As the EU political season gets back into full swing, member states are confronted by daunting challenges. In the last few days, they have revisited the thorny question of providing security guarantees to Ukraine – which, of course, means dealing with the notoriously mercurial US president, Donald Trump. Transatlantic tensions are obvious, both politically and on the trade side of things – despite an EU-US agreement on tariffs struck at the end of July. We take a closer look at the geopolitical and economic headwinds faced by the EU with Arancha Gonzalez Laya, the dean of the Paris School of International Affairs at Sciences Po university. She is a former foreign minister of Spain, and a former senior official at the World Trade Organization and the United Nations.

This story originally appeared on France24

'The weakening of France has a spillover effect on the EU': Spain's ex-FM Gonzalez

Aryna Sabalenka hits back at Nick Kyrgios and vows to ‘kick his ass’ in ‘Battle of the Sexes’ showdown | World News

Aryna Sabalenka has said she can beat Nick Kyrgios when they play against each other next January, even promising to “kick his ass”.

The Belarusian, who has just made it through to the US Open where she is defending her title, will face the tennis bad boy in a match that will mimic one of the most famous showdowns in the sport’s history – Billie Jean King’s 1973 victory over Bobby Riggs at the Houston Astrodome.

Sabalenka said the match with Kyrgios, expected to take place before the Australian Open in January, was a “good idea” and will be “spectacular to watch”.

“It’s going to be fun, especially against someone like Nick. Like he said in another interview, that I genuinely think that I’m going to win, and I’ll definitely go out there, and I’ll try my best to kick his ass (laughter),” she said.

She was responding to Kyrgios, who, earlier in the week, indulged in some tennis trash talk when he claimed he would not have to play at 100 per cent to beat the women’s world number one.

Sabalenka, 27, has won three grand slams and also reached three Wimbledon semi-finals. Kyrgios, 30, has won no majors and reached the Wimbledon final in 2022, where he lost in four sets.

It has been reported that the pair could play in Hong Kong in January, just before the Australian Open, but Sabalenka said the time and location of the eagerly anticipated contest have not yet been confirmed.

“Definitely if we’re going to bring it, we’re going to bring it to somewhere where it’s going to be a lot of people watching, and we’re gonna put a lot of pressure on Nick.”

Read more from Sky News:

Football star apologises for spitting at rival team’s staffer

Teacher stabbed at school in Germany

Speaking on the ‘Tea with Bublik podcast’, with fellow player Alexander Bublik earlier this week, Kyrgios said that “Sabalenka is awesome, she’s such a character”.

“I think she’s the type of player who genuinely believes she’s going to win,” he added.

Sabalenka secured her place in the US Open final with a commanding victory over Jessica Pegula in the 2025 US Open semi-finals.

The match will be a modern-day replay of the legendary clash between Billie Jean King and Bobby Riggs, 52 years ago

King, 29, triumphed over the 55-year-old Riggs with a straight-sets victory of 6-4, 6-4, 6-4, and won $100,000.

Prior to that, Riggs had defeated Margaret Court, who was the world’s top-ranked female player at the time.

This story originally appeared on Skynews

Noncompete ban abandoned by Trump’s FTC : NPR

Federal Trade Commission Chairman Andrew Ferguson testifies on Capitol Hill on May 15, 2025 in Washington, D.C.

Kevin Dietsch/Getty Images North America

hide caption

toggle caption

Kevin Dietsch/Getty Images North America

The Federal Trade Commission is moving to vacate its rule banning noncompete agreements, reversing what was seen as a signature accomplishment of the commission under President Biden.

Noncompetes are employment agreements that prevent workers from taking new jobs with a competing business or starting one of their own, usually within a certain geographic area and timeframe after leaving their job.

The ban, championed by former FTC chair Lina Khan, was finalized in 2024 but never took effect. Following a lawsuit brought by the Dallas-based tax services firm Ryan LLC, a federal judge in Texas found that the FTC had likely exceeded its authority in issuing the ban and halted it nationwide.

Last fall, the Biden administration appealed that ruling to the 5th Circuit Court of Appeals. But in March, the Trump administration asked the court for a 120-day pause on the appeal. The government’s attorneys cited the changeover in administration and comments made by new FTC Chair Andrew Ferguson that the agency should reconsider its defense of the rule.

Then in July, the Trump administration told the court it needed still more time. The court approved another 60-day pause that was to end on September 8.

Late Friday afternoon, just ahead of that deadline, the FTC announced it had voted 3-1 to dismiss the appeal and take steps to vacate the rule.

“The Rule’s illegality was patently obvious,” wrote Ferguson in a joint statement with his fellow Republican commissioner Melissa Holyoak. “It preempted the laws of all fifty States, and actively displaced hundreds of existing laws across forty-six States.”

The dissenting vote was cast by Rebecca Kelly Slaughter, whom Trump had tried to fire earlier this year. Now the lone Democrat on the commission, she returned to her seat Wednesday following a ruling from the Court of Appeals for the D.C. Circuit.

30 million people bound by noncompetes

The FTC has estimated that some 30 million people, or 1 in 5 American workers, from minimum wage earners to CEOs, are bound by noncompete agreements.

The agency’s rule, narrowly approved by the commission along party lines in April 2024, would have invalidated nearly all existing noncompetes and banned new ones except in rare circumstances. Khan said because workers would be able to freely pursue new opportunities without the fear of being taken to court by their past employers, it could lead to increased wages totaling nearly $300 billion per year and the annual creation of 8,500 new businesses.

Lina Khan, chair of the Federal Trade Commission under President Biden, testifies on Capitol Hill on May 15, 2024, in Washington, D.C.

Kevin Dietsch/Getty Images North America

hide caption

toggle caption

Kevin Dietsch/Getty Images North America

From the business community, there was immediate pushback. In its lawsuit, Ryan LLC argued that the noncompete ban would inflict irreparable harm by enabling its employees to leave for the competition, potentially taking with them valuable skills and information gained on the job. The U.S. Chamber of Commerce, which joined Ryan’s lawsuit, argued that the rule constituted an unlawful overreach of the FTC’s authority and warned it would harm the economy.

Ferguson, one of two Republican commissioners on the FTC at the time, voted against the rule, arguing that the FTC lacked the authority to issue a nationwide prohibition on a centuries-old business practice. In his written dissent, he called the ban “by far the most extraordinary assertion of authority in the Commission’s history” and a violation of the Constitution.

Still, since becoming FTC chair under Trump, Ferguson has made clear he’s no fan of noncompete agreements.

“Noncompete agreements can be pernicious,” he wrote in his statement released Friday. “They can be, and sometimes are, abused to the effect of severely inhibiting workers’ ability to make a living.”

