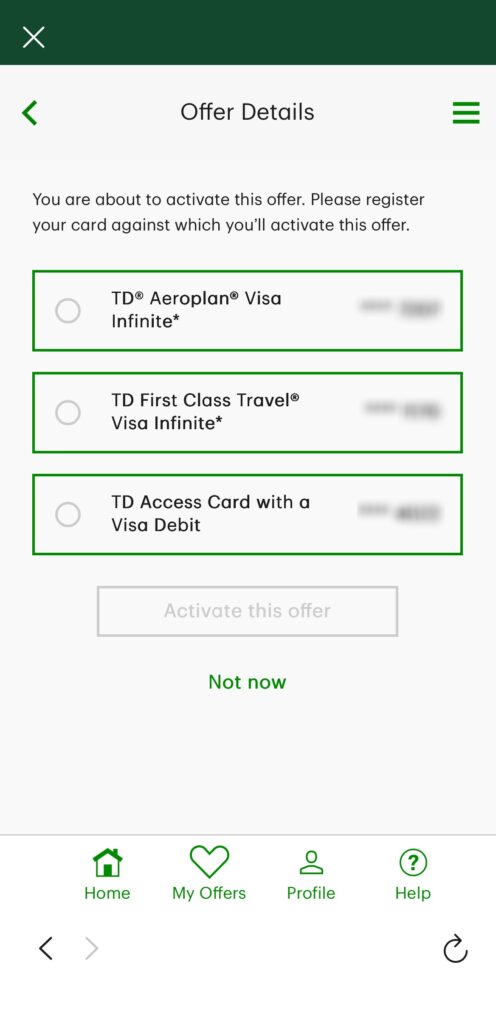

- Open an offer and activate it on a specific card (e.g., TD Aeroplan Visa Infinite, TD First Class Travel Visa Infinite, or even a TD Access Card with Visa Debit).

- Pay with the same card you activated.

- You can “heart” offers to favourite them and surface them faster later.

My Initial Thoughts

It’s great to see TD stepping up with added value for cardholders. The ability to choose which TD card to attach an offer to is genuinely useful, especially when you want to pair an offer with the card that has the best earn rate or insurance for that purchase.

The trade-off, of course, is that you’ll need to track which card each offer is tied to. That’s a bit more tedious than RBC Avion Offers, which typically attach at the account level and trigger on any eligible RBC card once activated.

Debit card support is the standout. Letting customers activate on TD Visa Debit makes the platform accessible to newcomers and teens who aren’t yet ready for credit cards. It’s a nice touch, and not something you see with Amex Offers.

It’s still early, but the potential is there. I’d love to see more travel-related offers pop up, something like “Spend X, get Y back” on hotel brands such as Marriott.

Add that to existing categories like restaurants and groceries, and this could become a go-to platform. The app interface is clean, the onboarding is simple, and the early offers are quite decent.

Conclusion

TD “Personalized offers” turns your wallet into a mini rebate machine: activate an offer on the card of your choice, pay as usual, and enjoy automatic statement credits or cash back.

It’s a user-friendly feature that stands out for its flexibility and debit card inclusion—something rare in the bank offer space.

As long as TD keeps the offers relevant and refreshed, this could easily become part of your weekly routine, right alongside your Amex and RBC stacks.

This story originally appeared on princeoftravel