Earlier this year, Ferguson told Fox Business that one of his top priorities would be, instead of a blanket ban, to send FTC enforcers out looking for noncompetes and no-poach agreements that violate the Sherman Act, the 1890 law prohibiting activities that restrict competition in the marketplace.

On Thursday, the FTC gave an example of the type of enforcement it now plans to pursue. The commission announced it had ordered the country’s largest pet cremation business to stop enforcing noncompetes against its nearly 1,800 employees.

While acknowledging that kind of enforcement is important, Slaughter says it’s no substitute for a nationwide rule.

“It does nothing to help the person working at the hair salon in Minnesota, or the engineer in Florida, or the fast food worker in Washington,” she says. “Those people deserve protection, too.”

The FTC this week also invited the public to come forward with information to help the commission “better understand the scope, prevalence, and effects of employer noncompete agreements, as well as to gather information to inform possible future enforcement actions,” according to a press release.

Slaughter points out that during the rulemaking process, the FTC received 26,000 public comments on noncompetes, almost entirely in support of a nationwide ban.

An architect of the noncompete rule warns the enforcement strategy will fail

Elizabeth Wilkins, Khan’s former chief of staff and one of the architects of the FTC’s noncompete rule, predicts Ferguson’s plan for going after noncompetes using agency enforcers will prove woefully insufficient.

“The FTC has something like 1,400 employees to police the entire economy — not just workers, not just labor markets, but everything,” says Wilkins, who is now president and CEO of the left-leaning Roosevelt Institute.

Wilkins notes that even in states that have passed their own laws making noncompete agreements unenforceable, companies are still using them.

“You find them almost as often as you do in states where they are enforceable, which is to say workers don’t know their rights,” says Wilkins. “A clear and simple ban on noncompetes is, to my mind, the only way to truly protect workers.”

A noncompete at a real estate company presents a hard choice

In Grand Junction, Colo., Rebecca Denton signed a noncompete when she took a job as a transaction coordinator with a real estate company in 2019.

Finding herself overworked during the pandemic-era surge in housing sales, she wanted to quit her job, which involved handling all the paperwork for closings. But there was a problem. Because of her noncompete, she knew she wouldn’t be able to do similar work in a three-state area for a year.

“You feel trapped,” says Denton. “Shackled with a ball and chain.”

Denton, who was 52 at the time, weighed her options. She decided on what she considered the lesser of two evils: Rather than remaining in a job that was running her into the ground with 16-hour days, she quit. She took on lower-paying gig work for a year, steering clear of the line of work in which she has expertise. She feels lucky to have had the financial resources to make that choice, a luxury she says many of her friends in real estate don’t have.

In 2022, Colorado enacted a law significantly limiting the use of noncompetes. Denton was pleased and says she knows people who were able to leave their jobs as a result. She hopes the law will encourage employers to find other ways to retain workers.

“If you’re a good company, and you are paying your employees at scale or better, and you’re treating them well, you have nothing to fear of them leaving,” Denton says. “You don’t need a noncompete because they’re going to happily stay right there.”

This story originally appeared on NPR

Buy Finnair Plus Avios with a 50% Bonus

Like many airlines, Finnair Plus puts on occasional promotions during which Avios are sold at with a bonus or a discount. Whenever these sales pop up, it’s a good idea to take stock of what’s at stake and see if you can work it in your favour.

This time, you can buy Finnair Plus Avios with up to a 50% discount through to September 17, 2025.

If you have your eyes on some aspirational oneworld flight redemptions or a flight to Northern Europe, a sale like this could be a strategic move to score travel in premium cabins at a steep discount.

Buy Finnair Plus Avios with a 50% Bonus

From now until September 17, 2025, you can purchase Avios from Finnair Plus and receive up to a 50% bonus.

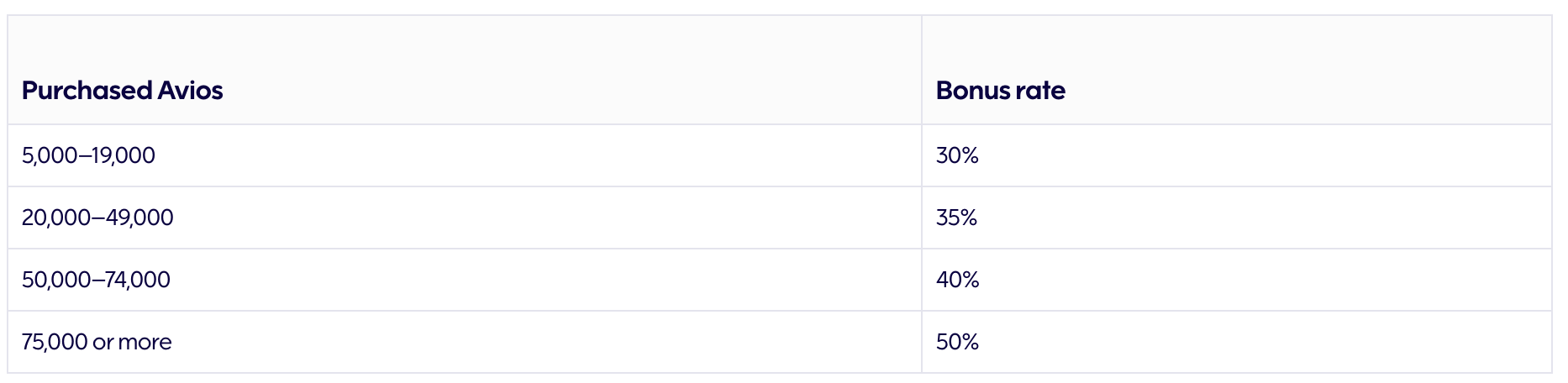

The size of the bonus you’ll receive on purchased Avios depends on how many you purchase, as it’s broken down into four tiers this time around:

- Buy 5,000–19,000 Avios, get a 30% bonus

- Buy 20,000–49,000 Avios, get a 35% bonus

- Buy 50,000–74,000 Avios, get a 40% bonus

- Buy 75,000+ Avios, get a 50% bonus

If you were to purchase Finnair Plus Avios with a 50% bonus, the cost works out to 1.4 cents per point (EUR), which is equivalent to around 2.26 cents per point (CAD).

We value Finnair Plus Avios at 2 cents per point (CAD), so while the best price during this sale is higher than that value, it’s still possible to come out ahead (as we’ll explore below).

There are a few stipulations that you need to know about buying Finnair Plus Avios during this sale:

- You must have joined Finnair Plus before August 20, 2025

- You must have a minimum balance of 500 Avios in your Finnair Plus account

Remember, you can transfer Avios into your Finnair Plus account from your British Airways Club account, so it shouldn’t be too hard to get the minimum account balance to access this sale.

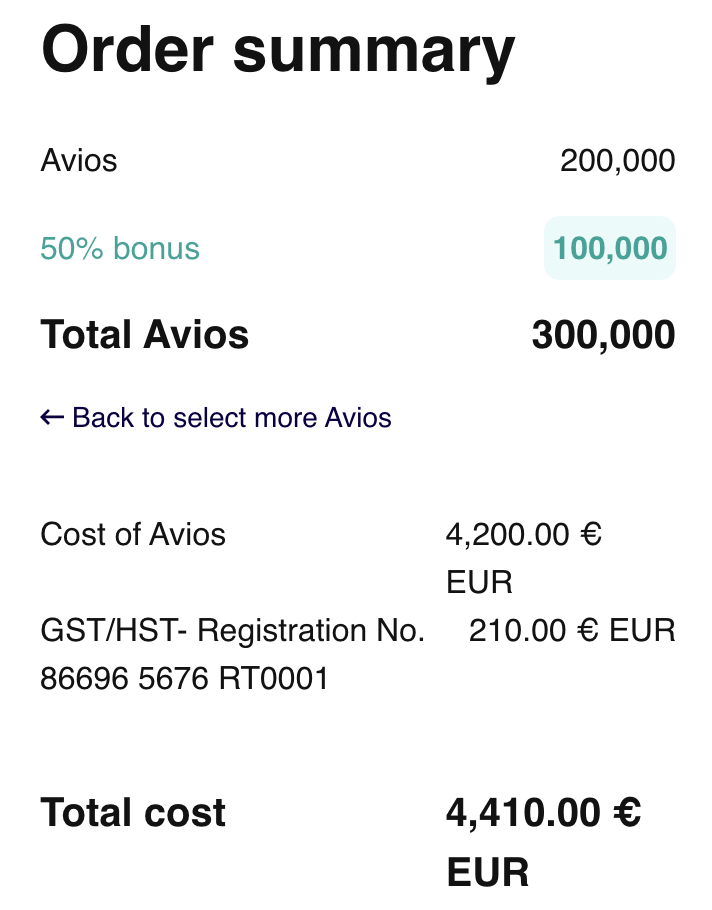

With Finnair Plus, you can purchase a maximum of 200,000 Avios each calendar year, excluding any bonus points. Therefore, if you were to max out this offer, you could purchase 300,000 Avios for €4,200 ($6,770 CAD).

Which Credit Card Should You Use to Buy Avios?

Finnair Plus processes Avios purchases through Points.com, which means these transactions won’t earn travel category bonuses on credit cards like the American Express Platinum Card.

Therefore, your best strategy here is to use:

Great Credit Cards for Buying Avios

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

130,000 MR points $799 annual fee |

130,000 MR points | $1,794 |

Apply Now |

|

Up to 70,000 RBC Avion points† $399 annual fee |

Up to 70,000 RBC Avion points† | $826 |

Apply Now |

|

50,000 Scene+ points First Year Free |

50,000 Scene+ points | $575 |

Apply Now |

|

80,000 Scene+ points $599 annual fee |

80,000 Scene+ points | $451 |

Apply Now |

|

80,000 Scene+ points $399 annual fee |

80,000 Scene+ points | $261 |

Apply Now |

|

45,000 Scene+ points $150 annual fee |

45,000 Scene+ points | $220 |

Apply Now |

As a reminder, Points.com is registered in Canada, and you’ll be obligated to pay GST/HST if you have a Canadian billing address. If at all possible, you should aim to use a foreign billing address to avoid the added costs, which erode the value from the sale.

When Does It Make Sense to Buy Finnair Plus Avios?

Speculatively buying points without a redemption in mind is almost never a good idea, since loyalty programs could implement changes at any time. However, buying points during sales can also deliver exceptionally strong value, especially when you compare it to paying cash for the same flights.

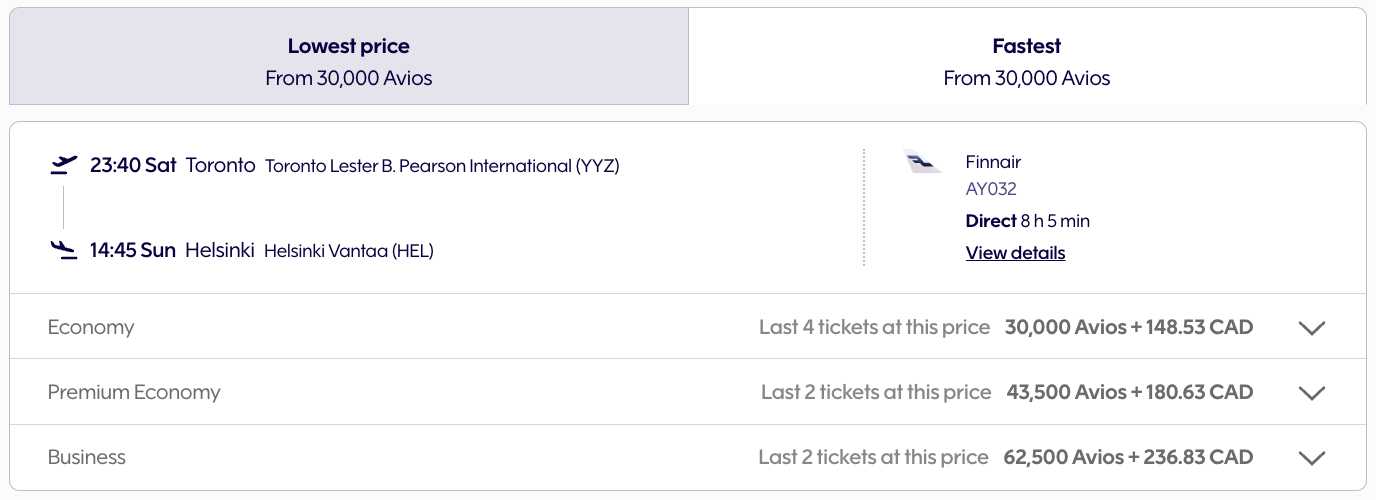

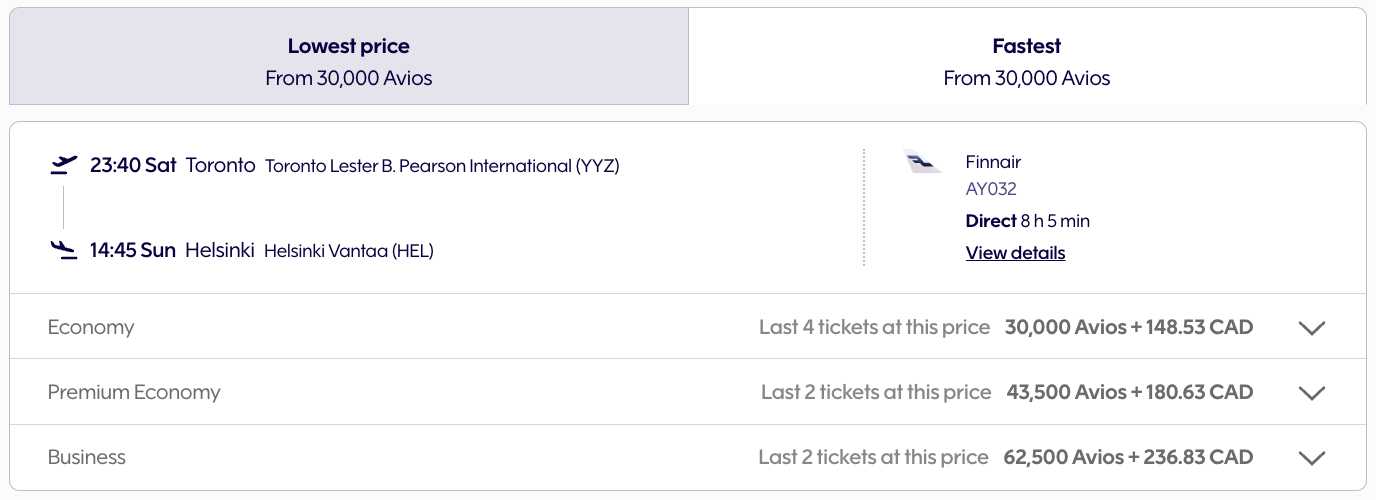

Guaranteed Award Availability with Finnair

Finnair guarantees a minimum amount of award seats that are released on all of its short- and long-haul flights.

For flights to and from North America, you’re guaranteed to find at least four award seats available in economy, and at least two award seats available premium economy and business class on Finnair-operated flights at the following rates:

- Economy: 30,000 Avios

- Premium economy: 43,500 Avios

- Business class: 62,500 Avios

If you value predictability, then you can depend on there being at least two business class award seats on every Finnair flight.

Plus, those award-flight prices are excellent, especially when you consider that the taxes and fees on Finnair flights are also quite reasonable.

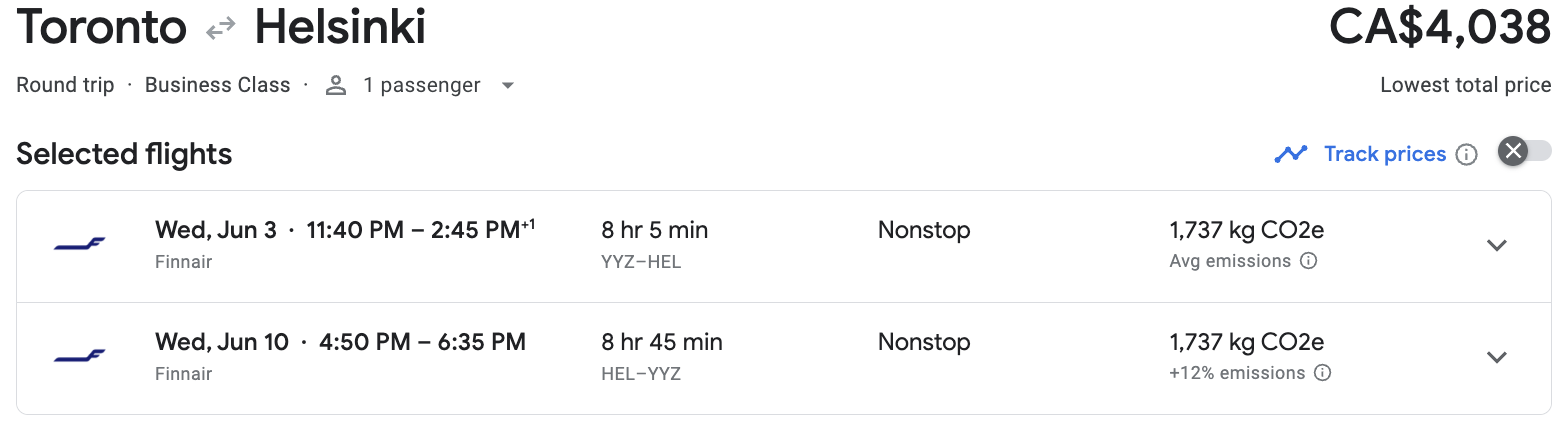

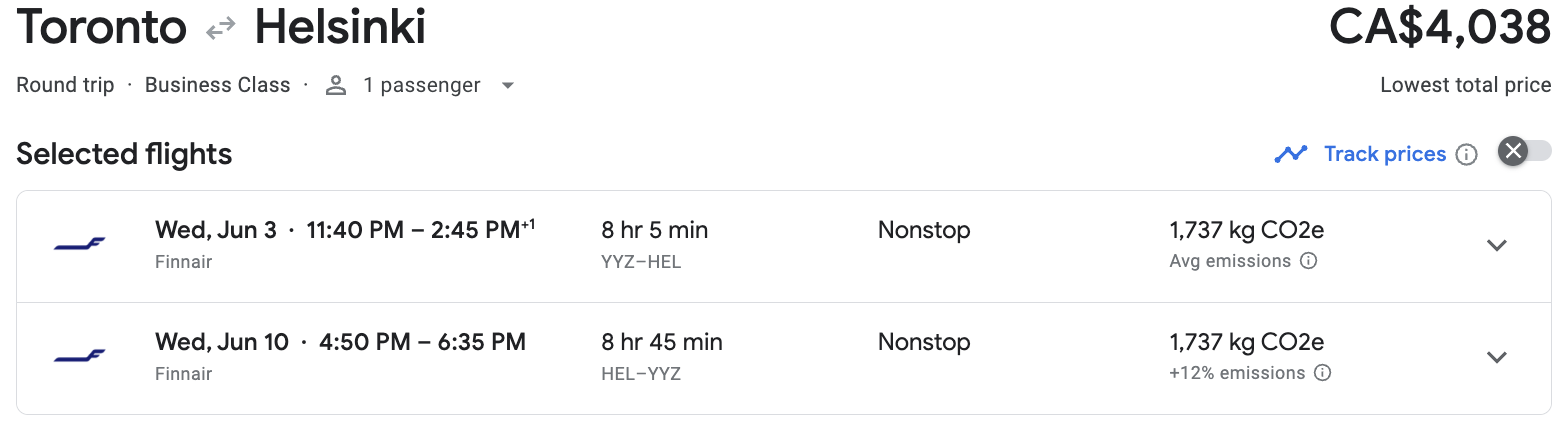

Premium flights are almost always the best deal when it comes to award redemptions, and buying 125,000 Finnair Plus Avios during this sale (enough for a round-trip booking in business class to Europe) would cost €1,848 ($2,979 CAD)…

Which is a significant amount less than paying cash for a good deal on round-trip flights in business class…

As a reminder, Finnair operates flights between Helsinki and Toronto, New York, Chicago, Miami, Dallas, Los Angeles, and Seattle (in North America).

If you don’t live in or near any of these cities, consider booking a positioning flight to get yourself to one of them once you have a Finnair-operated flight locked in.

Sweet Spot Redemptions on Partner Airlines

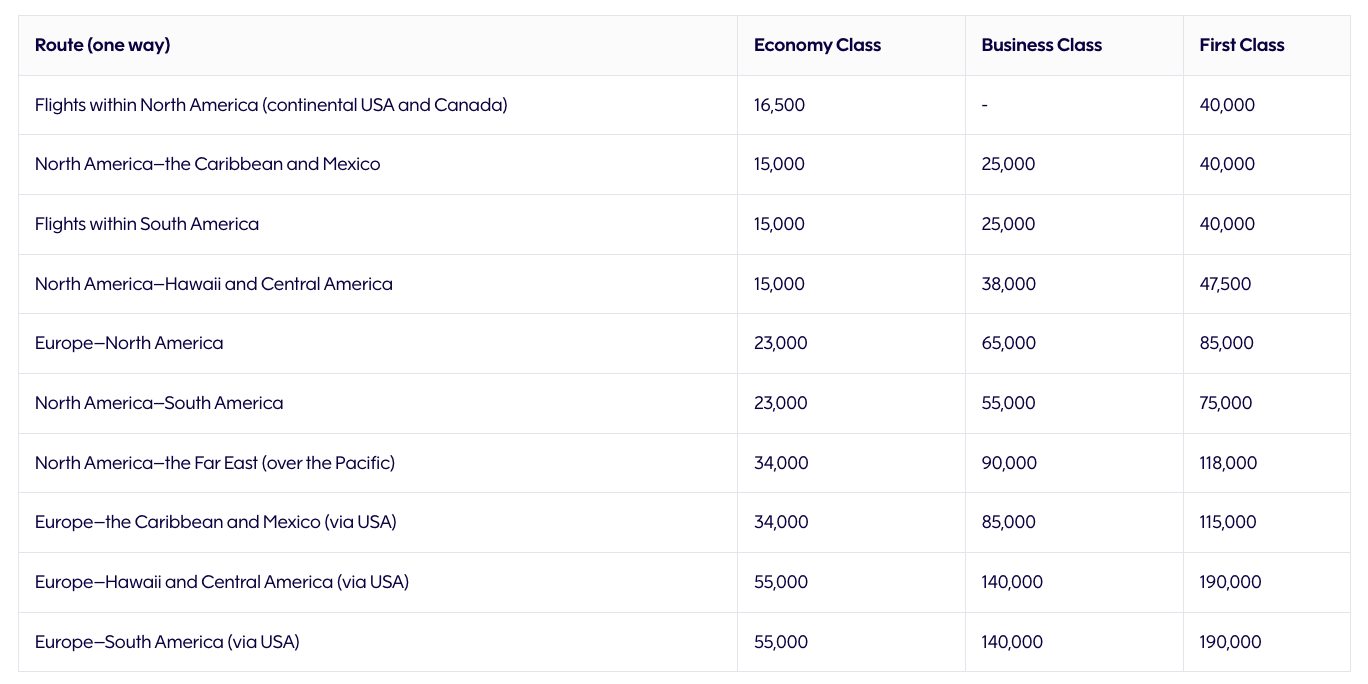

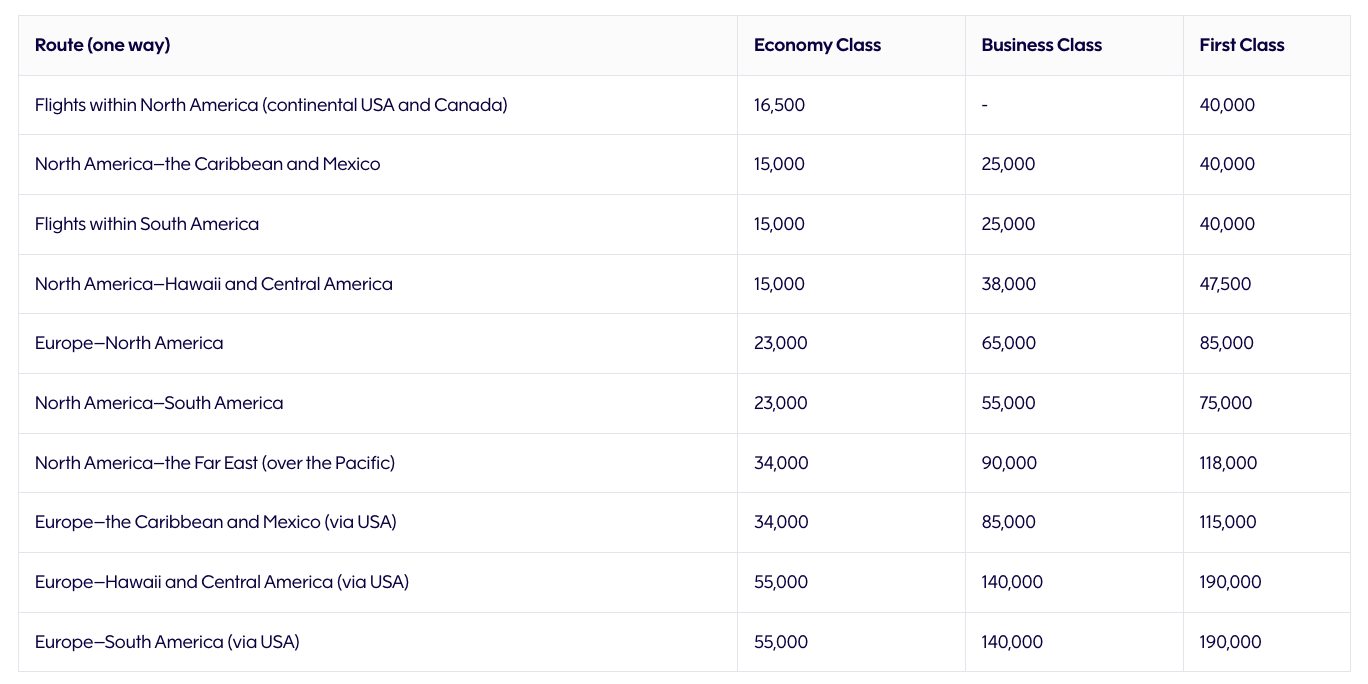

Finnair Plus offers members access to oneworld airlines, as well as non-affiliated partners. Each partner airline is subject to its own award chart, which can be found on the Finnair website.

If you’ve located award availability on a oneworld or partner airline, you’ll be happy to know that Finnair Plus doesn’t levy a hefty amount of taxes and fees for award bookings in premium cabins. Plus, award pricing is quite reasonable, and in many cases, it’s better than what you can find for the same flights booked via The British Airways Club.

If you can find “Saver” award availability on flights with American Airlines, you might do well with Finnair Plus – especially if you have your sights set on the Caribbean and Mexico.

I booked a one-way flight from Vancouver to Cancun via Dallas for just 25,000 Avios plus a few hundred dollars in taxes and fees, which is an absolute bargain.

While it’s exceedingly rare, if you come across Cathay Pacific business class award availability, the pricing with Finnair Avios is excellent. You’d pay just 85,000 Finnair Plus Avios for a flight from Vancouver or Toronto to Hong Kong.

In fact, if you’ve found award availability with oneworld airlines but it doesn’t show up on the Finnair Plus website, I’d encourage you to call in and see if they can price it out. You may well be pleasantly surprised with the results.

Padding Your Other Avios Balances

Outside of the aforementioned excellent applications of Finnair Plus Avios, you can consider using a sale like this to pad your overall Avios balance.

One of the unique aspects of Avios is that it’s a points currency used by multiple programs. In addition to Finnair Plus, Aer Lingus AerClub, The British Airways Club, Iberia Plus, and Qatar Airways Privilege Club use Avios, too.

Each program has its own set of sweet spots, and if you can find award availability for a flight in one of the other programs, you can buy Finnair Plus Avios during this sale and convert them into other “flavours” of Avios from within the ecosystem.

Depending on the program you’re moving Avios to or from, there are some strings attached to this, but it’s worth looking into.

Other Ways to Earn Avios

Before jumping on this promotion, consider these more cost-effective methods to build your Avios balance.

Canadian Credit Card Options

While there aren’t any direct transfer partners with Finnair Plus in Canada, we’re fortunate to have multiple pathways to earn Avios by way of The British Airways Club through Canadian credit cards:

American Express Membership Rewards transfer to The British Airways Club at a 1:1 ratio, occasionally with transfer bonuses up to 30%. Consider these cards as great pathways to a tidy sum of British Airways Avios:

American Express Cards for Avios Redemptions

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

130,000 MR points $799 annual fee |

130,000 MR points | $1,794 |

Apply Now |

|

70,000 MR points $250 annual fee |

70,000 MR points | $1,676 |

Apply Now |

|

110,000 MR points $799 annual fee |

110,000 MR points | $1,581 |

Apply Now |

|

40,000 MR points $199 annual fee |

40,000 MR points | $846 |

Apply Now |

|

15,000 MR points $156 annual fee |

15,000 MR points | $372 |

Apply Now |

RBC Avion points also convert to British Airways Avios at a 1:1 ratio, with frequent bonuses reaching 30% and occasionally as high as 50%.

Within the RBC family, the RBC® British Airways Visa Infinite† also offers a direct pathway to the Avios ecosystem by way of its promotional welcome offer and on daily spending.

RBC Credit Cards for Earning Avios

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

60,000 Avios† $165 annual fee |

60,000 Avios† | $1,235 |

Apply Now |

|

55,000 Avion points^ $120 annual fee |

55,000 Avion points^ | $1,080 |

Apply Now |

|

55,000 RBC Avion points^ $120 annual fee |

55,000 RBC Avion points^ | $1,080 |

Apply Now |

|

Up to 70,000 RBC Avion points† $399 annual fee |

Up to 70,000 RBC Avion points† | $826 |

Apply Now |

|

35,000 RBC Avion points $175 annual fee |

35,000 RBC Avion points | $700 |

Apply Now |

|

35,000 RBC Avion points $120 annual fee |

35,000 RBC Avion points | $580 |

Apply Now |

Conclusion

Finnair Plus is currently offering a 50% bonus on purchased Avios.

As we’ve explored in this article, there are certainly some great redemption opportunities available, and plenty of ways to turn your purchased points into outsized value with the right strategy.

If you’re interested in taking advantage, don’t delay – this offer expires on September 17, 2025.

This story originally appeared on princeoftravel

Google Report: This Is How Leaders Are Using AI at Work

AI is making a mark in marketing, security, and customer experience, according to a new Google Cloud report, which surveyed 3,500 senior leaders at global companies to find a clear use case for AI — and figure out if leaders had seen a return on their AI investments.

Each leader surveyed works for a business that earns at least $10 million in annual revenue, has at least 100 employees, and leverages generative AI. The majority of respondents (55%) indicated that AI was a useful marketing tool, helping them with tasks like data analysis, content generation, and editing. Nearly 60% of executives at media and entertainment firms indicated that AI had a positive impact on their marketing efforts.

Security was also an area where AI was useful to executives, according to the report. AI security tools combat cyberthreats by automatically detecting intruders and analyzing incidents. Almost half of executives (49%) said in the survey that AI helped with cybersecurity. Of that group, 53% stated that AI had diminished the number of security incidents reported in their organizations.

Executives also found that AI improved customer experience. Close to 62% of leaders said that AI had enabled them to deliver better customer service, an increase from 59% of respondents who answered the same survey in 2024. Three in four leaders said customer satisfaction improved as a result of AI this year.

The survey also sought to uncover whether AI had delivered a strong return on investment for organizations. Only 40% of respondents stated that AI had directly caused revenue growth for their companies, but 70% said that AI had made employees more productive.

Google Cloud’s VP of Global Generative AI, Oliver Parker, wrote that the report indicated that AI hype in organizations is calming down.

“The conversation has shifted to value,” he wrote.

The report’s findings contrast with research published last month by MIT, which found that though U.S. businesses have invested up to $40 billion in AI altogether, the overwhelming majority (95%) have yet to see a return on their investments or an impact on profits.

AI is making a mark in marketing, security, and customer experience, according to a new Google Cloud report, which surveyed 3,500 senior leaders at global companies to find a clear use case for AI — and figure out if leaders had seen a return on their AI investments.

Each leader surveyed works for a business that earns at least $10 million in annual revenue, has at least 100 employees, and leverages generative AI. The majority of respondents (55%) indicated that AI was a useful marketing tool, helping them with tasks like data analysis, content generation, and editing. Nearly 60% of executives at media and entertainment firms indicated that AI had a positive impact on their marketing efforts.

The rest of this article is locked.

Join Entrepreneur+ today for access.

This story originally appeared on Entrepreneur

Fired Nestlé CEO Laurent Freixe caught cheating on mistress with subordinate

Former Nestlé CEO Laurent Freixe was fired after a senior executive said to be his mistress allegedly caught him in a Zurich hotel with a subordinate — and then filed a complaint through the company’s anonymous hotline that triggered an internal investigation, according to an explosive report.

Freixe, the 63-year-old Frenchman who was shown the door earlier this week, was canned after a company investigation revealed that he had been carrying on a romance with an underling — a senior marketing executive who left the company earlier this year.

But a new report claims that the now-former company chief had previously been involved with another subordinate known as his “official” mistress who caught him and his lover in the act.

The Zurich-based financial news site Inside Paradeplatz reported that the confrontation set off a chain reaction inside the world’s biggest food company.

Nestlé Chairman Paul Bulcke and vice chair Pablo Isla reportedly humiliated Freixe in person after learning of the affair — telling him he was out “effective immediately” and, according to the outlet, ordering him to hand over his phone while calling him a “liar.”

According to the site, the “main mistress” received a severance package as a result of the complaint. The woman, who has not been named, recently moved to a high position at another large company, the report claimed.

The other subordinate involved with Freixe also departed the firm and was given a large severance package that was arranged by the fired CEO, according to the site.

“Everything that needs to be said on the matter has been said, and I will not engage in further wild conjectures and speculation,” a company spokesperson told the site when asked for comment.

The Post has sought comment from Nestlé.

Nestlé said it fired Freixe, a nearly 40-year veteran of the company, on Monday for failing to disclose a relationship with a direct report — a violation of its code of conduct — but has not confirmed the explosive allegations about how the affair was exposed.

He did not receive any severance payout for his four decades at the food giant.

After the drama, Freixe re-emerged on LinkedIn, boasting, “I got my mobile back, I am reachable anytime,” and sending a congratulatory note to his successor, Philipp Navratil — misspelling his name as “Philippe,” according to the Swiss report.

Freixe had been named CEO less than a year ago, making his downfall one of the fastest in Nestlé’s history.

Bulcke and other senior executives said the move was necessary to protect Nestlé’s values and ethical standards, stressing that top leaders are held to the same rules as the rest of the 270,000-strong workforce.

This story originally appeared on NYPost

What billionaire businessman Bill Ackman’s just beginning to learn about politics

Bill Ackman’s about-face on Andrew Cuomo is just the latest example of how even great businessmen can’t instantly succeed when they set out to influence politics.

Immediately after a fumbling Cuomo lost the Democratic mayoral primary to far-left upstart Zohran Mamdani, Ackman publicly promised to bigfoot the process and save New York by “crowdsourcing” to find the “best centrist candidate” to take on the Democratic Socialists “on the campaign trail and on the debate stage.”

“I will take care of the fundraising,” Ackman vowed. “There are hundreds of millions of dollars” to be tapped quickly.

Oops: After a few days of poking around under the hood and reading the manual of local politics, Ackman realized that taking over City Hall isn’t just a matter of holding a candidate cattle call and calling up a few buddies to ante up millions.

It’s actually a lot more complicated.

So Ackman backed off on finding a savior to parachute into the muddle and called for Cuomo to drop out: The ex-guv’s “subdued energy” and failure to win a gimme election, he explained, showed “that he is not up for the fight.”

Instead, Ackman declared, he was 10 toes down for Mayor Eric Adams, “who is ready to go to battle, guns blazing with enormous energy and clarity.”

Two two months later, Adams still lags in the polls and seems poised to exit (perhaps to join the Trump administration) — so Ackman is back on Team Andy, calling Cuomo an “experienced leader” who has the “relevant experience and skills” to lead us.

Faint praise never won fair city.

We don’t mean to be too tough on Ackman: After all, it’s practically yesterday that he started paying much attention to politics of any kind, and he’s scored some real points in other battles.

Extremely successful people, who’d never invest big in an industry they don’t remotely understand, nonetheless time and again treat politics as if it’s an easy game.

You may sincerely mean to save New York from the error of its ways, but then it turns out that other people, perhaps not as rich but just as smart, got there first.

Folks on the left may be dead wrong about their policies, but they understand that politics is a matter of organized, sustained effort, the cultivation of critical constituencies and year after year of consistent base-building.

You can’t summon up decent candidates from nowhere, either: Even the best free agents come up through somebody’s farm system.

New York City politics, in particular, is a rat’s nest of competing ethnic blocs, labor unions, activist groups, varied business interest small and large (and politically wise and naive), as well as a thicket of election law that was built to stymie high-minded outsiders like Ackman.

If sober-minded centrists and advocates for normal people want to retake New York, they need to commit for a much longer haul.

This story originally appeared on NYPost

Josh O’Connor Talks About Spitting in Paul Mescal’s Mouth

Josh O’Connor has shared new details about the spitting scene with Paul Mescal in The History of Sound. At a recent Q&A, O’Connor described the details of this particularly intimate scene in which his character spits water into the mouth of Mescal’s character.

Josh O’Connor describes how the spitting scene with Paul Mescal went

The Crown star offered fans a behind-the-scenes look at his spitting scene with Paul Mescal in The History of Sound.

Over the weekend, the movie was screened at the Telluride Film Festival in Colorado. During a Q&A, Josh O’Connor shared details about the scene that has already captured audience attention. The moment in question is labeled by GQ as “the horniest moment in the film.” It shows David (portrayed by O’Connor) spitting water into Lionel’s (portrayed by Mescal) mouth before the two characters engage in a sexual encounter.

Speaking about the first take, O’Connor recalled, “We were kind of keeping ourselves separate, and really in the characters, and then we did the first take, and it was the spit, and I just—it just dribbled down me.”

The Challengers actor further explained that Mescal, in character as Lionel, “was like waiting,” and mimed the actor lying back with his mouth open. (via Pride) Both actors and the audience then shared laughter over the moment. Moreover, Mescal joked, “If you clipped this without sound it would be…”

The History of Sound is a romantic drama set during World War I. The film follows David and Lionel’s complex journey across the country to record the lives of their fellow countrymen. It also stars Molly Price, Raphael Sbarge, Hadley Robinson, Emma Canning, Briana Middleton, and Gary Raymond.

The Oliver Hermanus directorial is scheduled for a theatrical release in the United States on September 12. It will arrive in Canadian theaters on September 19. Meanwhile, a release date for the United Kingdom has yet to be confirmed.

Originally reported by Disheeta Maheshwari on Mandatory.

This story originally appeared on Realitytea

How to watch or stream Friday’s exclusive streaming game of the NFL’s 2025-2026 football season live, online, and free without cable: YouTube

Less than two years ago, the idea of an NFL game being aired exclusively on a streaming system was revolutionary. Now, it’s almost commonplace, but for some fans, it can still be a frustrating affair.

Game two of the 2025-2026 NFL Season takes place tonight, but you won’t find it aired on television. Instead, YouTube will be the exclusive home for the matchup of the Chiefs and Chargers. That’s another shift in viewing habits for many people, but, on the upside, it’s one that won’t require them to sign up for another service.

Like last year, this season is off to a rolling start. The Cowboys and Eagles kicked things off last night and on Sunday, there is the usual tsunami of games.

Here’s all you need to know about tonight’s streaming exclusive.

Which NFL teams are playing Friday? And what channels are airing the games?

There’s no FOMO tonight, as the NFL is hosting just one game. As always, the home team is listed second.

Friday, Sept. 5

Kansas City Chiefs vs. Los Angeles Chargers, 8:00 p.m. ET on YouTube

How can I watch the NFL season opener for free—even if I am out of market?

In short, you can’t. Normally, we’d suggest a good HD antenna here, but that won’t do you any good for tonight’s game.

Can I stream 2025-2026 NFL games live online if I don’t have a cable subscription?

Since it’s a streaming exclusive, of course, but you’ll only have one option.

YouTubeTV

After a free trial, you can expect monthly charges of $83.

Can I watch the NFL’s opening game on Amazon?

No. Amazon Prime Video’s first matchup this year will be the Washington Commanders facing the Green Bay Packers on Sept. 11.

Why is this game being streamed on YouTube?

YouTube already has a partnership with the NFL as it is the home of NFL Sunday Ticket. But this goes a bit further than that. This will be the first time YouTube broadcasts an NFL game live, but it has streamed other major events, including Coachella earlier this year.

The NFL is hoping to reach a broader, younger audience, which tunes in more to streaming services than traditional broadcast television. Exclusive deals also are more lucrative for the league.

Will any other games be streaming exclusives this year?

Yes, several more in fact.

Amazon will largely be the exclusive home of Thursday Night Football once again, with the exception of Thanksgiving (though it will air an exclusive game on Black Friday). On Oct. 20, ESPN+ will exclusively carry to the Seattle Seahawks vs Houston Texans game.

On Christmas Day, both Netflix and Amazon will each host a streaming exclusive game. And Peacock will have an exclusive of its own on Dec. 27.

Does the NFL offer any viewing packages to watch the games I want?

It does. You have three to choose from.

NFL App

The NFL App will let you stream games that are being broadcast locally in your market on Sundays. If you want to watch an “out of market” game, you’ve got two choices.

NFL+

Watch live local and out of market games and (with the premium subscription) replays. You’re looking at a $50 charge per season. ($100 for premium.)

NFL Sunday Ticket

YouTube once again is the home for this channel. Prices this year start at $83 per month for Sunday Ticket and YouTubeTV or $480 for just Sunday Ticket, if you’re a returning user (spanning the entirety of out-of-market games this season). New users can get a standalone Sunday Ticket subscription for $276.

Why is this game taking place in Brazil?

The NFL wants to become known as more than an American sport. Brazil could be a key part of that international expansion, with over 38 million fans, the league says. The first international game was held in Mexico City in 2005 and since then, the NFL has played in several international cities, including London and Munich, Germany. This is the second year in a row the league has opened the season in Brazil.

This story originally appeared on Fortune

See how much income 1,696 Legal & General shares pay when the dividend lands on 26 September

Image source: Getty Images

The bad news for those holding Legal & General (LSE: LGEN) shares is that performance has been poor. They’re up less than 5% over the last year and only about 15% over five years. The one positive is that they have paid a heap of income along the way.

High income attraction

The trailing dividend yield currently stands at 9.1%, one of the highest on the blue-chip index. That’s far more than even the best-paying savings accounts, and dividends carry another advantage. Companies aim to lift payouts each year to protect investors from inflation and ideally provide some real growth too.

Over the last 15 years, Legal & General’s dividend per share has grown at an average rate of 11.75% a year. Growth has slowed lately, though, and management now expects to lift payouts by just 2% from here. Even so, the yield is forecast to hit 9.26% in 2025 and 9.43% in 2026.

Dividends are never guaranteed, of course. They must be covered by earnings, and here there are some worries. Forecast cover is just one, when investors would prefer to see at least 1.5 or ideally 2. Earnings per share have been sliding for three consecutive years, falling 62%, 43%, and 61%. No wonder the price-to-earnings ratio has soared to above 80. A P/E of around 15 is typically seen as fair value. When I first bought the stock in 2023, it traded at six or seven times earnings. It felt like a bargain then, less so today.

FTSE 100 income play

The insurer remains profitable. First-half results published on 6 August 2025 showed pre-tax profits up 28% to £406m, helped by strong demand for institutional retirement products.

Legal & General’s solvency ratio is steady at 217%, while net debt has dropped from £4.71bn to £3.39bn. Yet broker RBC Markets has flagged a few issues. It notes that profitability in the pension ‘bulk annuity’ market is still under pressure, and warns the outlook for fee income from asset management and retail operations looks weaker. The group trails peers both on price-to-book and return on equity ratios.

Shareholder payouts

Let’s say someone owns 1,696 shares, worth just under £4,000 at today’s price of 235.5p. The shares went ex-dividend on 21 August, and the 6.12p interim dividend will be paid on 26 September. That means a payout of around £103. Reinvesting that could buy another 44 shares, lifting the total holding to about 1,740.

The bigger cheque should come next June. If the final dividend rises 2% from last year’s 15.36p, 1,740 shares deliver about £267. Added to the interim, that’s £370 of income from a £4,000 investment. Which is pretty handy. Any share price growth is on top.

It’s hard to know when Legal & General will get back on track, although I expect high-yielding dividend stocks to look even more attractive when interest rates finally start to fall. I think investors could consider buying with a patient outlook. With luck, they’ll get plenty of income while they wait for the shares to kick on. Yet, it’s still trailing FTSE 100 rivals like Aviva, M&G, and Phoenix Group Holdings, and investors might want to explore them first.

This story originally appeared on Motley Fool